Hundreds of new cryptocurrencies join the market every year, but Bitcoin still stands above them all. Its success can be attributed to many factors, like its mainstream recognition, pioneering status and, of course, its meticulously designed economic principles.

Central to this design is Bitcoin mining — a process that allows miners to receive rewards for validating transactions. However, unlike many assets, Bitcoin has a limited supply. As a result, periodically, the mining reward is halved in an event known as “halving.” I’ve seen firsthand how these halvings can create waves in the crypto industry, influencing both Bitcoin’s price and the general market sentiment. In this article, I’ll take a look at what Bitcoin halvings are, why they take place, and how they can impact the rest of the crypto industry.

What Is Bitcoin Halving (Halvening)?

Bitcoin, one of the world’s most well-known digital currencies, has a unique monetary policy built into its code. At its heart is an event known as the Bitcoin halving. This event is essentially a reduction in the block rewards received by miners for verifying and adding transactions to the blockchain.

Initially, when Bitcoin was created, miners received 50 BTC per block as their reward. However, every 210,000 blocks, or approximately every four years, this reward is cut in half. So, after the first halving, it dropped to 25 Bitcoins per block, to 12.5 after the next, and so on.

What Happens During a Bitcoin Halving?

During a BTC halving:

- Block rewards that miners receive for adding new transactions to the blockchain are reduced by 50%.

- As a result, the BTC per block that miners receive as their reward for mining decreases, making the overall inflation rate of Bitcoin drop.

- Transaction fees do not get halved. They continue to provide an incentive for miners to keep the network secure, especially as block rewards decrease over time.

- The crypto market often reacts to this event with increased speculation and discussions about Bitcoin’s future value and role in the financial ecosystem.

Why Do Bitcoin Halvings Occur?

Bitcoin halvings are integral to its design and have several purposes:

- Controlled Supply. Unlike fiat currencies that can be printed in unlimited quantities by central banks, Bitcoin has a maximum supply of 21 million coins. The halving mechanism ensures that these Bitcoins are introduced into the system gradually, which makes it a deflationary asset over time.

- Reduced Inflation. When the supply of Bitcoin decreases, it effectively leads to a lower inflation rate of Bitcoin itself. This is in stark contrast to traditional fiat currencies, where inflation can be influenced by external factors such as political decisions or economic conditions.

- Sustainability. The halving process ensures that all 21 million Bitcoins won’t be mined too quickly, giving the Bitcoin network more time to grow, mature, and become widely adopted.

- Miner Incentive. Although block rewards decrease, the hope is that the increasing value of Bitcoin, coupled with transaction fees, will continue to provide a lucrative incentive for miners to maintain the network’s security and integrity.

Essentially, while Bitcoin and other digital assets continue to evolve in the ever-changing crypto market, the halving mechanism serves as a balancing act, regulating Bitcoin’s supply and, by extension, its value against traditional assets and currencies. It stands as a testament to Bitcoin’s promise to challenge the status quo of central banks and traditional fiat currencies, offering an alternative in the form of decentralized digital currency.

When Is the Next Bitcoin Halving?

The Bitcoin protocol specifies that a halving event occurs every 210,000 blocks. Given that the last halving took place in May 2020 at a block height of 630,000, the next halving is anticipated around the 840,000th block. If we consider that a new block is added to the Bitcoin blockchain approximately every 10 minutes, the next halving is projected to occur in 2024.

How Will Halving Affect Miners?

As I mentioned earlier, the April 2024 Bitcoin halving will significantly increase mining and cash costs due to halved block rewards. In their recent report, CoinShares projects mining costs to rise from $16,800 to $27,900 and cash costs from $25,000 to $37,800 per Bitcoin. The average cost post-halving is expected to be around $37,856.

CoinShares points out that while companies like Riot, TeraWulf, and CleanSpark are well-equipped for this change, a drop in Bitcoin price below $40,000 could be challenging for all miners. Despite more efficient mining technology, the report indicates an increase in energy costs, rising from 68% to 71% of total expenses.

The halving is expected to tighten miners’ profit margins, with only the most efficient surviving. CoinShares also anticipates a reduction in mining difficulty and possible miner exits after the halving, leading to a complex impact on Bitcoin prices.

The report suggests that high prices may reduce miner profits, creating selling pressure, yet the halving could also positively influence Bitcoin’s value. They do not provide any Bitcoin price prediction post-halving. This indicates huge uncertainty surrounding post-halving prices, though one thing we can predict for sure — the halving event will generate significant market hype.

