- Bearish sentiment dominated the crypto market.

- BTC and ETH led the bearish sentiment with their poor price trends.

While holders of certain meme coins may be celebrating significant gains in recent days, the broader cryptocurrency market appears subdued.

Recent data indicated an overall negative sentiment prevailing in the market, potentially paving the way for an uptrend in the near future.

However, as of now, the market capitalization is on the decline, with major assets experiencing decreases in value over the past 24 hours.

Negative sentiments dominate crypto market

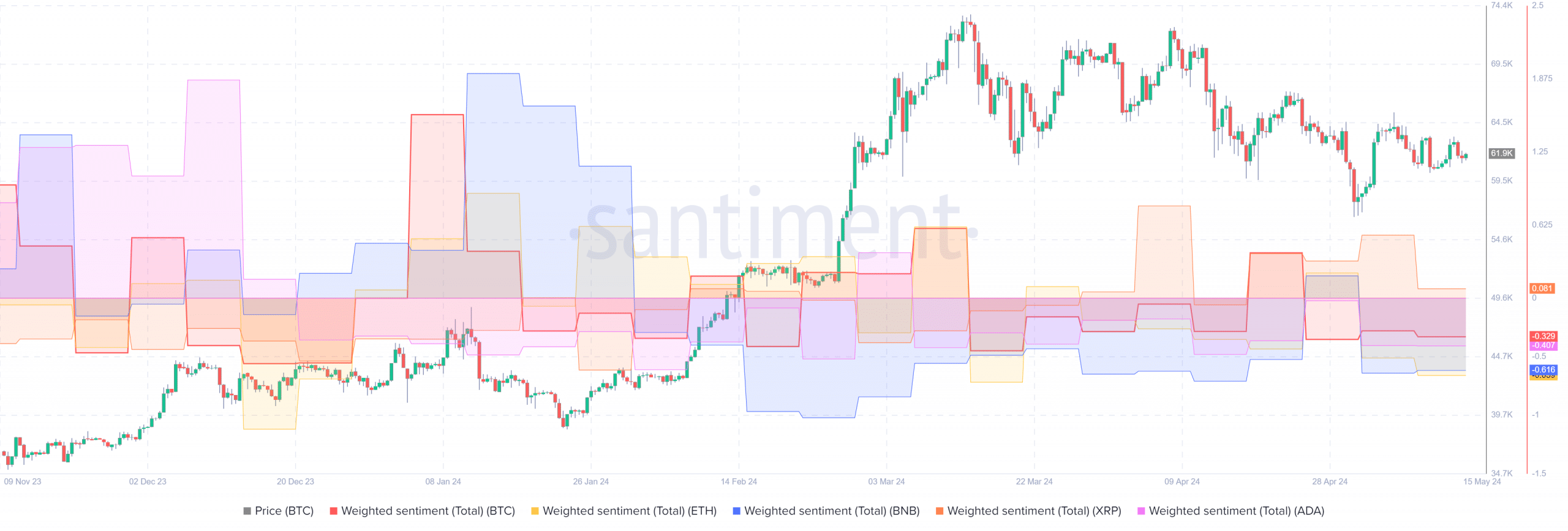

AMBCrypto’s analysis of the crypto market’s Weighted Sentiment, focusing on large-cap assets such as Bitcoin [BTC], Ethereum [ETH], and Binance BNB, revealed a prevailing negative sentiment at press time.

The Santiment chart illustrated a bearish sentiment across the market from the 8th to the 14th of May.

Similar patterns of universal bearishness were observed from the 10th to the 16th of April, as well as the 13th to the 19th of March.

At press time, Ripple exhibited the lowest Weighted Sentiment, with Bitcoin following closely as the second lowest.

Source: Santiment

Crypto market capitalization declines

AMBCrypto’s examination of the crypto market data on CoinMarketCap revealed a decline in market capitalization over the last 24 hours.

