- Bitcoin, Ethereum, and Solana fell significant on the price charts

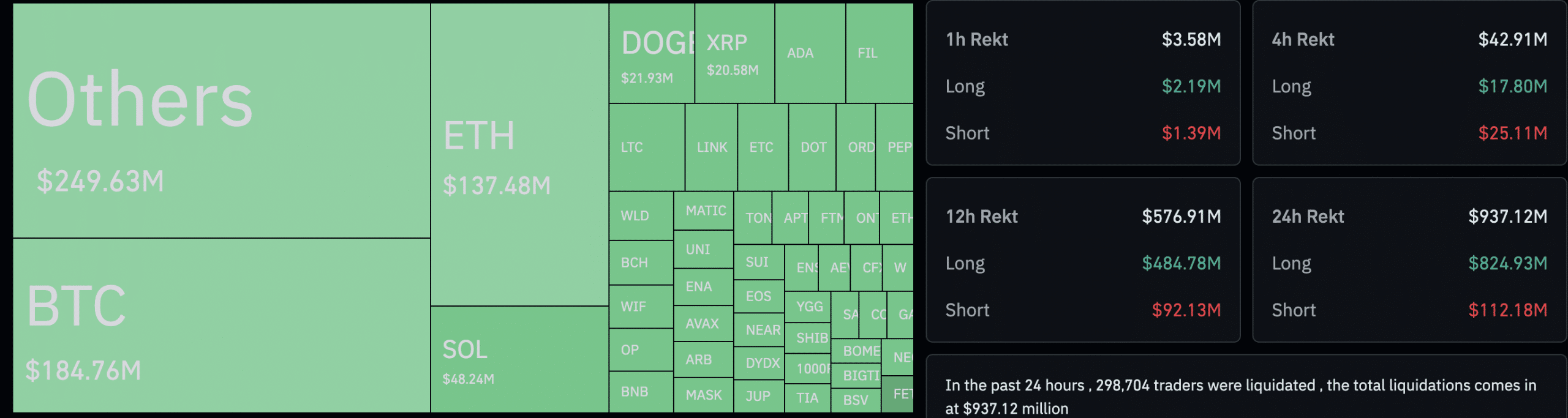

- Almost $1 billion worth of positions were liquidated in the last 24 hours

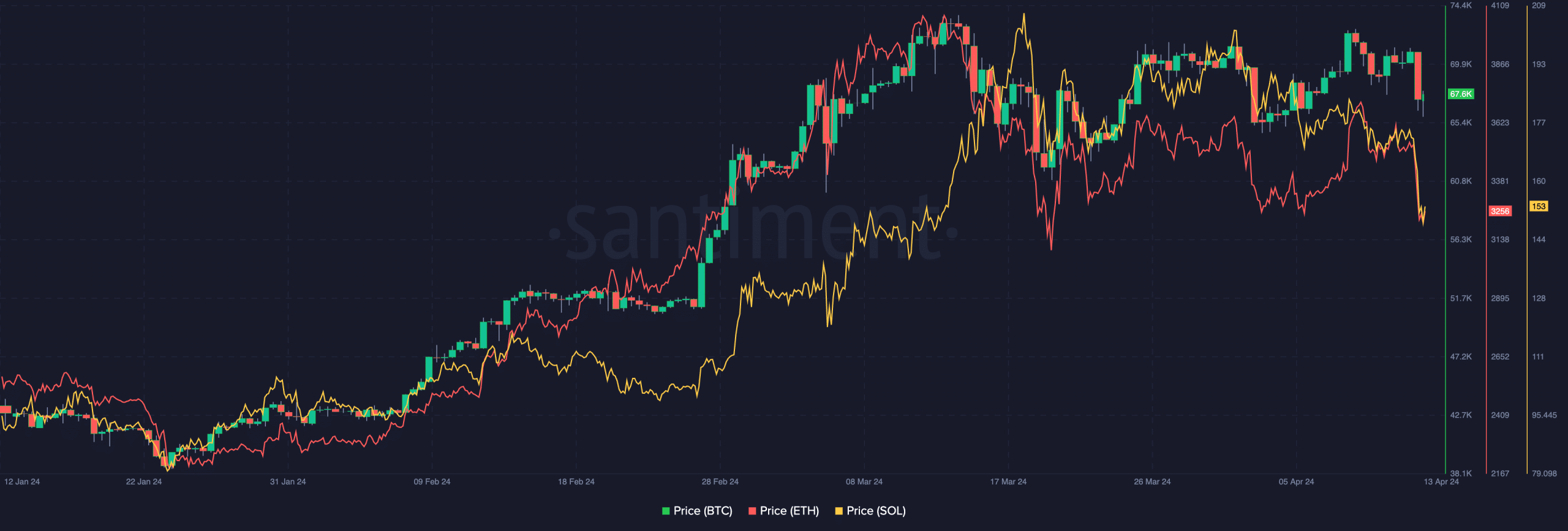

Following a surge in its price over the past week, Bitcoin [BTC] recorded a significant correction over the last 24 hours. Over the said period, the cryptocurrency’s price fell by 4.95%, with BTC trading at $67,829.94 at the time of writing. Bitcoin fell on the back of traditional markets tanking owing to the geopolitical uncertainty associated with Iran possibly attacking Israel. Accordingly, both the S&P500 and Nasdaq fell, with the value of traditional safe havens like gold appreciating.

The decline in Bitcoin’s price had a cascading effect, leading to other cryptocurrencies depreciating on the charts too as well.

Another one bites the dust

Due to the high correlation with Bitcoin, Ethereum [ETH] and Solana [SOL]‘s prices also fell dramatically and suffered a worse fate. SOL fell by 11.93% over the last 24 hours and ETH declined by 8.33% over the same period. Thanks to the same, both SOL and ETH broke past their previously established higher lows, disrupting their ongoing bullish trend on the charts.

