- Bitcoin hit $35,500 as the FOMC meeting ended in a favorable decision for the market

- There were long positions targeted at $ 42,697, as technical indicators suggest a continuous price rise

After Bitcoin [BTC] struggled to reclaim $35,000 earlier, discussion about a possible plunge emerged among players in the market. One reason for this fear was that many thought the market had seen enough gains for widespread profit-taking to begin in November.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Balanced rates, rising values

Contrary to the speculations, that was not the case. According to Santiment, the Federal Open Market Committee’s (FOMC) decision to keep interest rates stable between 5.25% and 5.50% was crucial for BTC’s jump to $35,500.

The FOMC is a branch of the U.S. Federal Reserve system. The committee meets eight times yearly to discuss monetary policy, employment conditions, economic growth, and price stability. Usually, this outcome of the meeting tends to increase Bitcoin’s volatility whether the interest rates increase or otherwise.

🇺🇸🎙️ #JeromePowell‘s #FOMC speech concluded 1 hour ago, and the #Fed is keeping interest rates steady between 5.25%-5.50%, as they have been since July. #Crypto climbed throughout the speech, and $BTC has hit $35.5K for the first time since May, 2022. 🎉 https://t.co/vFfusjYdLD pic.twitter.com/V2DKBgUUBV

— Santiment (@santimentfeed) November 1, 2023

Details from Yahoo Finance showed that Fed Chair Jerome Powell gave reasons for the decision to hit the pause button on the rates. One of Powell’s key takeaways was that the committee is dedicated to driving the inflation rate to 2%.

Regarding the latest resolution, he said:

“Inflation has moderated since the middle of last year and readings over the summer were quite favorable.”

Powell further explained that,

“But a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably.”

Traders look past $40,000

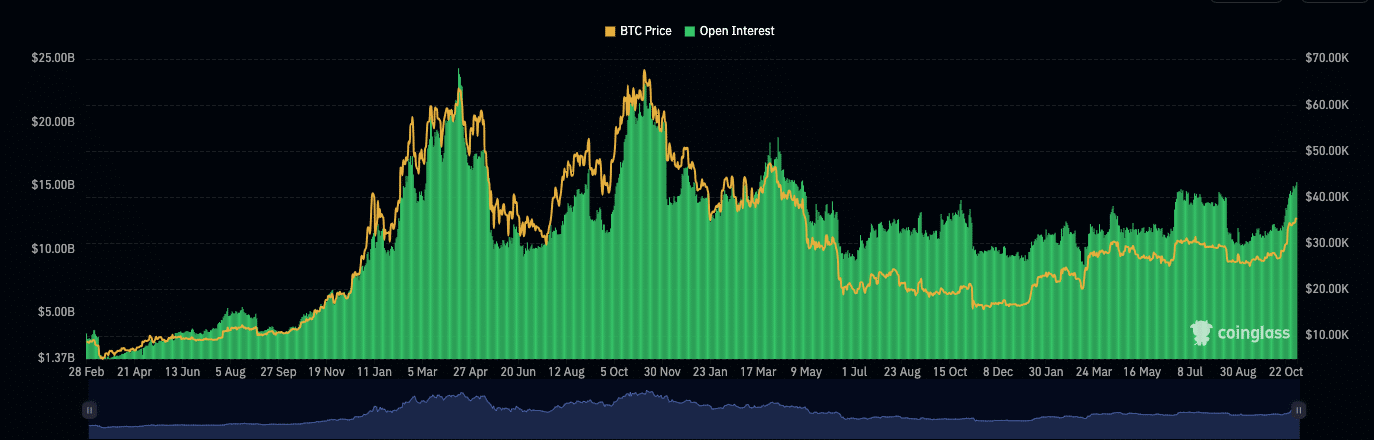

Apart from the price increase, Bitcoin’s open interest also jumped as a result of the FOMC decision. The Open Interest is the number of open long and short positions in the derivatives market.

As the Open Interest increases, so does the volatility, liquidity, and attention given to the asset.

