Market volatility is nothing new, however it has reached its top in recent times. This has led to numerous hype and buzz round stablecoins, that are designed to keep up their worth no matter market traits. The USDT Tether token is without doubt one of the hottest stablecoins available on the market, and plenty of merchants have turned to it to mitigate the results of market volatility. Nevertheless, there’s some controversy surrounding USDT Tether, as some have claimed it’s getting used to control the crypto market. Regardless of this, it’s nonetheless among the many most generally used stablecoins. Let’s deep dive into the USD Tether token — a contemporary tackle the age-old idea.

USDT Overview

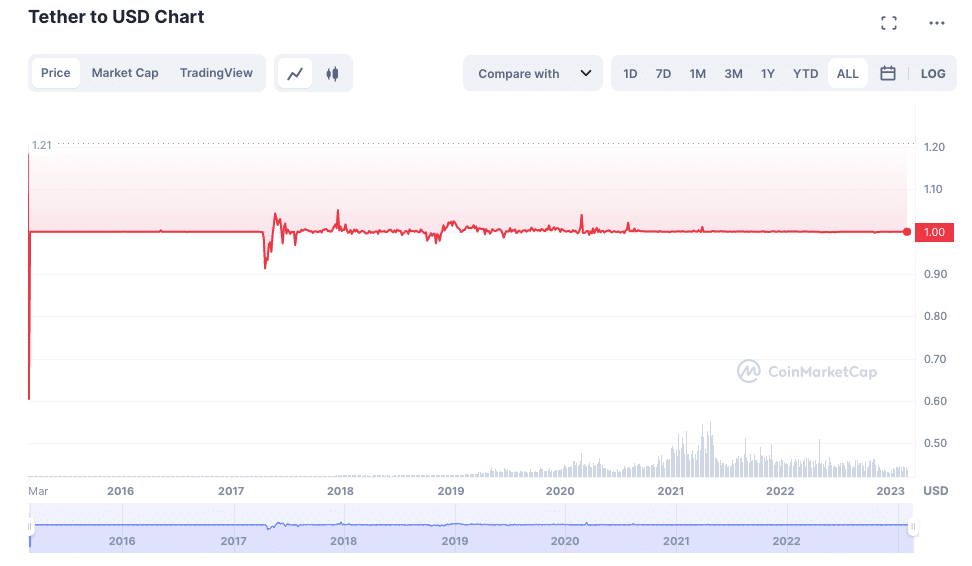

| Tether Worth | $1.00 |

| Tether Worth Change 24h | -0.11% |

| Tether Worth Change 7d | 0.15% |

| Tether Market cap | $75,282,651,752.91 |

| Tether Circulating Provide | 75,171,191,255 USDT |

| Tether Buying and selling Quantity | $61,401,951,505.68 |

| Tether All time excessive | $1.22 |

| Tether All time low | $0.57 |

USDT, also referred to as Tether, is a cryptocurrency whose worth is pegged to the US greenback — a stablecoin. A stablecoin is a kind of cryptocurrency that seeks to peg its worth to a different asset, such because the US greenback reserves or gold. USDT was launched in 2014 by Tether Restricted. USDT is backed by Tether’s reserves, that are held in numerous financial institution accounts. USDT is used to purchase different cryptocurrencies in addition to to supply liquidity for exchanges.

Nevertheless, USDT additionally was on the middle of controversy a number of occasions because of considerations about its reserves and transparency.

In November 2017, round $31 million value of USDT tokens had been stolen from Tether. The identical yr, Tether did not adjust to all withdrawal requests. Whereas Tether representatives repeatedly mentioned that they would offer an audit report proving that the quantity of Tethers in circulation is backed one-to-one by US {dollars}, they’re nonetheless but to do that.

What Is USDT Backed by?

Two years later, in 2019, USDT creators mentioned the coin is backed not solely by money but in addition by loans from associated organizations. On the finish of April of the identical yr, they reported that solely 74% of the cryptocurrency is backed by fiat cash ({dollars}) or money equivalents. Moreover, some have claimed that Tether is used to control the value of Bitcoin. Regardless of these controversies, USDT stays one of the vital common stablecoins and is broadly used on cryptocurrency exchanges.

How Does USDT Work?

USDT is pegged to its matching fiat foreign money — the US greenback. Because of this every USDT Tether token is backed by an equal amount of money, making it a protected funding throughout occasions of financial uncertainty. As well as, USDT can be utilized to buy items and companies, with the volatility of different cryptocurrencies being out of the image. To attain this stability, USDT tokens are minted or burned based mostly on demand. When extra USDT tokens are wanted, new tokens are minted and deposited into exchanges. When there’s much less demand for USDT, tokens are burned as a way to cut back the availability. This matching of provide and demand helps to make sure that every Tether token stays pegged to the US greenback. Consequently, USDT gives traders with a protected and secure option to retailer worth.

