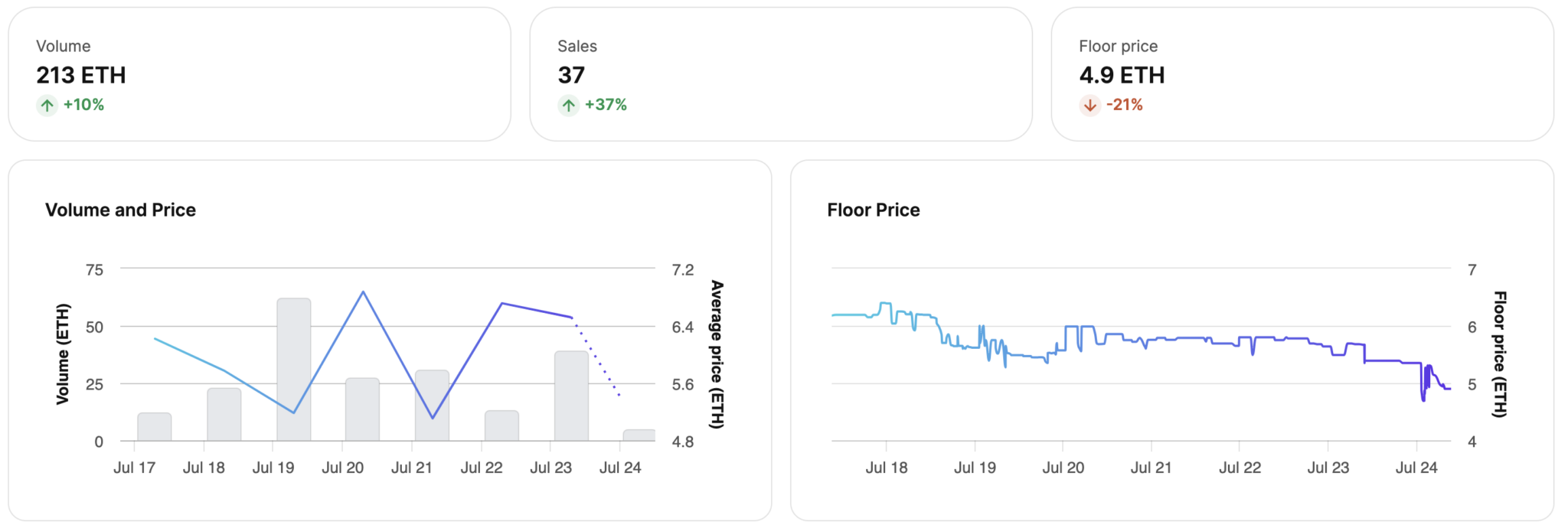

The floor price of any cryptocurrency refers to the lowest price at which it is currently being traded in the market. For Azuki, a popular and promising crypto asset, the floor price acts as a key indicator of its overall market health and attractiveness to potential buyers. However, the recent plunge of 21% in just seven days has sent shockwaves throughout the crypto community.

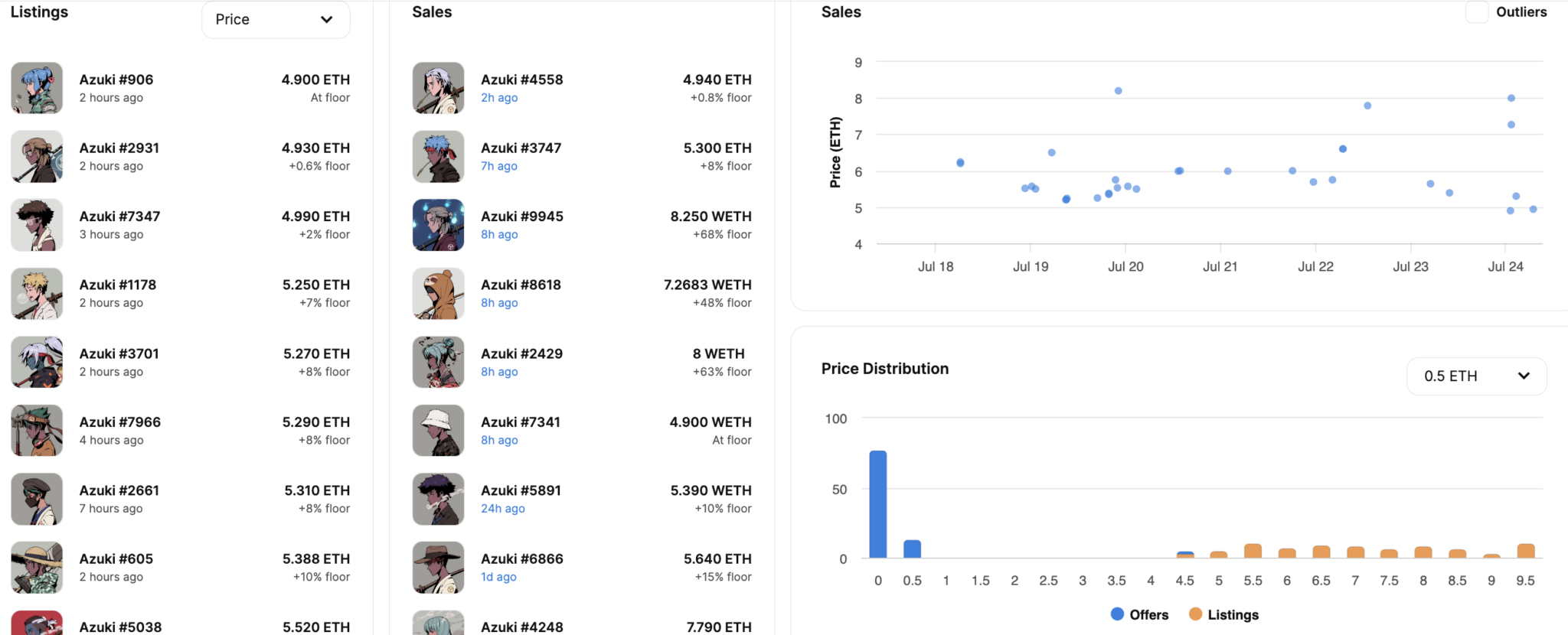

The news of Azuki’s floor price dipping below 5 ETH came as a surprise to many investors who had placed their trust in the token’s performance. The decline has prompted heated discussions on online forums and social media platforms, with investors expressing their concerns and speculating on the reasons behind this sudden downturn.

Some analysts attribute the drop to a combination of factors, including the broader market sentiment and potential regulatory challenges in the cryptocurrency space. Market sentiment can heavily influence the performance of digital assets, and any negative perception can trigger a downward spiral in prices.

Despite the concerning drop, seasoned traders and crypto enthusiasts are looking at this development as an opportunity. They believe that such price fluctuations offer a chance to buy the dip and accumulate more Azuki tokens at a discounted rate. The crypto market has a history of displaying remarkable resilience, and many investors are hopeful that Azuki will regain its momentum in the near future.

For those considering investing in Azuki or other cryptocurrencies, it is essential to conduct thorough research and stay informed about market trends. Diversifying one’s investment portfolio is often recommended as a risk management strategy in the volatile world of crypto trading.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.