How Will Halving Affect Bitcoin price? 10 Main Theories

The future of Bitcoin and the overall crypto market post-halving remains a mystery to experts worldwide. To shed some light on the potential outcomes, I’ve compiled 10 prominent theories. Let’s delve into these hypotheses and explore what might unfold.

1. Mining Death Spiral Post-Halving

The theory suggests that the halving’s reduction in mining rewards could lead to unprofitable mining, causing a significant drop in hashrate and slower block production. This could spiral into reduced system utility and further price drops. However, practical considerations, like the scale of the mining industry and contractual obligations, make such a scenario unlikely.

2. Stock-to-Flow Ratio and Price Pressure

Proposed by economist Safedean Ammous and quant researcher PlanB, this model predicts a price increase post-halving due to a doubled stock-to-flow ratio. However, whether this reduction in supply alone will significantly impact Bitcoin’s price remains a subject of debate and skepticism.

3. Speculative Demand Shift

This hypothesis suggests that the pre-halving price is inflated by speculation and may lead to post-halving sell-offs, similar to equity market dynamics. While some speculative demand is likely, its conversion to supply is not expected to drastically affect prices.

4. Increased Selling Pressure from Miners

Post-halving, miners may face ROI challenges and sell more Bitcoins, including tapping into reserves, to maintain profitability. This could temporarily increase selling pressure. However, halving also reduces Bitcoin production by 50%, potentially offsetting this pressure.

5. Halving as a Non-Event

Some believe the halving won’t significantly disrupt Bitcoin’s price or technical operations, price volatility will remain within normal bands, and supply-demand balance effects will materialize slowly. The theory suggests that the market will adjust post-halving, with miners upgrading or exiting the industry. Such changes on the supply side could potentially lead to a positive long-term impact on Bitcoin’s price.

6. Acceleration of Institutional Adoption

This theory posits that the halving event might catalyze increased interest and investment from institutional players. The narrative is that the reduced supply and increased perception of Bitcoin as a scarce asset could make it more appealing to institutional investors seeking a hedge against inflation or a new asset class. However, the extent to which institutional adoption can influence the overall market remains a matter of speculation.

7. Enhanced Public Awareness and FOMO

The halving event often brings Bitcoin into the limelight, potentially increasing public awareness and interest. This heightened attention could trigger fear of missing out (FOMO) among retail investors and, therefore, drive up demand and prices. Nonetheless, the impact of such sentiment-driven rallies is unpredictable and can lead to increased market volatility.

8. Technological Advancements and Efficiency Gains

Another theory focuses on the technological progress in mining hardware. The halving could incentivize miners to invest in more efficient mining technologies, leading to long-term gains in network efficiency and sustainability. While this might not have an immediate impact on Bitcoin’s price, it could enhance the overall robustness of the Bitcoin network.