Source: Santiment

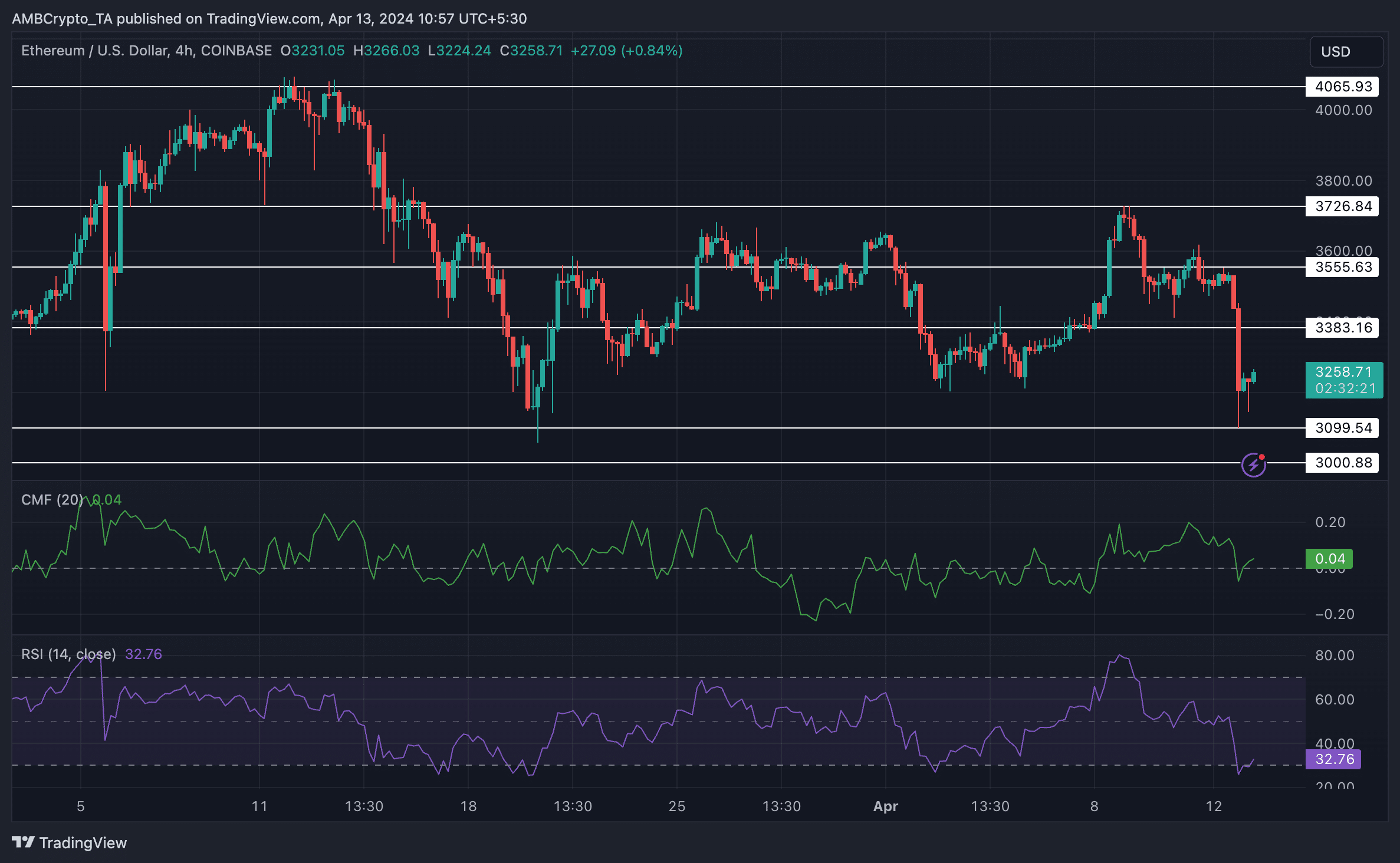

In fact, the price of ETH fell all the way to $3099 during this drawdown. However, after testing this level, it managed to climb back up to $3256.96, at the time of writing.

Previously, Ethereum had tested this level on 20 March. If Ethereum follows a similar trajectory going forward, it may attain the $3384-level soon.

