- Active addresses have not neared 2021’s peak, indicating a bullish potential.

- Bitcoin displayed a positive volume pressure, suggesting higher prices.

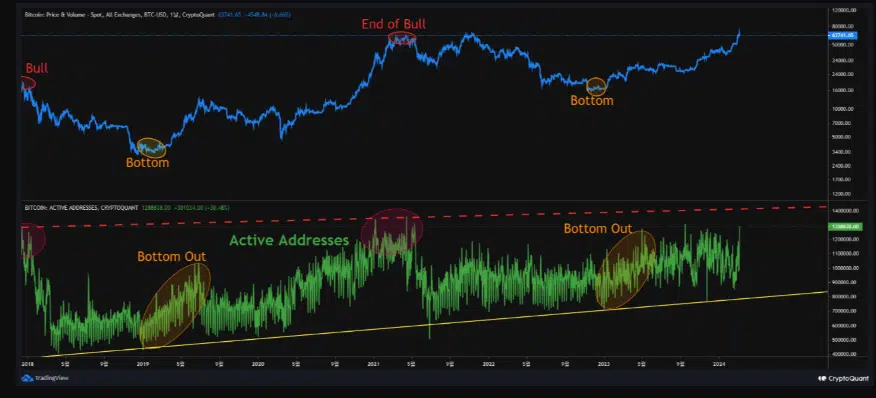

Though Bitcoin’s [BTC] rise to a new high was good news for the market, some analysts believe that $69,000 is only a little of how high the price can go. One of those analysts is Crypto Dan, a Korean investor. Dan published his analysis on CryptoQuant with a focus on Bitcoin’s active addresses.

For those unfamiliar, active addresses measure the level of user interaction with a project. If the metric increases, then it means that there is a high level of transaction within the blockchain.

On the other hand, a decline implies that the daily level of speculation is low.

Bitcoin has not started yet

Dan, in his post, noted that active addresses rise twice in a cycle, highlighting that the metric skyrockets at the end of a bear market, and the beginning of the bull market. For some time, market participants have repeatedly said that the current condition is a bull cycle.

Source: CryptoQuant

The analyst agreed with this point. However, he mentioned that Bitcoin’s state concerning the active addresses meant that the price had not yet neared its highest value. While defending his point with the chart above, he wrote,

“Currently, we can be considered to be in the middle of a bull market. Eventually, the crypto market will reach the end of the bull market as the number of active addresses rapidly increases and reaches the overheating zone (red dotted line). But not yet.”

AMBCrypto observed that the present state of the metric was closer to the bottom than the top. Therefore, one can assume that BTC might climb much higher than $69,000 going forward.

BTC daily analysis

On the daily chart, Bitcoin seems to be walking its way up to $68,000 while trading a little below $67,000. For the long-term outlook, we considered the Exponential Moving Average (EMA).

At press time, the 50 EMA (blue) had crossed over the 200 EMA (yellow), indicating a bullish trend for the coin. As long as BTC does not drop below $52,200, the price has the potential to hit the $80,000 region.

Another indicator AMBCrypto looked at was the On Balance Volume (OBV). As of this writing, the OBV reading had increased, indicating positive volume pressure. With this position, Bitcoin’s price might not wait for a long time before it surpasses the high it hit a few days ago.

Furthermore, the Awesome Oscillator (AO) displayed a green daily histogram bar, suggesting increasing upward momentum. In the short term, BTC might rally toward $72,000 to $75,000.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-2025

However, this number might be small compared to the next few months if the active addresses surge. Should the number of active Bitcoin users rise as it was in the 2021 bull market, then the price might climb higher.

However, if it doesn’t, BTC might jump but it might not hit an astronomical valuation