- Long positions constituted about 83% of the total liquidations.

- An analyst reaffirmed that the market generally becomes “significantly volatile” in the lead up to Bitcoin’s halving.

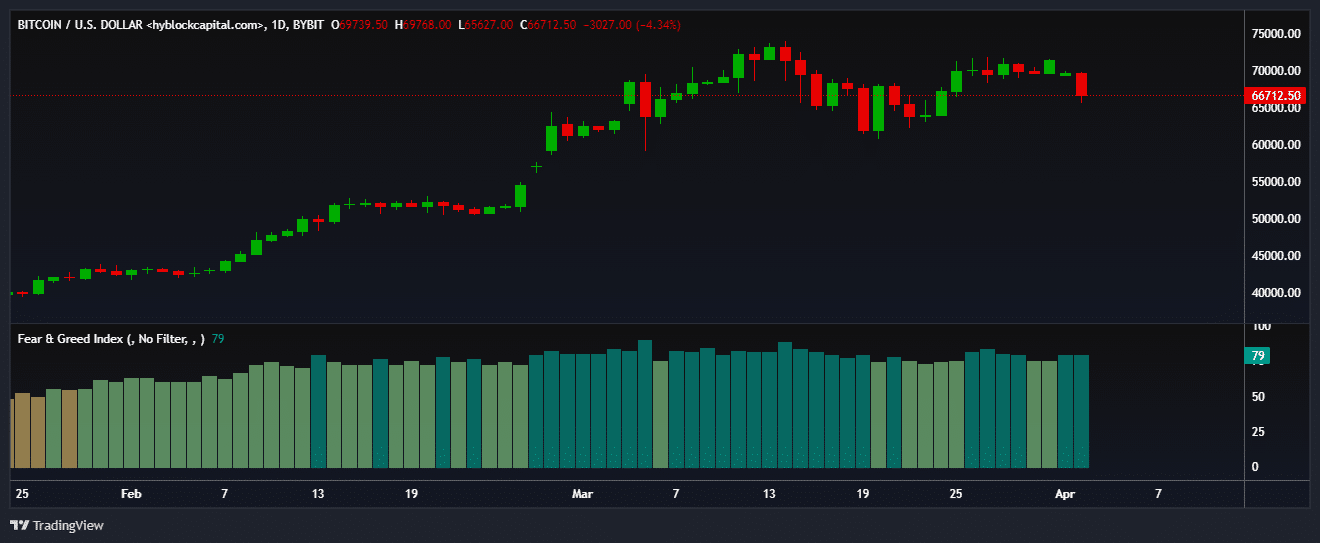

Bitcoin [BTC] sharply corrected during early Asia hours on Tuesday, plunging 5.7% to as low as $66,000.

The sudden retracement triggered liquidations worth $200 million from the entire crypto market in the last four hours, as per AMBCrypto’s analysis of Coinglass’ data.

Long positions constituted about 83% of the total liquidations.

Source: Coinglass

The dip also caused the majority of BTC derivatives traders to turn bearish on the asset.

Also, the Long/Shorts Ratio fell sharply below 1 in the last few hours until press time, indicating a sharp increase in bearish leveraged positions.

This slump followed a weak start to the week for Bitcoin spot exchange-traded funds (ETFs).

Ten new investment avenues, tracking spot prices of the world’s largest digital asset, witnessed net outflows of $85 million on the 1st of April, AMBCrypto noticed using SoSo Value’s data.

Source: Coinglass

The downward pressure was also a reaction to stronger-than-expected U.S. manufacturing sector data, Shivam Thakral, CEO of Indian cryptocurrency BuyUcoin, said to AMBCrypto.

Typically, risk-based markets such as cryptocurrencies and equities interpret such events as a lower likelihood of the U.S. Federal Reserve cutting interest rates.

Wall Street’s main indices like S&P 500 and Nasdaq Composite also slipped lower on this development.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Thakral, however, reaffirmed that the crypto market generally becomes “significantly volatile” in the lead up to Bitcoin’s halving. Hence, participants could brace for more ebbs and flows over the next two weeks.

The market sentiment was one of “extreme greed” at press time, according to Hyblock Capital’s data. This could accelerate buying pressure in the days to come, helping Bitcoin push further north.

Source: Hyblock Capital