Tether was first launched on the Bitcoin blockchain via the Omni Layer protocol, however it could now be issued on all blockchains that assist Tether. In response to CoinMarketCap, as of February 2023, there are greater than 50 chains doing so, together with Ethereum, BNB Sensible Chain, Terra Traditional, Polygon, Fantom, Optimism, Tron, Bitcoin Money, Solana, NEAR, Dogechain, and plenty of, many extra.

USDT: Tether’s Historical past & Founders

USDT was created in 2014 by Brock Pierce, Reeve Collins, and Craig Sellars with a mission to supply the world with a secure digital token ecosystem. Initially named Realcoin, the token couldn’t compete with common altcoins. Nevertheless, after a collection of updates, it modified its identify to Tether and altered its issuance expertise. The transformation was essential to survive on this planet of digital cash. That is how the stablecoin Tether, which in a while turned a handy selection for companies and people, was born.

Tether is a digital token ecosystem that provides a risk-free alternative to retailer, ship, and obtain digital tokens. Tether Restricted is the corporate that points Tether tokens. Quickly after the launch, rumors emerged that the group was related to the Bitfinex cryptocurrency change because it was the primary change to listing the coin. After some evaluation and investigation performed by Paradise Papers, such data was confirmed. The Hong Kong-based company iFinex Inc., which additionally operates the cryptocurrency change Bitfinex, is the proprietor of Tether Restricted.

Having reached the best day by day and month-to-month buying and selling volumes available on the market in 2019, Tether overtook Bitcoin when it comes to buying and selling quantity. In 2021, USDT surpassed the $1 trillion mark in on-chain quantity, making it one of the vital profitable cryptos in historical past.

Right this moment, USDT continues to be one of many main cryptocurrencies, with thousands and thousands of {dollars} value of transactions being carried out every day. Because of its comfort and safety, USDT is prone to stay a best choice for cryptocurrency customers for years to return.

How you can Mine / Stake USDT?

Tether mining shouldn’t be doable: its technology is carried out solely after backing with actual cash. This perplexes some cryptocurrency customers as a result of the concept is opposite to digital cash. Nonetheless, this specific token occupies the center floor between conventional foreign money and digital property.

USDT Crypto: Benefits & Disadvantages

One key distinction between USDT and different digital property is that USDT is backed by business paper. Because of this there’s all the time actual collateral backing every USDT in circulation. Consequently, USDT has a really low threat of default.

As well as, USDT might be shortly and simply exchanged for different currencies on crypto exchanges. And what’s extra, Tether has expanded in reputation due to its integration into quite a few totally different blockchains.

This makes it an excellent selection for traders who wish to commerce digital property with out having to fret concerning the volatility of the crypto market.

Nevertheless, some individuals argue that the usage of business paper makes USDT much less clear than different digital property. In addition they level out that the USDT change charge is commonly decrease than the dollar-to-bitcoin charge, which means that customers could not get as a lot worth for his or her funding in USDT. Different main cons are:

- Disturbance of the worldwide market steadiness as a result of mixture of actual and digital cash;

- Accusations that the corporate behind the coin makes use of a particular reservation scheme, the place extra tokens are made than there’s actual cash. By doing this, Bitcoin’s change charge will increase to regulate the market;

- Safety issues brought on by the occasions of November 20, 2017 — the day when Tether’s system was hacked. 30 million USDT had been stolen, the creators couldn’t get the cash again, and the safety degree didn’t enhance both.

Finally, every investor might want to weigh the benefits and drawbacks of USDT earlier than deciding whether or not or not it’s a match for them.

Tether Tokens In comparison with Different Stablecoins

When selecting between stablecoins, traders ought to think about their targets and threat tolerance.

USDT vs USDС (USD Coin)

There are at present two property vying for the title of the highest stablecoin — USDT (Tether) and USDC (Circle). Each intention to supply a secure cryptocurrency that’s pegged to the US greenback, however there are some key variations between the 2.

USDT is issued by Tether, an organization that additionally runs the favored cryptocurrency change Bitfinex. USDC is issued by Circle, a monetary companies firm backed by Goldman Sachs. One key distinction between the 2 stablecoins is that USDT is backed by actual foreign money property, whereas USDC is backed by fiat foreign money deposits saved in regulated banks. Because of this USDT is extra vulnerable to fluctuations within the worth of actual property, whereas USDC must be extra secure total. In distinction to USDC, which is famend for its security and higher regulatory compliance, USDT is extra often used for buying and selling and funds. This makes USDT extra accessible to a wider vary of customers. Finally, each stablecoins have their professionals and cons, however USDT stays the preferred selection for these searching for a secure cryptocurrency.

