- There appeared a reluctance among BTC traders to cash their profits.

- Early HODLers were distributing to newer entrants.

It has been a roller coaster ride for Bitcoin [BTC] after its most recent halving.

The initial response was positive, with the king coin shooting up to touch $67,000 three days after the pivotal event, according to CoinMarketCap. However, the gains have been erased, as BTC pulled back by 4% in the last 24 hours to pre-halving levels.

It thus becomes critical to understand where does the world’s largest digital asset stands after halving, as well as insights about its next moves in the near to medium term.

Profit-taking still on the lower side

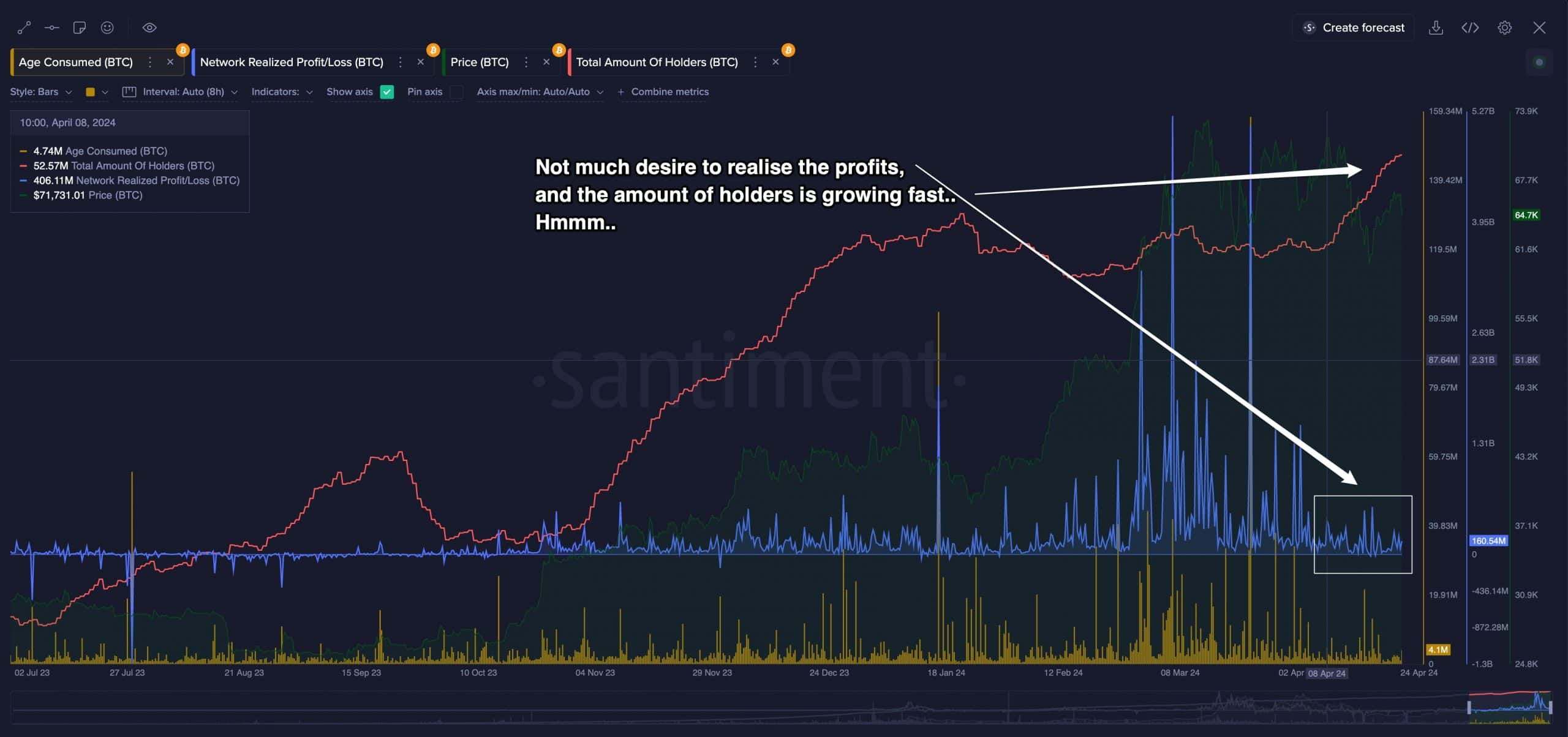

According to on-chain analytics firm Santiment, there appeared a reluctance among BTC traders to cash their profits. The Network Realized Profit/Loss (NRPL) indicator remained low, and the pattern aligned with previous peak periods of 2017 and 2021.