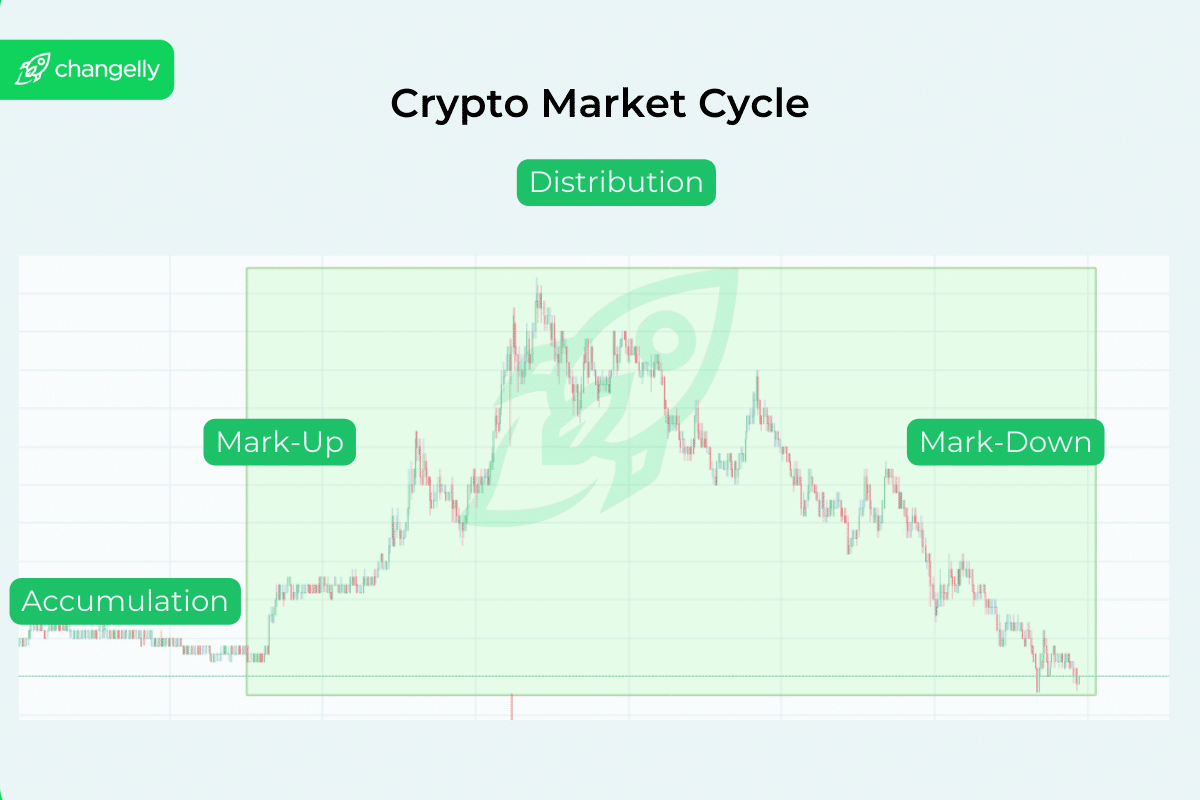

9. Market Cycle Alignment

This perspective examines the halving in the context of Bitcoin’s historical market cycles. Some analysts suggest that halvings tend to coincide with the beginning phases of major bull markets in Bitcoin.

The cycle is commonly referred to as being around 4 years, largely because of Bitcoin’s halving events. However, past performance is not a reliable indicator of future results, and each halving occurs under unique market conditions.

10. Regulatory Environment Shifts

Post-halving, regulatory reactions and policy changes could significantly impact Bitcoin. If the halving leads to higher prices and increased market activity, it could attract more regulatory scrutiny or, conversely, lead to regulatory clarity and acceptance.

Each of these theories adds a different dimension to understanding the potential impacts of the Bitcoin halving, underlining the multifaceted nature of this event and its significance in the broader context of cryptocurrency markets.

