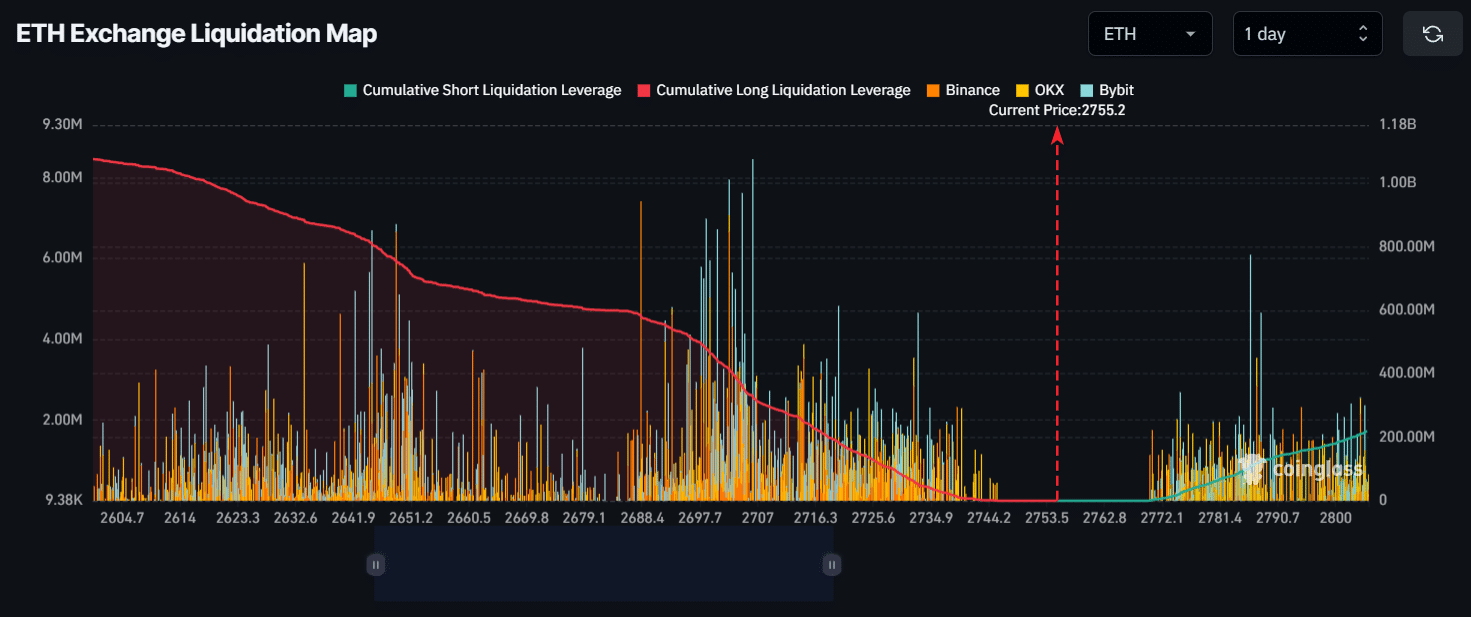

- If ETH’s price falls to $2,705, nearly $323 million worth of long positions will be liquidated

- According to one expert, Ethereum’s market cap will surpass Bitcoin’s market cap within the next five years

The wider cryptocurrency market recorded a significant rally after the potential interest rate cut announcement by the Fed Chair. Ethereum (ETH) was no different, with the world’s second-largest cryptocurrency by market capitalization breaking its 14-days of consolidation zone and turning bullish.