USDT vs BUSD

BUSD is the native token of the Binance Sensible Chain, a blockchain that runs in parallel with the Binance Chain. By utilizing this good chain, customers can develop decentralized functions (dApps), subject their very own tokens, and use good contracts. The transaction charges on the Binance Sensible Chain are paid in BUSD, which is burned (destroyed) after every transaction. This reduces the availability of BUSD, making it a deflationary foreign money.

The full provide of BUSD is capped at 100 million. To this point, 50 million tokens have been minted and are in circulation. The remaining 50 million shall be minted over time as extra transactions are made on the Binance Sensible Chain.

USDT and BUSD are two common stablecoins which have totally different advantages and dangers.

BUSD is a stablecoin that’s pegged to the US greenback, too. BUSD is 100% backed by US {dollars} in US banks insured by the FDIC. BUSD is on the market for buy on Binance and different exchanges like Paxos. You’ll be able to simply purchase it on Changelly as effectively.

USDT is extra broadly accessible and has been round for longer, however in contrast to BUSD, it isn’t backed by an asset.

BUSD could also be extra risky than USDT as a result of it’s new and might’t boast such a big availability, however it presents traders the soundness that comes with being backed by an asset.

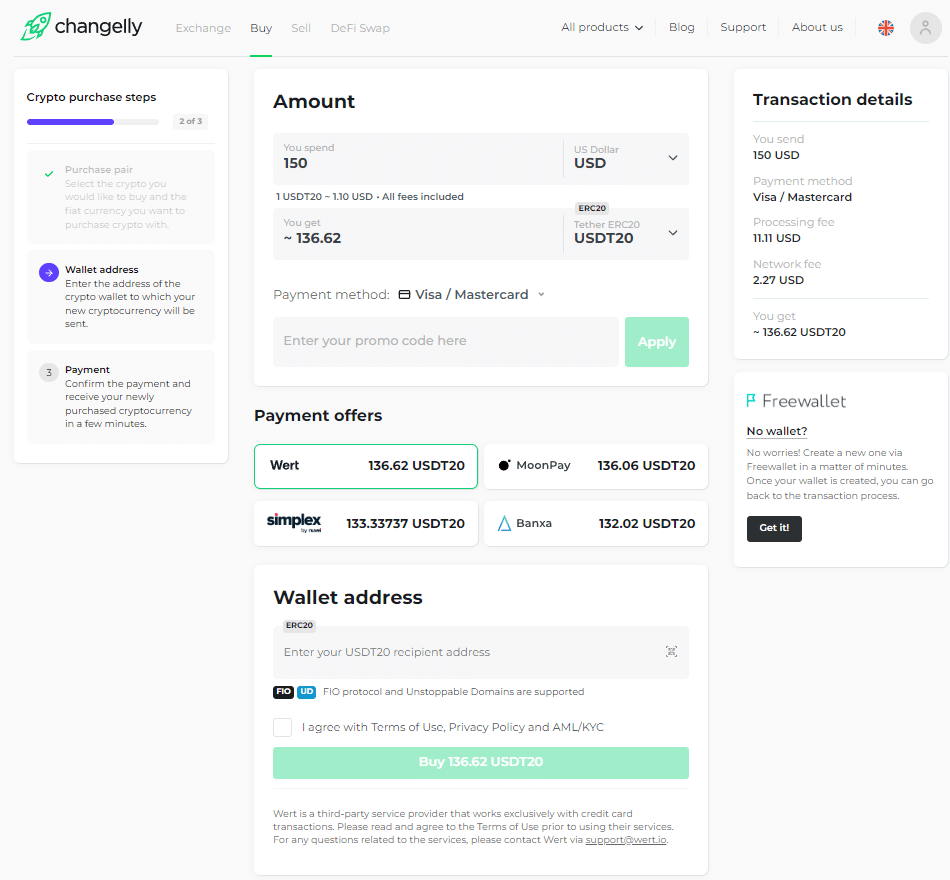

How you can Purchase USDT on Changelly?

Changelly made shopping for crypto a no brainer! As a crypto change aggregator, our platform presents one of the best charges, on the spot transactions, low charges, 24/7 shopper assist, and extra perks — all garnered below a single interface!

Right here’s a little bit instruction on easy methods to purchase USDT on Changelly.

