The Solana ecosystem is displaying indicators of a promising future within the midst of a unstable crypto market, in accordance with its founders Anatoly Yakovenko and Raj Gokal.

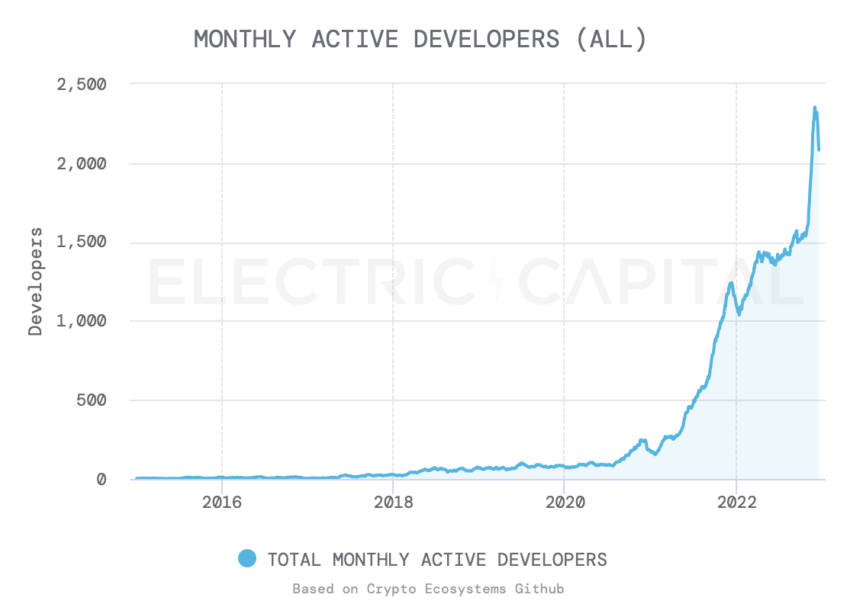

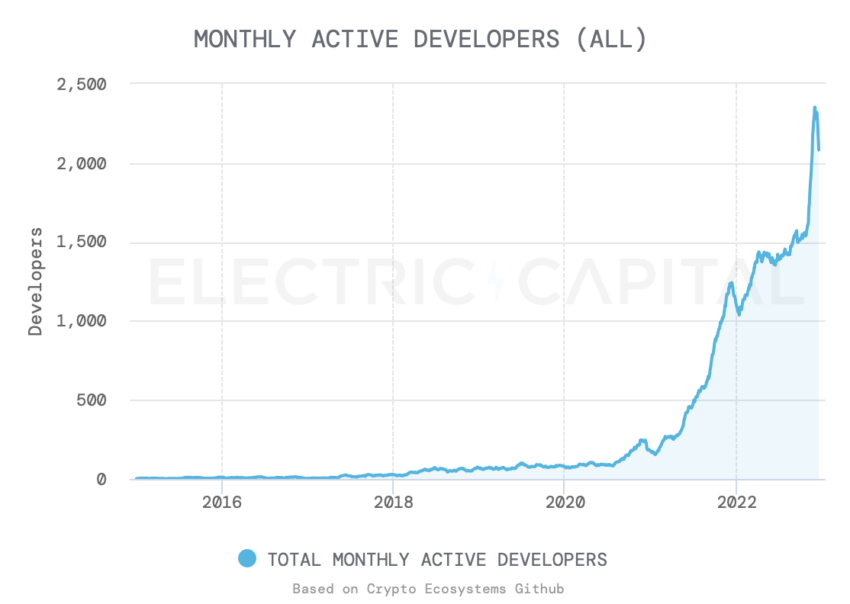

Electrical Capital’s current Developer Report confirmed that the variety of builders on Solana has risen 83% from a year ago to over 2,000, making it second solely to Ethereum when it comes to uncooked developer numbers.

Surviving the Crypto Winter

Yakovenko and Gokal began Solana in late 2017 with the imaginative and prescient of making a future that prioritizes truthful entry to finance, freedom, and safety via blockchain know-how. The mainnet was launched in beta lower than three years in the past, and since then the Solana ecosystem has continued to develop and evolve.

Regardless of the reputational injury to the crypto trade as an entire in 2022, the staff of builders behind this undertaking stay committed to core tenets of decentralization, self-sovereignty, and equity. The variety of validators on the Solana community has elevated, with over 2,000 nodes now operating the blockchain. Performance upgrades have additionally been carried out and scheduled to permit for a extra secure and environment friendly community.

In accordance with Yakovenko and Gokal, the ideas of web3, equivalent to decentralization and self-custody, are important for a decentralized future. They imagine that decentralized finance is disrupting the standard monetary fashions at a fast tempo, and the one approach to really embrace the promise of web3 is to have an uncompromising dedication to these ideas.

Solana founders keep that the crypto neighborhood could be seen for instance of antifragility, an idea that implies that assaults on a system can have the surprising impact of creating it stronger. In the identical manner, they imagine that bear markets also can have the same influence, and Solana is not any exception.

Work on Community Outages

Solana skilled a number of community outages in 2022 that triggered downtime and disrupted the community’s skill to course of transactions. These had been attributable to quite a lot of elements, together with excessive demand for transactions, technical points with the community, and safety breaches.

The constance downtimes have negatively impacted Solana’s fame as a dependable and reliable platform, inflicting some buyers to query its stability and safety. This led to a decline in confidence within the platform, inflicting some buyers to promote their holdings and chorus from investing within the platform.

Yakovenko and Gokal affirmed {that a} validator shopper developed by a third-party group, Firedancer, is ready to considerably cut back the danger of community outages. With the potential to course of 0.6 million transactions per second in a testing setting, the introduction of this new validator shopper may assist transition the community out of beta and right into a extra secure state.

A Disastrous 2022

Sam Bankman-Fried, former CEO of Alameda Analysis, was among the many many who touted Solana as one of the crucial underrated cryptocurrencies final summer season. Nonetheless, for the reason that collapse of crypto change FTX, the token’s market worth has plummeted.

SOL presently trades round $24, down over 90% from its November 2021 all-time excessive of $260, and one other correction may very well be on the playing cards.

The Solana ecosystem has been hit onerous because of FTX’s collapse. The Basis staff released a blog post explaining the financial ties between Solana and Bankman-Fried’s empire.

It highlighted the truth that FTX and Alameda had bought over 50.5 million SOL tokens, price roughly $500 million, that may stay locked till 2028. It additionally revealed that round $1 million in money or belongings sitting on FTX as of Nov. 6, 2022, the day the crypto change needed to pause buyer withdrawals as a result of liquidity shortages.

The destiny of those holdings is presently unclear throughout FTX’s chapter proceedings.

It’s price noting that in current weeks, two of the highest NFT collections on the Solana blockchain, DeGods and Y00ts, introduced they’d be migrating to different blockchains, equivalent to Ethereum and Polygon, respectively.

The fast depreciation within the worth of the community and the fixed outages raises questions in regards to the blockchain’s stability and the way forward for decentralized exchanges like Serum that Bankman-Fried constructed. Regardless of Yakovenko and Gokal’s confidence in Solana, it stays to be seen if SOL will recuperate from its current stoop.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.