The number of BTC holders was also seen to be increasing alongside.

Santiment referred to this phase as “irrational divergence” wherein market was refusing to sell despite rising prices.

While rooted in the BTC’s long-term growth potential, the phase has historically preceded “significant market tops”, thus making it sound more like a bearish signal.

Source: Santiment

HODLers were redistributing

In contrast, the Mean Dollar Invested Age (MDIA) metric declined sharply in recent months, signaling an active redistribution phase.

During redistribution, wealth transfers from early HODLers to newer market participants. After a 12-month redistribution cycle, the market has historically returned to an accumulation phase, lending support to the belief that the bull market will continue.

Source: Santiment

Is your portfolio green? Check out the BTC Profit Calculator

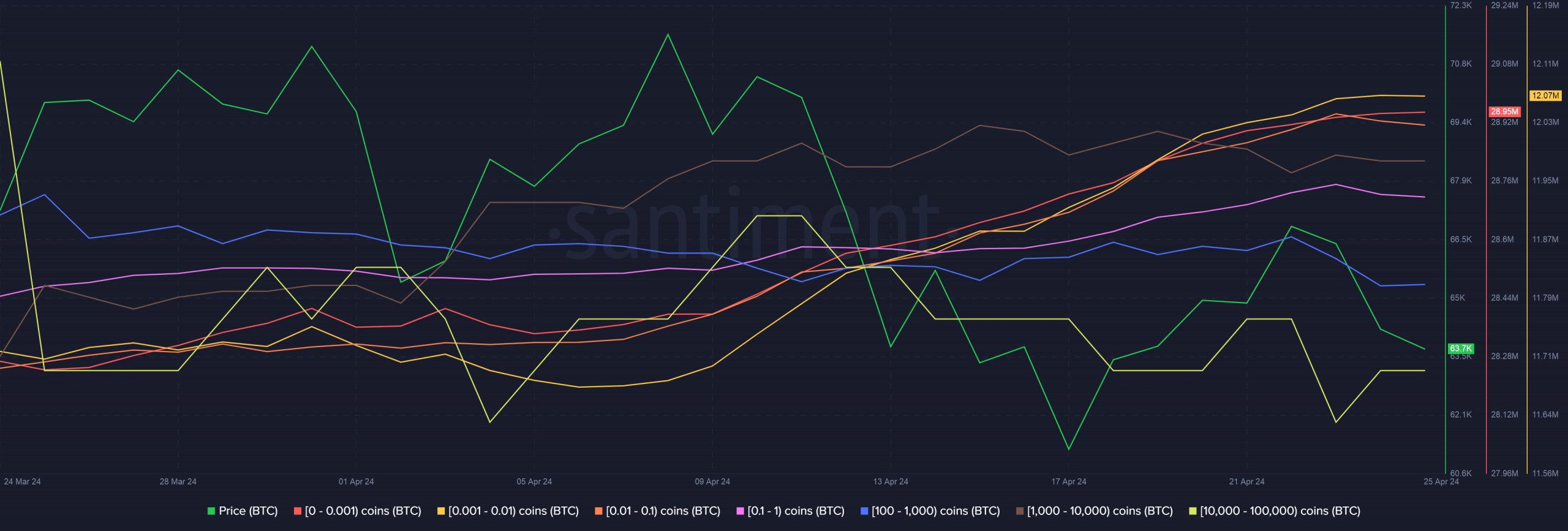

The aforementioned deductions reflected in the supply distribution across key cohorts. Notably, small holders, or those holding up to 1 whole Bitcoin, were seen to be buying after the halving.

To the contrary, sharks and whales, having reserves between 100 to 100,000 coins, were distributing their coins.

Source: Santiment