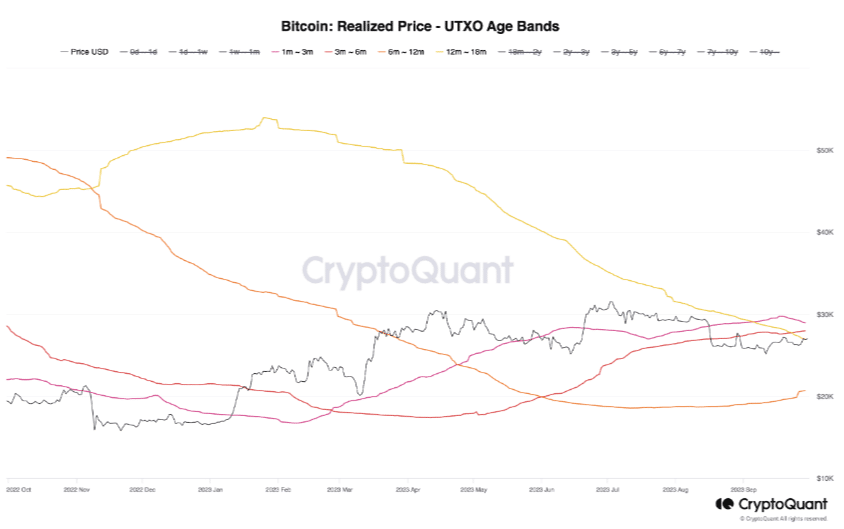

- Bitcoin’s 12–18 months UTXOs are not selling despite being close to the breakeven point.

- The average BTC holder was in profit at press time, with more optimism on display.

Long-term holders of Bitcoin [BTC] are displaying unwavering belief in the coin, as BTC maintained its value above $27,000 as the new month began. This conclusion was a result of the realized cap’s new high.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Support for BTC

On 1 October, Glassnode revealed that the Bitcoin realized cap reached a 30-day high of $395.65 billion.

📈 #Bitcoin $BTC Realized Cap just reached a 1-month high of $395,653,566,989.08

View metric:https://t.co/C8JhD26mC1 pic.twitter.com/HXiL7C6TfH

— glassnode alerts (@glassnodealerts) October 1, 2023

The realized cap offers a macroeconomic view of the BTC price. This is done by computing the value of each Unspent Transaction Output (UTXO) by the price when the coin last moved.

As a way to measure the value of a coin, the increase in the realized cap means that the majority of Bitcoins last moved were acquired at cheaper prices.

Furthermore, the Bitcoin market cap being above the realized cap means that the market was in aggregate profit despite some downturn over the last few months. The confidence shown by long-term holders was also corroborated by on-chain analyst Lidja Jahollari.

To do this, Jahollari compared Bitcoin’s current price and the realized price. The realized price is calculated as the realized cap divided by the total coin supply.

This value obtained from the calculation can be interpreted as the average price market participants paid for their coins. It can also act as an on-chain support price or resistance.

Source: CryptoQuant

The former is more positive than the latter

At the time the analyst published on CryptoQuant, BTC’s 12–18 months UTXO realized price was $26,950. She also added that the 6 -12 months cohort was $20,600.

In explaining both values, Jahollari noted that the 6 -12 months cohort gained much higher in terms of profitability since the former was almost at the breakeven point.

She wrote,

“The 12-18 Months UTXO Realized Price indicates that holders within this timeframe have reached their average purchase price. In contrast, the 6-12 Months UTXO Realized Price, lower than the market price, hints at profitability for this cohort.”

Another metric the analyst considered was the exchange inflow UTXO Age Bands. This metric summarizes the behavior of long and short-term holders alongside the price action.

Source: CryptoQuant

From the data above, the 6–12 months UTXOs are actively taking profit via transfers on exchanges. However, the 12-18 months group, despite living through a long period of unrealized losses, chose not to sell.

Is your portfolio green? Check out the BTC Profit Calculator

Due to this behavior, Jahollari mentioned that BTC at $26,950 may not serve as a resistance to the actual value. Instead, it had the tendency to be the on-chain support.

She concluded that,

“Given the limited influx of Bitcoin from the 12-18 Months UTXO cohort into exchanges indicating low selling pressure, it suggests that their realized price may not serve as a resistance level for Bitcoin price. This implies that Bitcoin has room to rise and potentially surpass this level.”