Step one: Open the Purchase web page. Choose the pair of fiat foreign money and crypto you’d prefer to change. In our case, it’s USD and USDT.

Subsequent, choose the quantity you’re going to spend to purchase the coin within the “You spend” column. The service will mechanically calculate how a lot crypto you’ll get in change for this quantity.

Then it’s good to select the fee give you like. After that, enter your card particulars and your crypto pockets tackle to which your cash shall be transferred. Should you don’t have a crypto pockets but, you possibly can open it straight away on the identical web page.

Cryptocurrency transactions are irreversible, so please double-check your pockets tackle earlier than continuing to the following step.

Lastly, it’s good to verify the fee. After a couple of minutes, you’ll obtain your newly bought cryptocurrency in your pockets.

FAQ & Every thing You Must Know

What’s a stablecoin?

A stablecoin is a cryptocurrency backed by one other asset that retains the worth of the coin comparatively fixed. The underlying asset might be gold, fiat currencies such because the US greenback or euro, or different cryptocurrencies. Stablecoins assist customers keep away from a number of the volatility present in different crypto property whereas nonetheless having publicity to digital property. This makes stablecoins enticing for each companies and merchants alike.

What’s Tether used for?

Stablecoins like Tether are utilized by cryptocurrency merchants to guard their funds from the volatility of the market and to make passive earnings via staking or lending. Moreover, they flip to such property to transform investments into and out of fiat cash.

Is Tether all the time $1?

Tether is pegged to the greenback by design, so in concept, one Tether ought to all the time be value $1. In follow, nonetheless, there might be discrepancies within the change charge because it fluctuates throughout totally different markets and exchanges. For instance, if one change is providing extra favorable charges than one other, the value of Tether may quickly rise or fall under its $1 peg till it resolves into equilibrium.

How does Tether become profitable?

Centralized stablecoins like Tether (USDT) generate earnings in quite a lot of other ways.

Brief-term loans and investing are two of the commonest methods stablecoin companies generate income. This strategy is just like how a financial institution runs: it lends out the cash that purchasers deposit in financial savings accounts. The $1 billion mortgage made by Tether to Celsius Community in October 2021 is a transparent illustration of this idea.

The issuance and redemption funds charged by centralized stablecoins generate earnings as effectively. Tether prices a redemption price of 0.1%. Nevertheless, to forestall minor redemptions, Tether prices a $1,000 minimal withdrawal price.

Is Tether the identical as Ethereum?

No, these two are utterly totally different cryptos.

Is USDT a token or a coin?

USDT is a stablecoin that’s pegged to the US greenback, however technically, it’s a token. The USDT token was initially issued on the Bitcoin blockchain, however at present, it may be issued on any of the 50+ chains that assist USDT.

How a lot is the USDT token?

Not like different cryptocurrencies that fluctuate in worth, USDT (Tether) value stays secure at $1.

Is USDT an excellent funding?

With regards to investing in cryptocurrency, there are lots of totally different choices to select from. One possibility that has been gaining reputation in recent times is investing in USDT or comparable stablecoins. Not like different varieties of cryptocurrency, stablecoins are designed to keep up a secure worth no matter market circumstances. This makes them a pretty possibility for traders who’re searching for a option to hedge in opposition to volatility. As well as, stablecoins can be utilized to make purchases and transfers with out the charges related to conventional monetary establishments. Consequently, USDT has emerged as a preferred selection for these trying to spend money on cryptocurrency.

Nevertheless, it’s essential to do not forget that stablecoins are nonetheless a comparatively new expertise, and there could all the time be unexpected dangers. As we talked about earlier, some have raised considerations about USDT’s lack of transparency and its potential for manipulation. Market knowledge means that USDT performs an essential position in cryptocurrency buying and selling, however crypto merchants ought to concentrate on the dangers earlier than investing.

What’s the way forward for the USDT (Tether) coin?

The intention of USDT is to supply a secure various to conventional fiat currencies within the digital foreign money house. While you purchase Tether, you might be successfully shopping for a promise from the corporate that you would be able to redeem your tokens for USD at any time. This provides the token its worth and stability. USDT can be utilized to buy items and companies, or it may be traded on digital foreign money exchanges. Not like different digital currencies, which are sometimes topic to volatility, USDT stays pegged to the US greenback, making it a extra secure possibility for these trying to commerce or use digital currencies. Because the adoption of digital currencies grows, USDT is prone to develop into an more and more common possibility for these searching for a secure digital foreign money.

How do I money out USDT?

You need to use Changelly’s promote web page to change your Tether cash for US {dollars} or euros.

Disclaimer: Please be aware that the contents of this text will not be monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.