The market cap had decreased by over 1.3% to approximately $2.27 trillion at the time of this writing. Despite this decline, the volume has surged, showing an increase of over 27% to around $68 billion.

Furthermore, the fear and greed index reflected a neutral sentiment, standing at 55 at press time. However, it appeared to be edging closer to fear.

This drop in market capitalization is attributed to the lackluster performance of major assets like Bitcoin and Ethereum in recent hours.

Bitcoin and Ethereum remain bearish despite increases

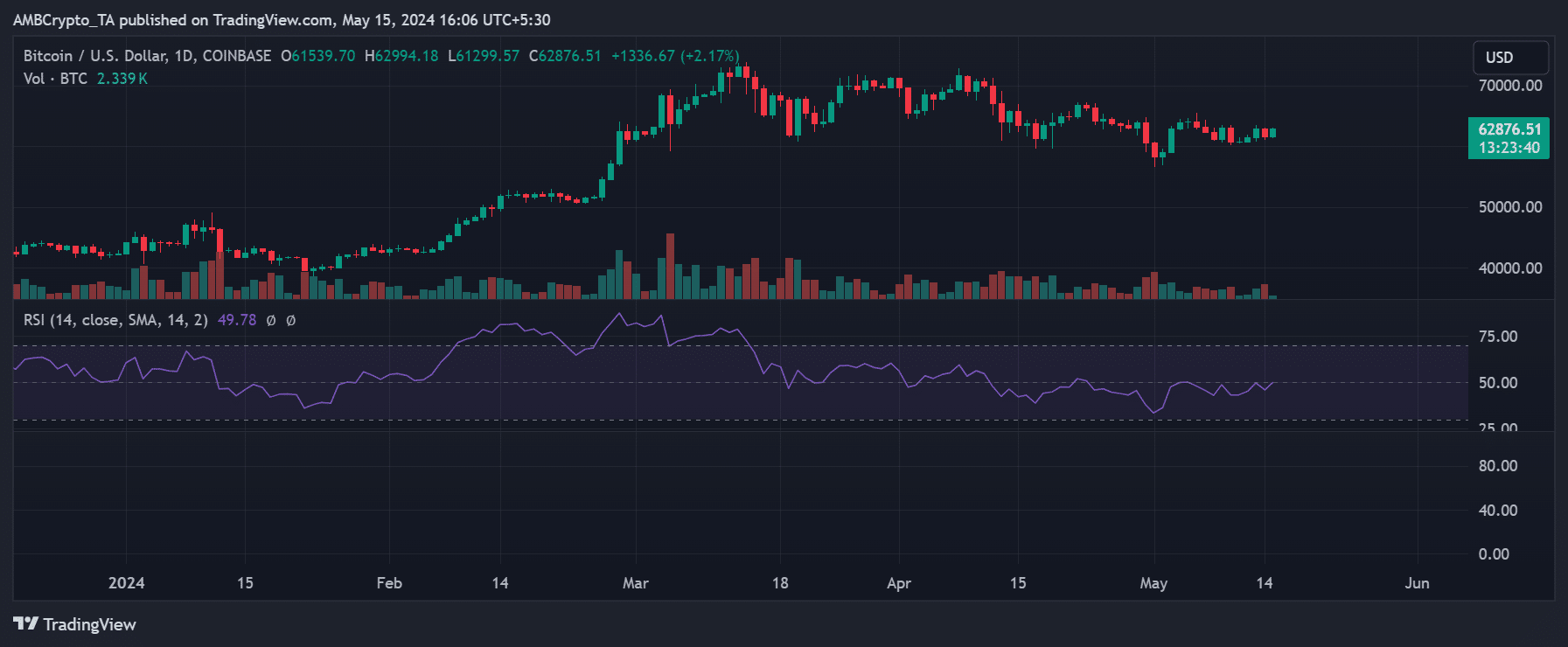

AMBCrypto’s analysis of the Bitcoin price trend on a daily timeframe revealed a setback in its attempted rebound.