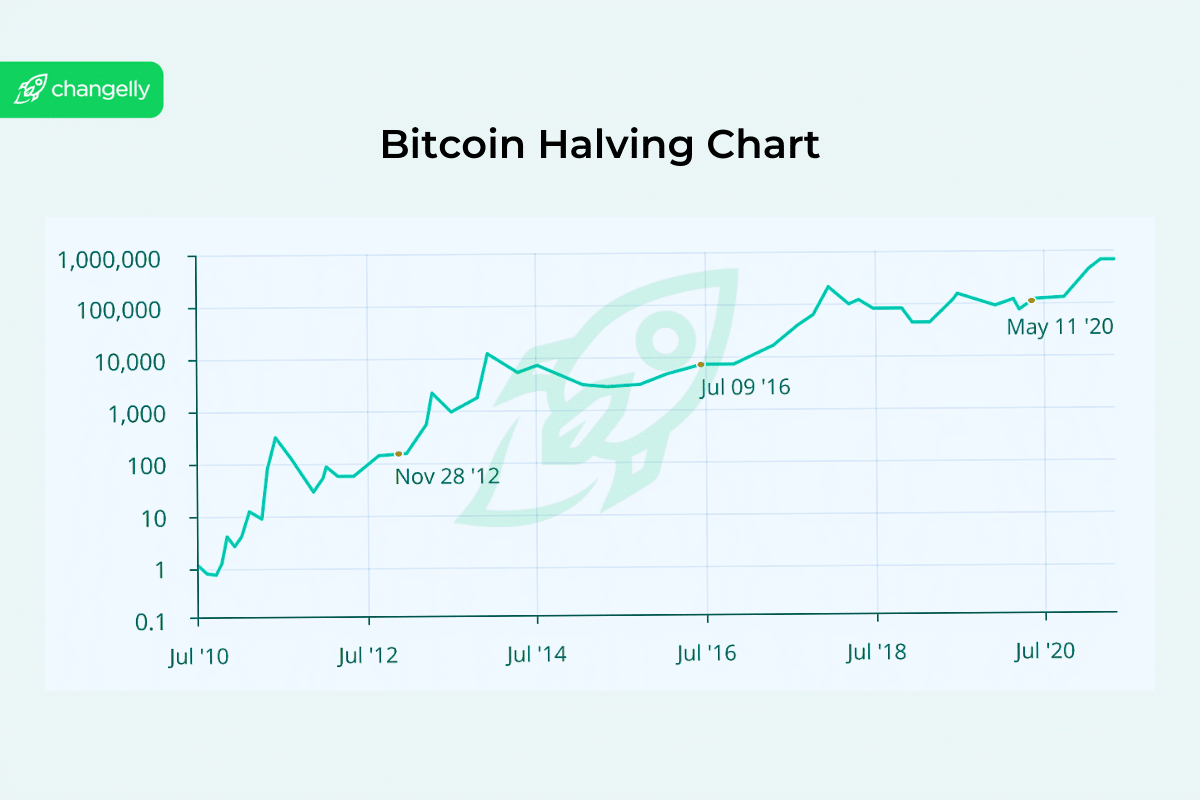

Bitcoin Halving History

The Bitcoin halving event plays a pivotal role in shaping Bitcoin’s economic model and market dynamics. Over the years, there have been several such events, each influencing Bitcoin miners, Bitcoin transactions, and the overall crypto market in their own unique ways. Diving into the Bitcoin halving dates history can give us a broader understanding of its impact on the digital currency’s landscape.

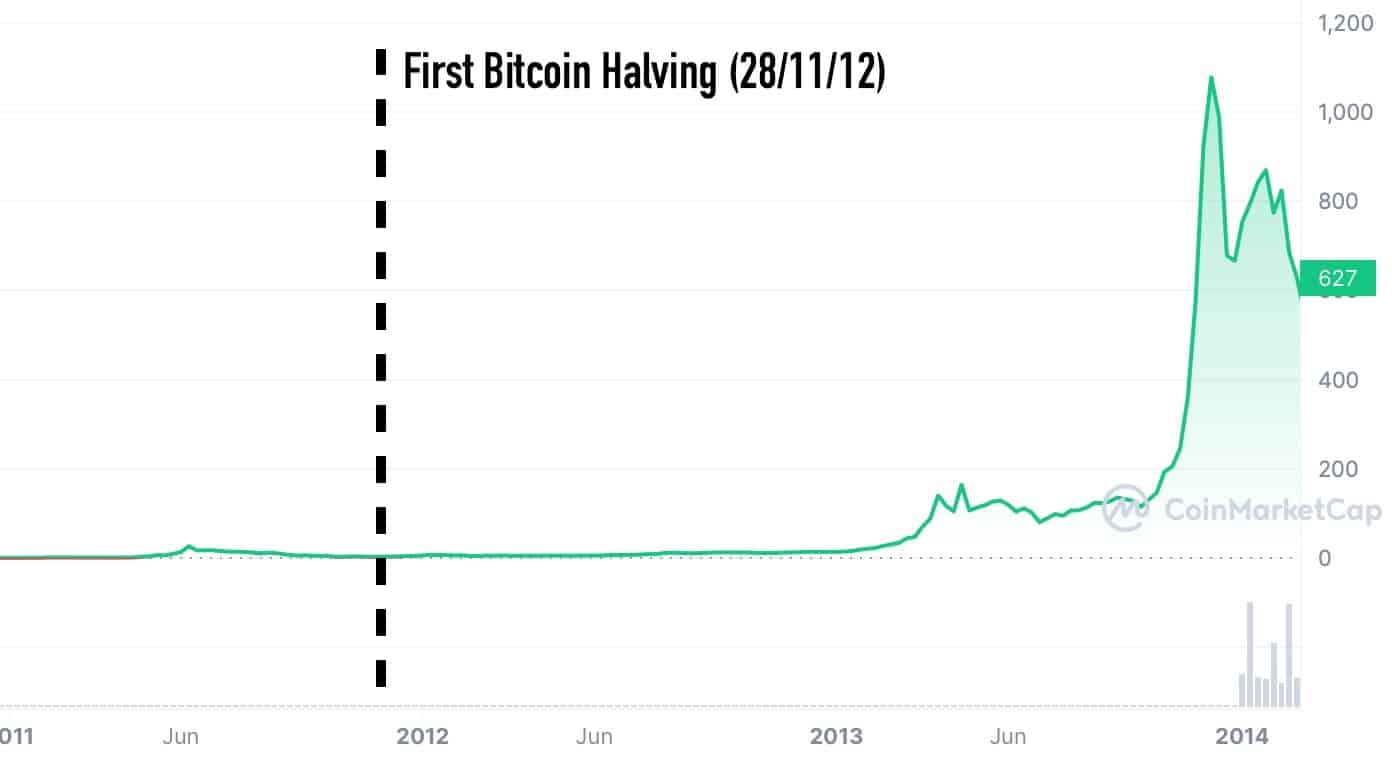

First Bitcoin Halving (2012)

