- Crypto investment products saw outflows worth $206 million.

- LTC and LINK outperformed Bitcoin because of the halving and interest rate speculation.

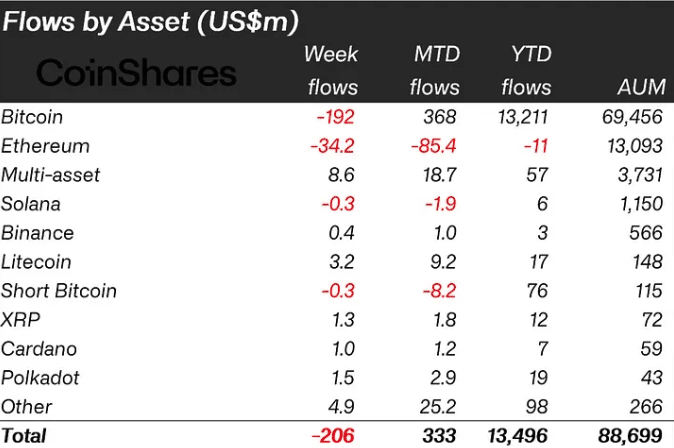

A total of $206 million flowed out of crypto investment products last week, CoinShares revealed. According to the report, Bitcoin [BTC] outflows were worth $192 million while Ethereum [ETH] was $34.2 million.

However, many altcoins including Litecoin [LTC] and Chainlink [LINK] registered substantial inflows within the same timeframe.

Investors worry about BTC’s future

From AMBCrypto’s assessment, Litecoin had $3.2 million in inflows. Chainlink, on the other hand, recorded $1.7 million. Furthermore, there were reasons the total investment had more outflows than inflows.

First off, the report noted that investors were worried about the effect the fourth Bitcoin halving which happened on 19th April, would have on miners.

Source: CoinShares

As such, they thought it was better to stay off BTC and probably return when the market settle. In recent articles, AMBCrypto reported how miners have been selling off their coins since their rewards were halved.

Therefore, it was not surprising that the outflows increased for the second consecutive week. Another reason Litecoin and Chainlink topped Bitcoin could be because of interest rates.

Recently, there has been speculation that the Fed will keep interest rates at a high point. Because of this, investor hunger for riskier assets has been diminishing. CoinShares noted that,

“The data suggests appetite from ETP/ETF investors continues to wane, likely off the back of expectations that the FED is likely to keep interest rates at these high levels for longer than expected.”

LINK may remain on top but LTC…

If the sentiment does not change, BTC, as well as ETH might continue to face further disinterest. For Litecoin and Chainlink, their respective price performance could have played a part in the surge in inflows.

At press time, LTC changed hands at $84.89. This was a 3.97% increase in the last seven days. LINK also had a similar performance as its price jumped by 6.18%.

If you compare the performances with those of ETH and BTC, you will observe that the top two cryptocurrencies lagged. Should the prices continue to stay unimpressive, the new week’s flow might also be negative.

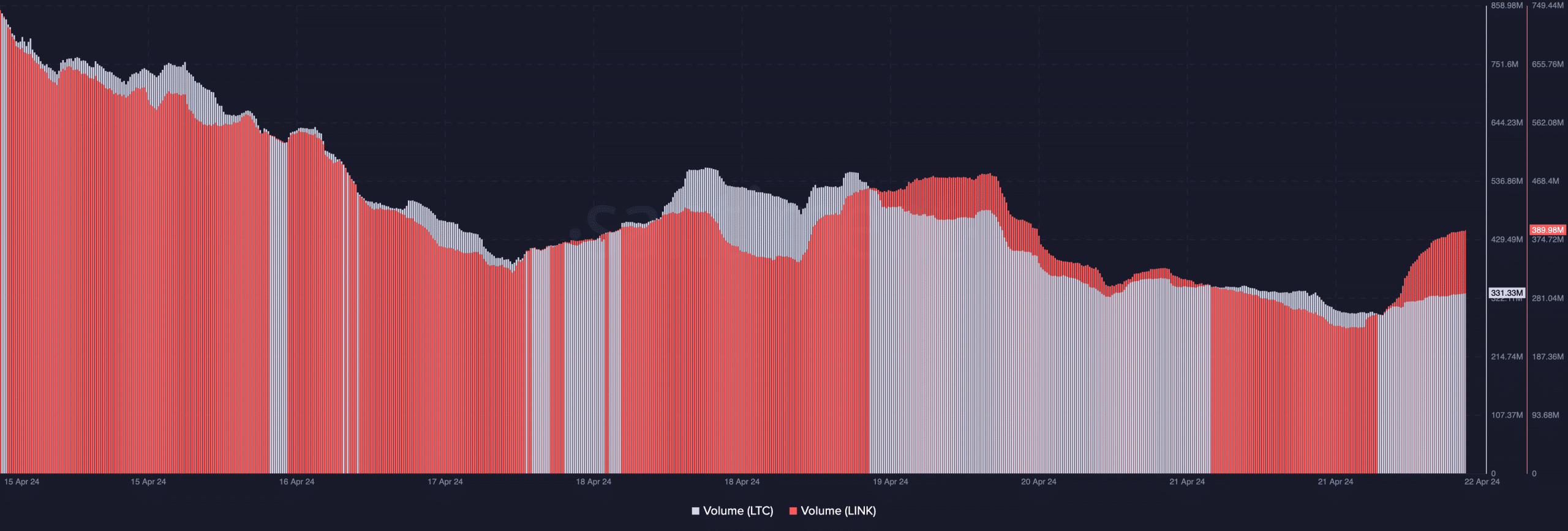

Meanwhile, we looked at Chainlink’s and Litecoin’s volume to ascertain interest in the cryptocurrencies. According to data AMBCrypto obtained from Santiment, both volumes dropped from the heights they were seven days ago.

However, there have been slight increases in the last 24 hours. For LINK, the hike could trigger a further uptrend for its price since it also increased in the last 24 hours.

Source: Santiment

But LTC might not enjoy that benefit as the rising volume could serve as strength for the downtrend the price experienced. If this remains the case all week long, Chainlink might be part of the top inflows again.

In a related development, CoinShares explained that the fear of investors might soon start playing out. According to the research team, Bitcoin miners might shift their focus from the coin to AI.

Is your portfolio green? Check the Litecoin Profit Calculator

The report, which was published on 19th April, mentioned that the reason for the prediction was that the halved rewards might no longer sustain miners’ expenses. Hence,

“We expect a shift towards AI in energy-secure locations due to its potential for higher revenues, with companies like BitDigital, Hive and Hut 8 already generating income from AI.”