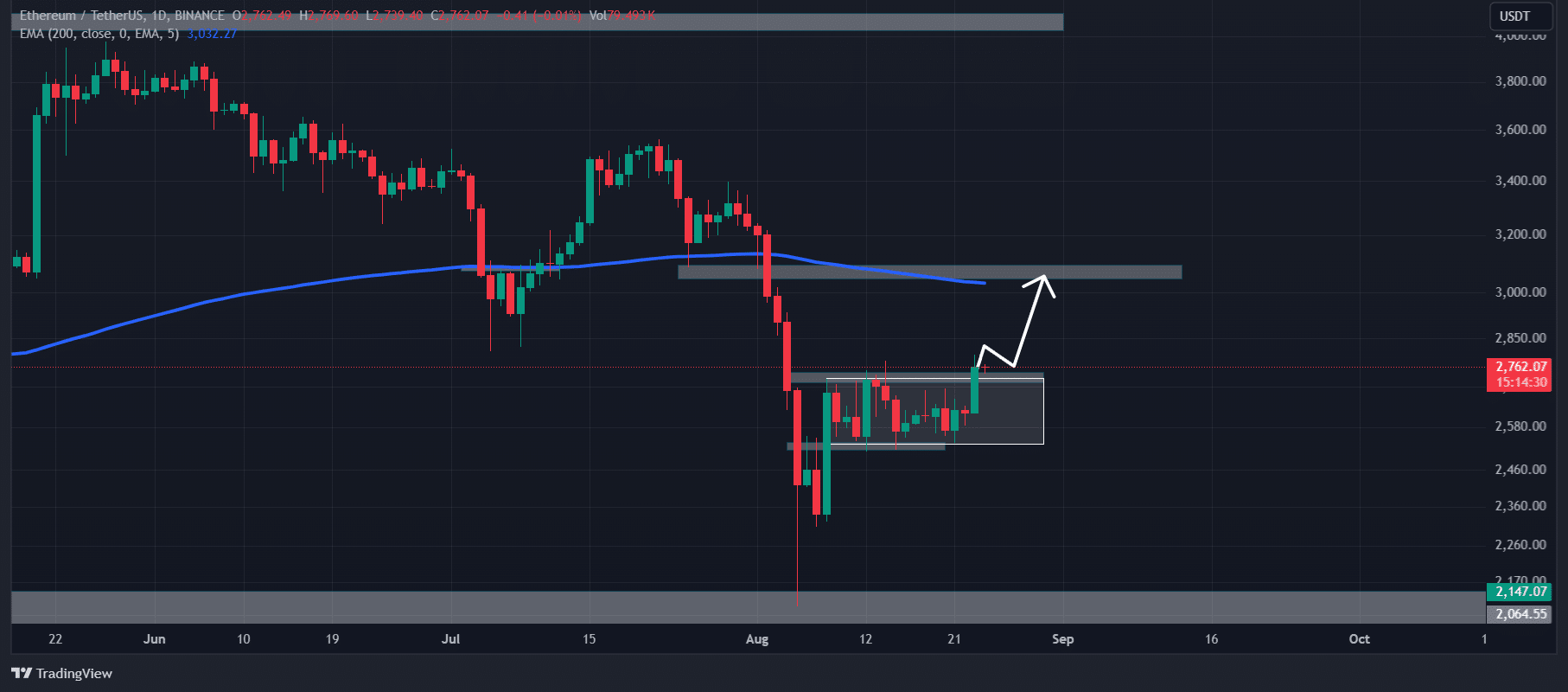

Ethereum’s breakout and upcoming levels

Between 8 and 23 August, ETH had been consolidating in a tight range between the $2,730 and $2,725 levels. Following the Fed Chair’s rate cut announcement, however, it broke of this zone and closed a daily candle above $2,760.

Source: TradingView

This breakout and candle closing above the zone might signal a bullish outlook for ETH. This, despite it trading below the 200 Exponential Moving Average (EMA).

Based on the price action and technical analysis, there is a high possibility that the altcoin’s price could soar to $3,000 – Its next resistance level.

At press time, ETH was trading near the $2,760 level, following a hike of over 3.5% in 24 hours. Meanwhile, its trading volume rose by 40% over the same period. This is a sign of higher participation from traders following the breakout and rate cut announcement.

Ethereum’s major liquidation levels

At the time of writing, the major liquidation levels were near $2,705 on the lower side and $2,786 on the higher side. This is the case as traders are highly leveraged at these points, according to the on-chain analytics firm CoinGlass.

Source: CoinGlass

If the sentiment remains bullish and ETH’s price rises to $2,786, nearly $111 million worth of short positions will be liquidated. Conversely, if the sentiment shifts and the price falls to $2,705, nearly $323 million worth of long positions will be liquidated.

Based on leveraged positions, it is clear that bulls are back in the market. This is a potentially positive sign for Ethereum and its holders.

Crypto expert’s views on ETH

Amid this bullish outlook, recently, 1confirmation Founder Nick Tomaino shared something. He believes that Ethereum’s market cap will surpass Bitcoin’s market cap within the next five years, which is approximately 4x. In the post on X, Nick said,

“BTC has a clear narrative (digital gold) that institutions have bought into by now. Ethereum is the chain that the most talented developers in the world are building the decentralized internet on and ETH is the digital oil that powers it.”

Since the launch of Spot Ethereum exchange-traded fund (ETF) in the United States, the rate of adoption has significantly risen. Additionally, ETF traders have also shown strong interest in it.