Date: November 28, 2012

Block Reward Before Halving: 50 BTC

Block Reward After Halving: 25 BTC

The first Bitcoin halving was a significant milestone, coming just three years after Bitcoin’s launch. This event set the precedent for future halvings. While it was a moment of intrigue within the crypto community, the wider world was still acquainting itself with the concept of Bitcoin. In the aftermath of this halving, Bitcoin’s price experienced a steady ascent, signaling the potential for future price surges.

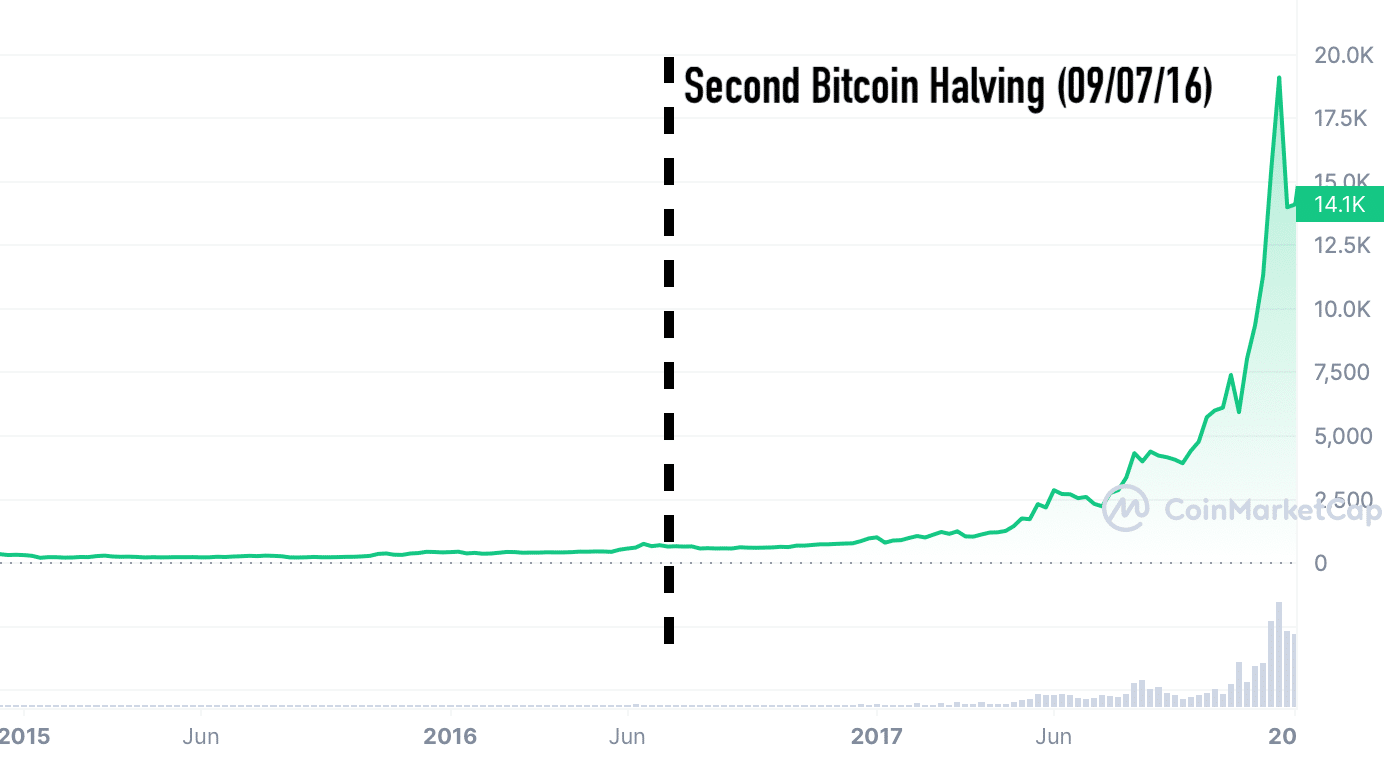

Second Bitcoin Halving (2016)

Date: July 9, 2016

Block Reward Before Halving: 25 BTC

Block Reward After Halving: 12.5 BTC

By the second halving event, Bitcoin had garnered significant attention. The crypto market watched eagerly, and the event did not disappoint. In the ensuing months, Bitcoin’s value started climbing, culminating in the remarkable bull run of 2017.