The decline was marked by an over 2% decline on the 14th of May, bringing its price back to the $61,000 zone.

However, at the time of this writing, Bitcoin had recovered with an over 2% increase, trading above $62,000 once again.

Source: TradingView

Read Ethereum’s [ETH] Price Prediction 2024-25

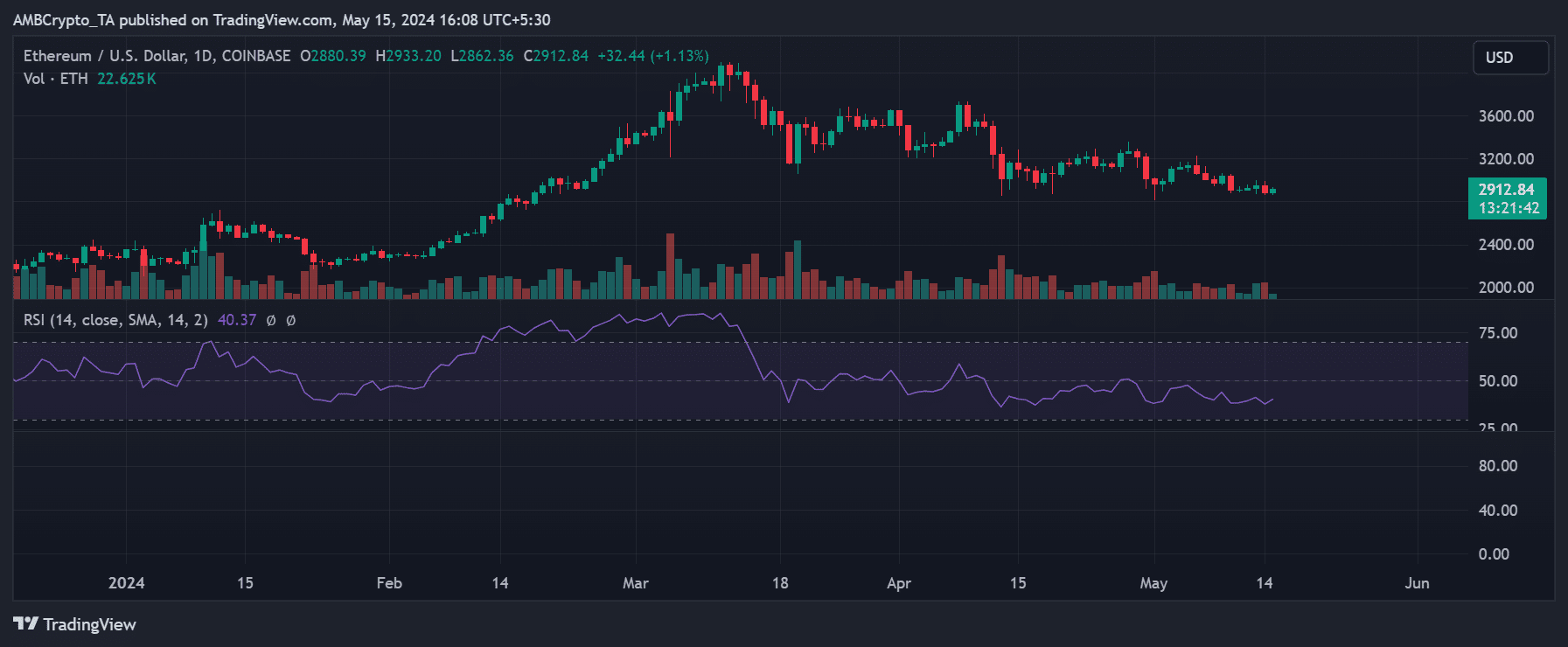

Similarly, Ethereum experienced a decline of over 2% in the previous trading session, settling around $2,800. Nevertheless, it had rebounded by over 1% at the time of writing, trading at approximately $2,900.

Despite these fluctuations, both assets remained in a bearish trend, contributing to the overall bearish sentiment in the crypto market.

Source: TradingView