When the metric decreases, it indicates otherwise. At press time, Coinglass’ data showed that Bitcoin’s Open Interest climbed to significant levels as shown below.

Also, rising Open Interest alongside an uptrend suggests enough strength for price action. If the indicator drops when the price increases, it is a sign of waning strength for the coin. So, it is likely that the Bitcoin price will continue to increase.

From the data above, traders are targeting as high as $42,697 in the short to mid-term.

However, BTC might need much more than a surging open interest to hit the price mentioned above. Therefore, it is necessary to check out the technical outlook.

Bears are far-flung

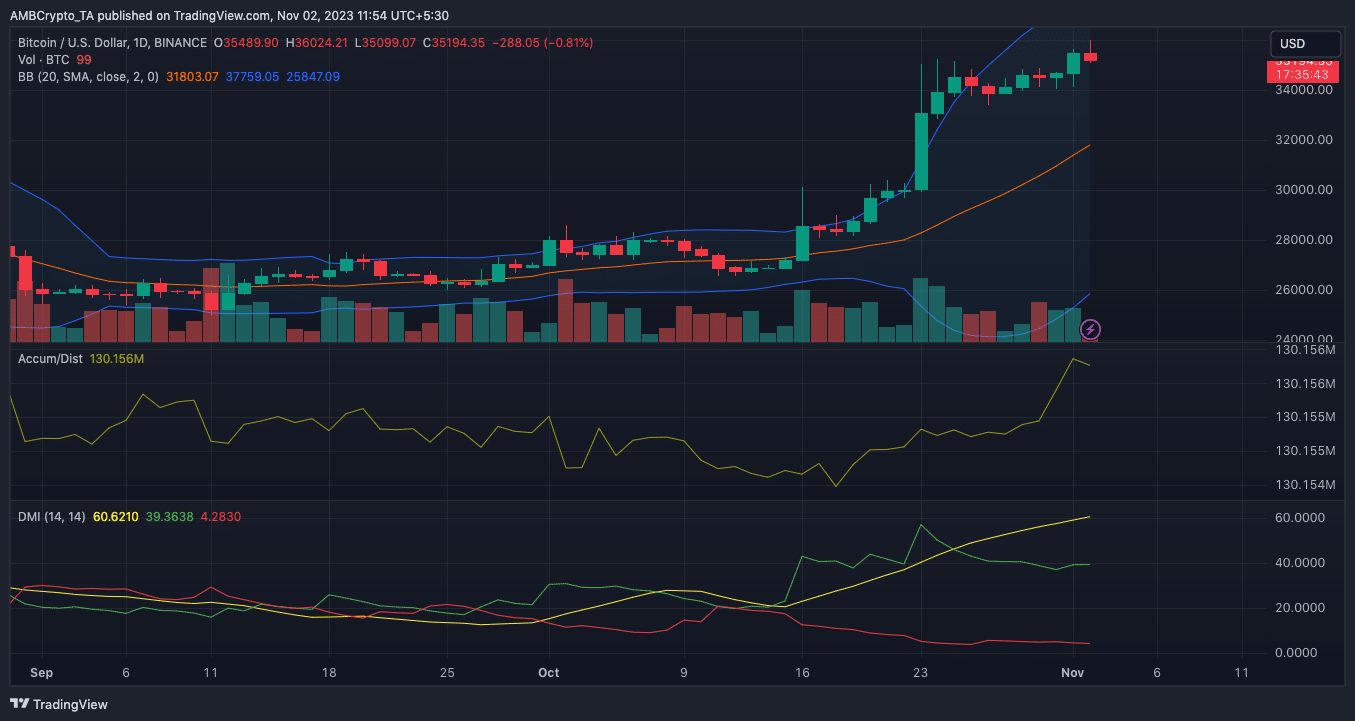

According to the BTC/USD daily chart, the distance between the Bollinger Bands (BB) widened. The BB is responsible for tracking volatility. Sometimes, it also gives the idea that a cryptocurrency is oversold or overbought.

