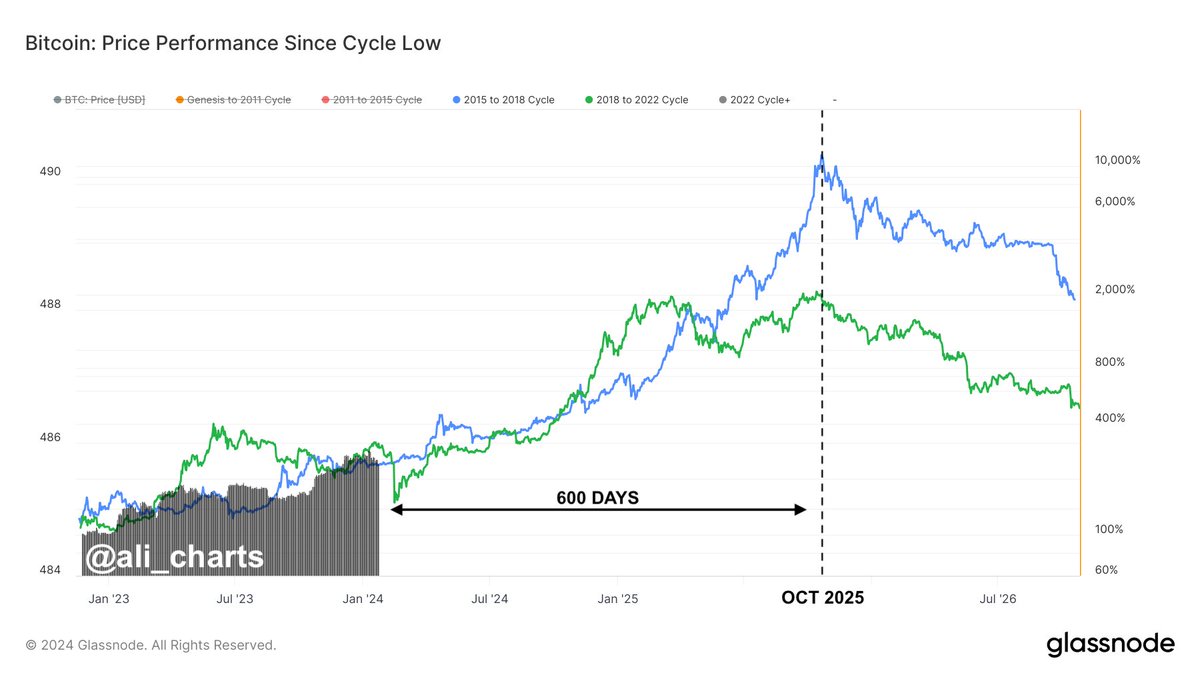

Crypto analyst and trader Ali Martinez says historical patterns may hold the key to how much longer Bitcoin’s (BTC) bull run could last.

Martinez tells his 42,300 followers on the social media platform X that if Bitcoin follows prior bullish cycles, the crypto king could remain in an uptrend for more than a year and a half.

“If Bitcoin mirrors past bull runs (2015-2018 and 2018-2022) from their respective market bottoms, projections suggest the next market peak could land around October 2025.

This implies BTC still has 600 days of bullish momentum ahead!”

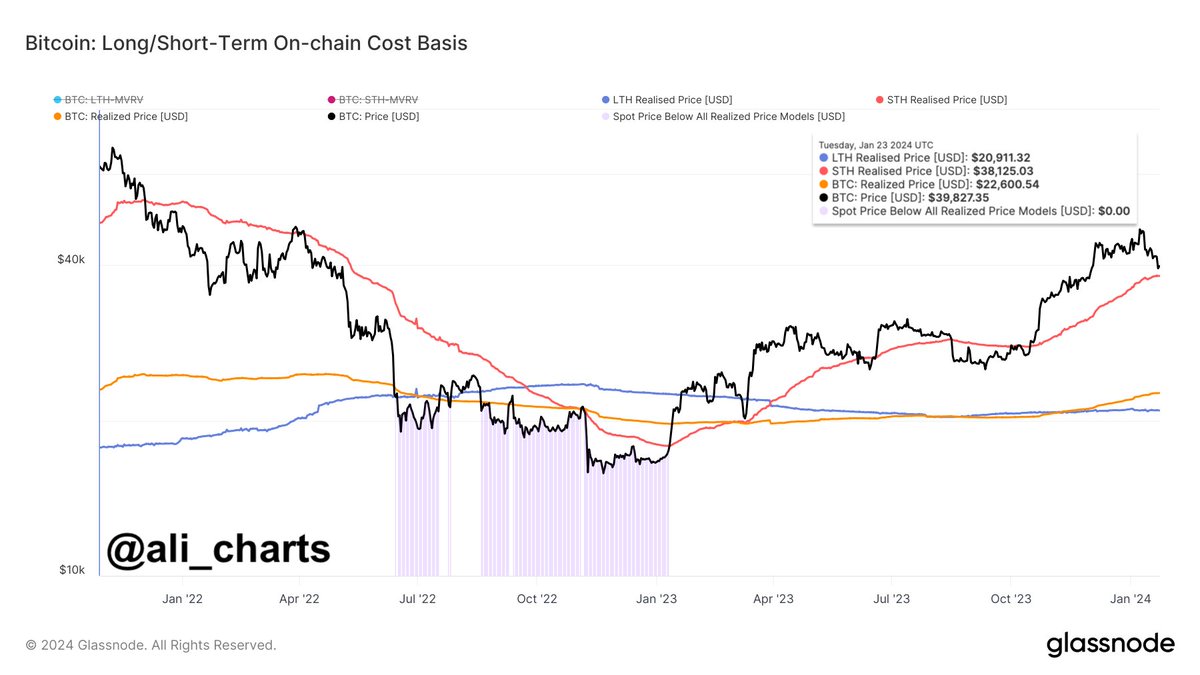

In the near term, the trader warns Bitcoin may face headwinds due to the cost basis of people who have held Bitcoin for under 155 days.

“If Bitcoin’s price falls below $38,130, short-term BTC holders could find themselves in the red. This potential BTC dip might trigger a new wave of panic selling as these holders will seek to minimize losses.”

The trader believes that since Bitcoin’s bullish momentum kicked off last year, its price is now in a fifth significant market correction. He predicts BTC will continue on its broader uptrend after completing the current correction.

“In this bull market, BTC has experienced four notable corrections: a 12% drop over 12 days, a 22.6% fall over 15 days, and two approximately 21% dips each lasting about 60 days.

Interestingly, Bitcoin is currently in the midst of a 21% correction, which has been ongoing for 12 days. Buy the dip.”

The trader warns BTC could correct down to the $33,000 level if it fails to hold $38,000 as support.

“A close below $38,000 on the weekly chart could signal a downturn for BTC, targeting the strong support cluster around $33,000.

This key area combines several technical elements: the lower boundary of a parallel channel, the 0.5 Fibonacci retracement level, and the 50-week simple moving average (SMA). These factors together form a significant line of defense that could potentially halt further BTC price declines.”

Bitcoin is trading at $39,718 at time of writing, down slightly in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Alberto Andrei Rosu/Sensvector