Third Bitcoin Halving (2020)

Date: May 11, 2020

Block Reward Before Halving: 12.5 BTC

Block Reward After Halving: 6.25 BTC

The third Bitcoin halving event was met with much anticipation. With a growing acknowledgment of digital currencies and their potential to reshape financial systems, this halving drew immense attention. Following this event, despite several global economic challenges, Bitcoin’s resilience shone through as it ventured into new all-time price highs.

The Cyclical Theory of Bitcoin Halvings: Historical Patterns and Contemporary Skepticism

The cyclical theory of the crypto market, particularly surrounding Bitcoin halvings, is a popular concept with many adherents. It’s grounded in the historical context of Bitcoin’s previous halvings and the market reactions that followed each of these events.

According to this theory, Bitcoin’s halving — an event that halves the reward for mining new blocks and occurs approximately every four years — plays a pivotal role in the cryptocurrency’s market cycles. The halving reduces the influx of new Bitcoin into the market, effectively constricting supply. When demand remains constant or increases, this supply reduction has historically led to significant price surges. For example, following the halvings in 2012 and 2016, Bitcoin experienced substantial increases in value over the ensuing periods, reinforcing the belief in this cyclical pattern.

Historically, whenever the Bitcoin halving occurred, it has typically been followed by a period of strong price appreciation.

The theory suggests that the market, in anticipation of the halving, often enters a bullish phase. Investors and traders, hoping for post-halving price rises, start buying Bitcoin, potentially setting the stage for the expected outcome. Furthermore, post-halving, the crypto market typically undergoes a period of adjustment. Reduced block rewards impact miner profitability, possibly leading to the exit of less efficient miners and a subsequent consolidation of the mining landscape.

Each cycle, marked by these halving events, not only impacts prices but also appears to increase Bitcoin’s visibility, adoption, and maturity, feeding into the next cycle.

However, the cyclical theory is not without its drawbacks and counterarguments.

Critics argue that past performance is not a reliable indicator of future results. Each halving event occurs under unique market conditions, influenced by a myriad of factors beyond just the halving itself. These include regulatory changes, advances in blockchain technology, macroeconomic shifts, and evolving market sentiments.

Additionally, as the cryptocurrency market matures and gains broader adoption, its behavior could diverge from past patterns. Increasing institutional involvement and regulatory scrutiny may also play a significant role in shaping market dynamics, potentially diminishing the impact of halvings over time.

In essence, while the cyclical theory based on Bitcoin’s halving events has many followers and is rooted in historical data, it’s essential to consider it within the broader, ever-evolving landscape of the cryptocurrency market.

FAQ

How does Bitcoin halving work?

Every 210,000 blocks, the block reward given to Bitcoin miners for processing Bitcoin transactions and adding them to the Bitcoin blockchain is reduced by 50%. This event is hardcoded into the Bitcoin protocol, ensuring that the total Bitcoin supply doesn’t exceed its cap of 21 million.

What happens when there are no more Bitcoins left?

Bitcoin has a capped supply of 21 million coins. As of now, the majority of these coins have already been mined, but it will take until approximately the year 2140 for the last Bitcoin to be mined. After the last BTC has been mined, miners will no longer receive block rewards in the form of new Bitcoins.

Instead, their incentive to keep validating transactions and maintaining the network’s security will come solely from transaction fees. The Bitcoin protocol has been designed with this eventual scenario in mind, emphasizing the importance of transaction fees in the long-term sustainability of the Bitcoin blockchain.

Will Bitcoin price rise after the next halving?

While past events provide insights, they don’t necessarily dictate future outcomes. Yet, they undoubtedly underscore the significance of the halving mechanism in Bitcoin’s design. Historically, previous halvings have been followed by periods of significant price appreciation for Bitcoin. However, it’s essential to understand that numerous factors influence the price of Bitcoin, including but not limited to market demand, global economic conditions, regulatory developments, and technological advancements.

While the reduction in the mining reward tends to lessen the selling pressure from miners (since they have fewer Bitcoins to sell), there’s no guaranteed outcome. Past price movements post-halving serve as a reference, but they don’t predict future performance. It can be beneficial to study trends following previous halvings for informational purposes, but one should approach the future with an understanding of Bitcoin’s broader ecosystem and the myriad of factors that can influence its value.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.