Non-fungible token (NFT) analytics reveal that NFT sales faltered in early February, with $119.49 million recorded during the first week of the month—a 33.73% contraction compared to the preceding seven-day stretch.

Digital Collectible Buyers and Sellers Slide Significantly

Data sourced from cryptoslam.io illustrates a pronounced cooling in the digital collectibles arena. Weekly figures slumped to $119.49 million, accompanied by a 95.33% reduction in buyers and a 94.06% decline in sellers. NFT transaction volume remained relatively stable, however, with 1.44 million NFT transfers logged—a slight 1.35% dip from January’s final week.

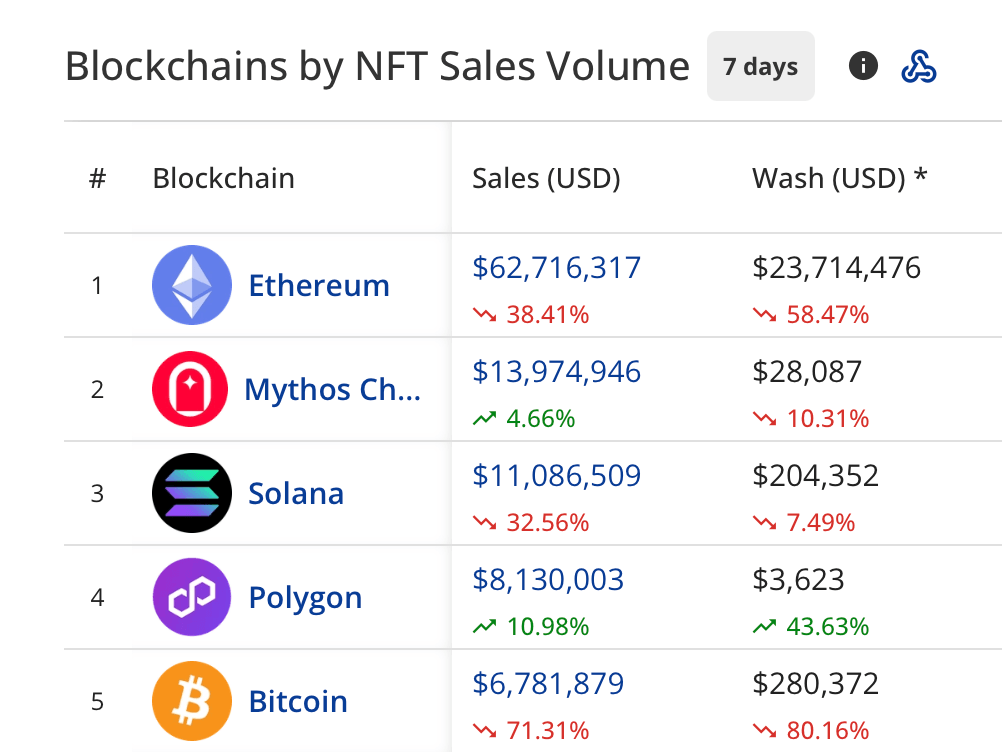

Ethereum-based NFTs weathered the sharpest downturn, sliding 38.41% to $62.71 million. The priciest Ethereum asset traded was f(x) wstETH position #373, commanding $803,297 on Feb. 7. Polkadot’s Mythos defied the trend, securing the week’s second-highest blockchain sales at $13.97 million. Solana, meanwhile, descended to third place with $11.09 million in finalized sales—a 32.56% slide from its prior weekly tally.

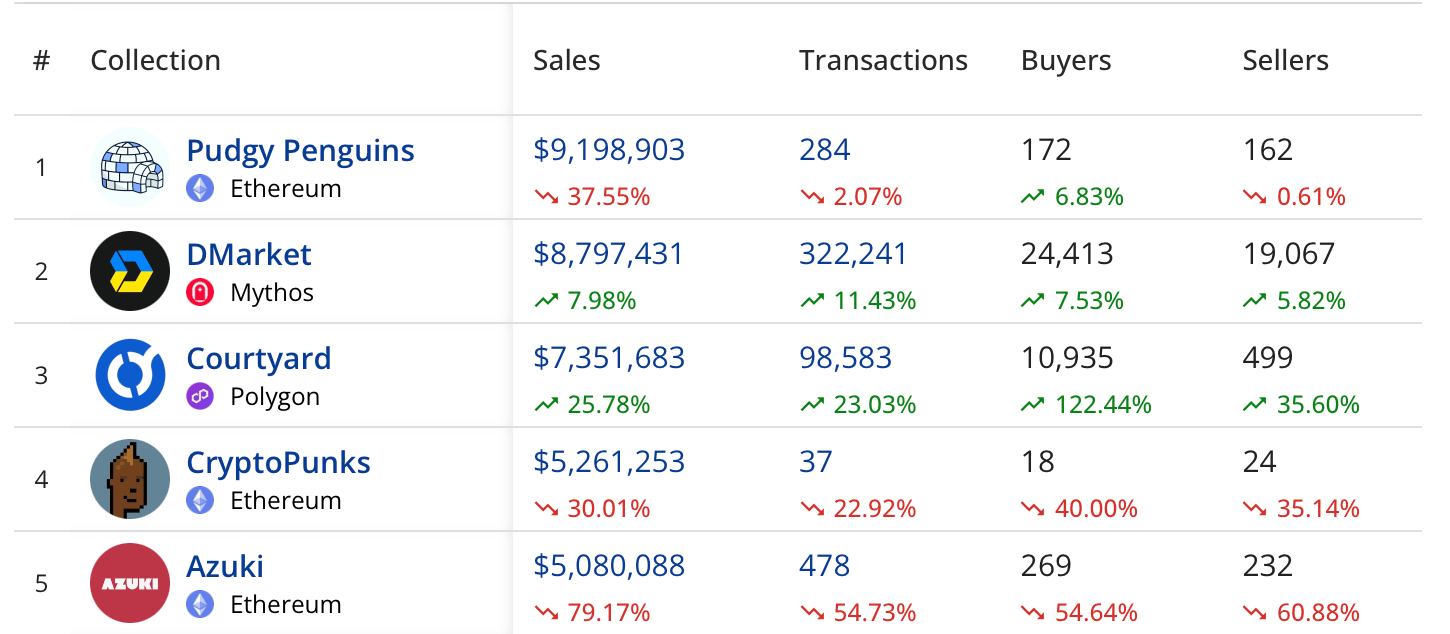

Five days prior, a Solana-minted Portals #14 commanded $172,956 in a notable transaction. Polygon secured fourth place with $8.13 million in digital collectible sales, marking a 10.98% expansion. Bitcoin captured the fifth position at $6.78 million—a sharp 71.31% contraction from January’s closing week. Ethereum’s Pudgy Penguins was crowned the week’s leading collection.

Pudgy Penguins cooled by 37.55% despite generating $9.20 million over the past seven days. Mythos’ Dmarket garnered $8.80 million, reflecting a modest 7.98% uptick. Mythos’ total weekly sales of $13.97 million represented a 4.66% rise.

Polygon’s Courtyard collection climbed 25.78% to $7.35 million, while Ethereum’s Cryptopunks slipped 30.01% to $5.26 million. Azuki, another Ethereum NFT offering, rounded out the top five with $5.08 million—a stratospheric 79.17% plunge from its prior weekly performance.