As was mentioned earlier, volatility was now extreme. This means that there could be significant price fluctuations either to the upside or downside. However, the Accumulation/Distribution (A/D) line also increased.

The status of this indicator means that there was significant buying pressure. If the pressure remains in the same direction, then BTC may drive in the $40,000 direction.

Another indicator considered in the chart above is the Directional Movement Index (DMI). The DMI indicates the possible direction a crypto is likely to follow. At press time, the +DMI (green) was 39.36 while the -DMI (red) was 4.28.

This large difference explains how buyers are in full control of the market. So, it is very unlikely for BTC’s price to nosedive anytime soon.

This assertion was also validated by the Average Directional Index (ADX). At the time of writing, the ADX was 60.62, suggesting a strong directional upward movement for Bitcoin.

The initial fear is fizzling out

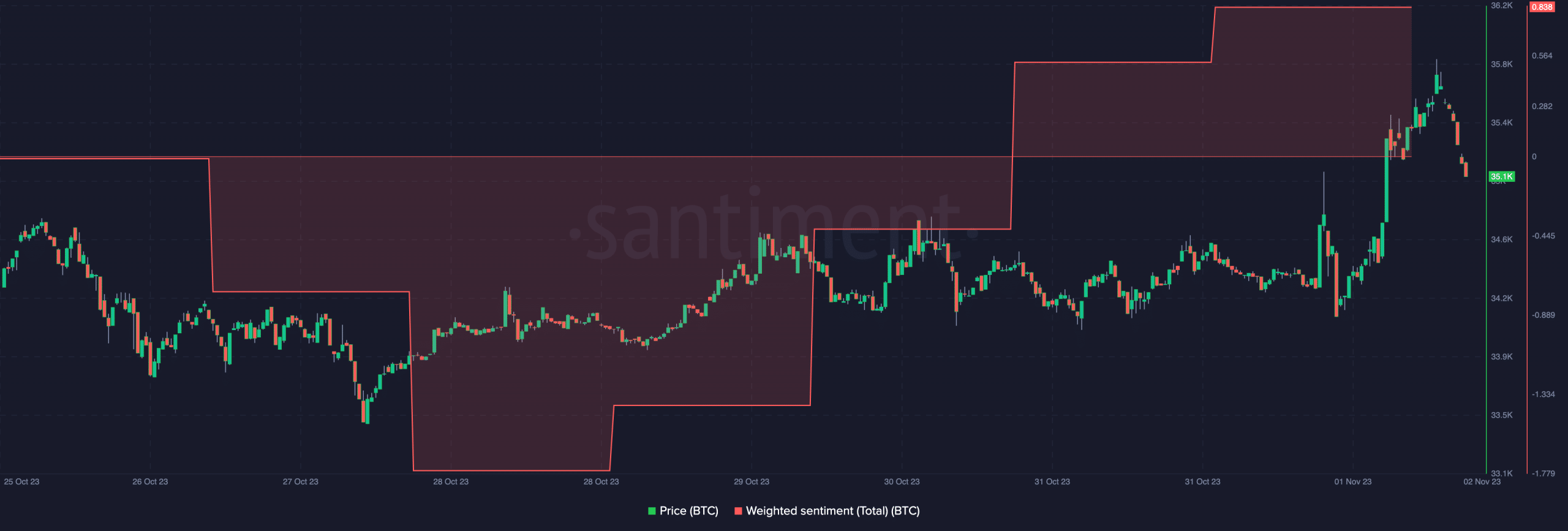

Additionally, on-chain data reinforced the notion of renewed optimism in the market, thanks to the Weighted Sentiment metric.

The Weighted Sentiment traces the perception shown by participants in the market.

Is your portfolio green? Check the BTC Profit Calculator

When this metric spikes, it means most messages are positive at the same time. Conversely, a notable drop in the metric signifies disappearing optimism.

As of this writing, the Weighted Sentiment had skyrocketed to 0.83. Therefore, a large part of the market expects the Bitcoin price to continue its uptrend unless halted by an all-inclusive sell block order.