Source: Trading View

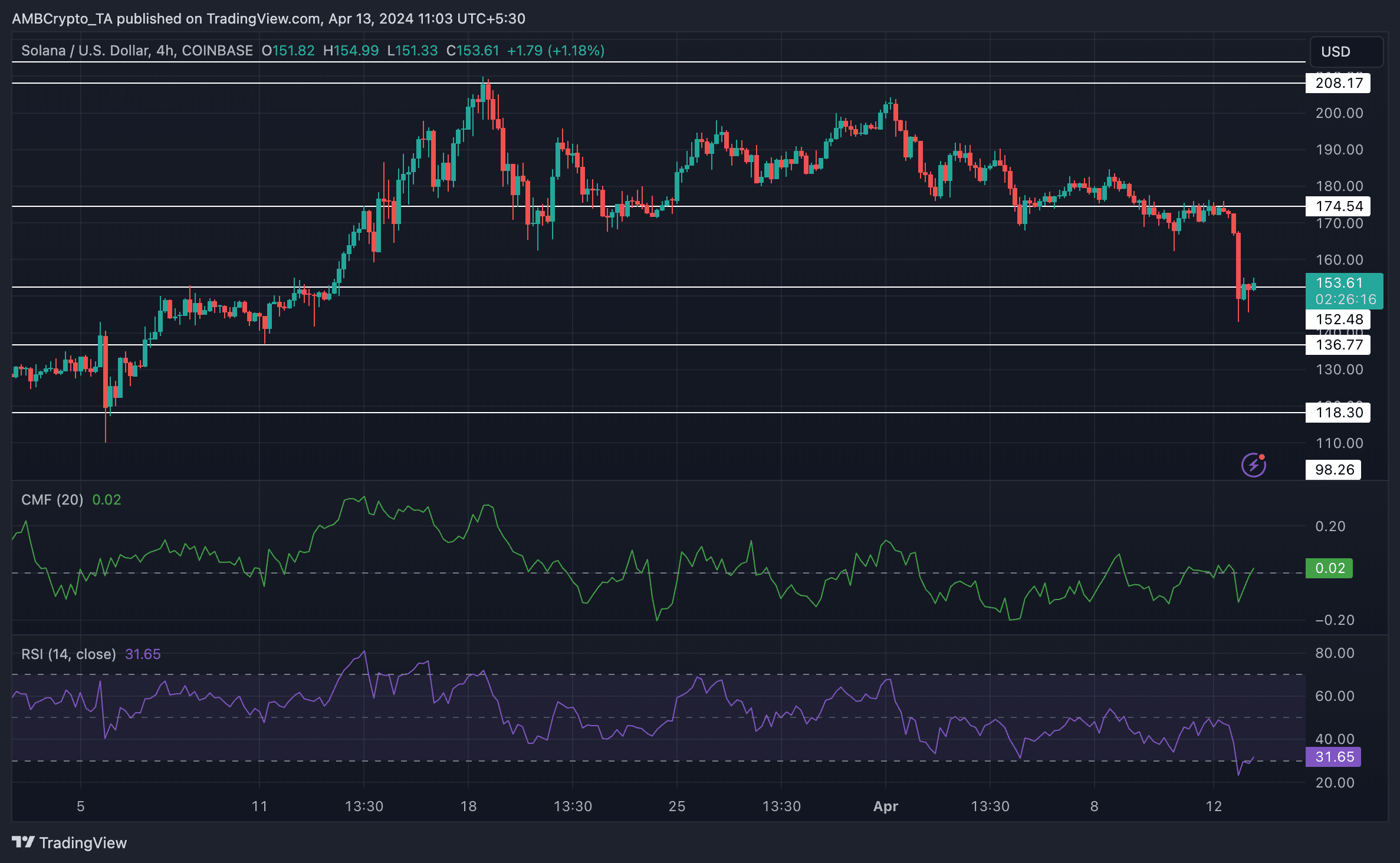

Solana traced a similar trajectory. Even though the correction was fairly recent, the price movement of Solana since 1 April hinted at a potential decline in price. Since the beginning of the month, SOL had exhibited multiple lower lows and lower highs, indicative of a bearish trend.

In order to rally, a massive resurgence in bullish momentum would be required for both ETH and SOL.

Source: Trading View

Are whales to blame?

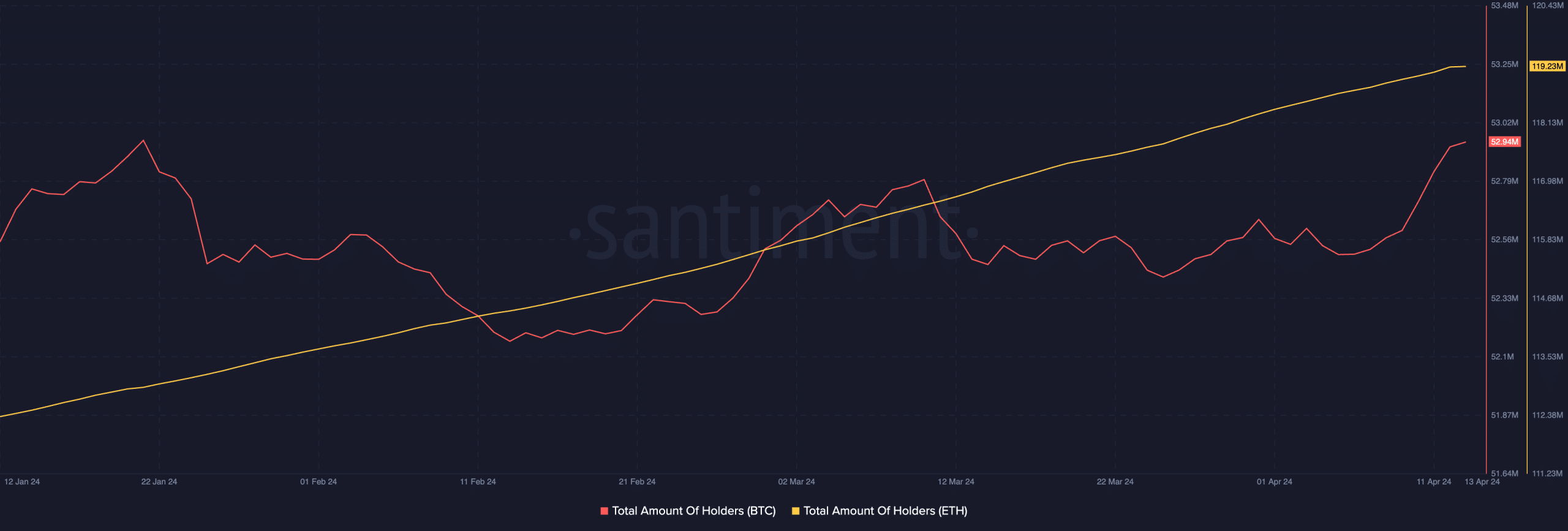

Despite these price corrections, however, interest in BTC and ETH remains high. In fact, AMBCrypto’s analysis of Santiment’s data revealed that the number of addresses holding BTC and ETH grew materially over the last few weeks.

This indicated that the recent decline in prices could have been caused by the behavior of a few whales who were indulging in profit-taking.

Source: Santiment

How are traders holding up?

In the last 24 hours, $947 million worth of positions were liquidated. Out of this, $824.94 million were long positions. Traders that were bullish on BTC, ETH and SOL lost the most amount of money. At this point in time, however, it’s too soon to say which direction BTC will head in, especially with the halving just over the horizon.

Source: Coinglass