- ETH’s short-term outlook shows signs of a bullish reversal around the $3,000 psychological level.

- On-chain metrics suggest selling pressure, but most ETH holders remain in profit.

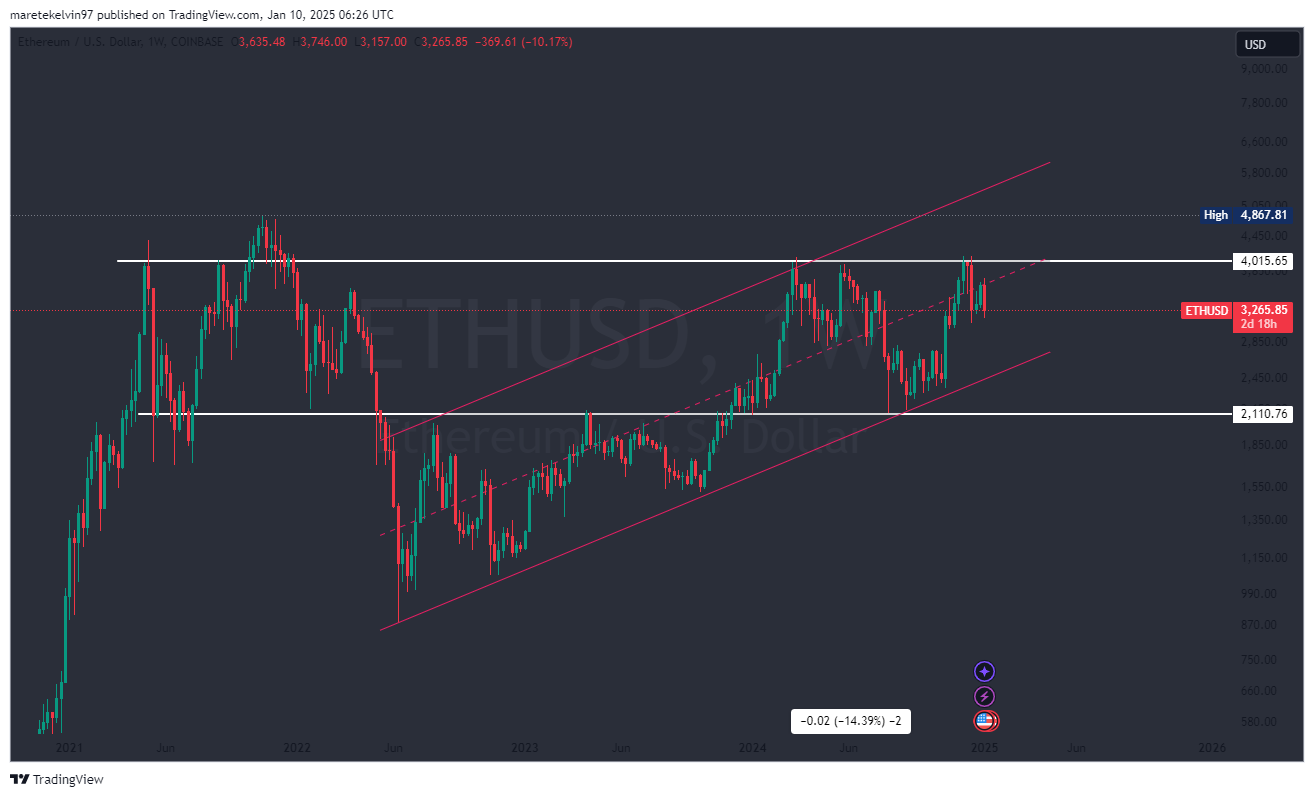

Ethereum [ETH] was also hit by the recent altcoin correction, dipping over 20% after being rejected at the $4,000 resistance level.

However, this downtrend may not be significant, as Ethereum’s technical patterns and on-chain metrics show mixed signals of a potential price recovery or further volatility.

ETH approaching key support at $2.8k

On the weekly chart, Ethereum’s price movement shows consolidation in a bullish flag pattern—a pattern that often precedes a breakout. The recent dip has brought ETH close to the lower boundary of this ascending flag at $2,800.

If this level holds strong, it could act as a springboard for a massive upward rally. A successful rebound here may push Ethereum toward its next key target of $6,000.

However, failure to maintain this support could expose ETH to further downside.

Source: TradingView

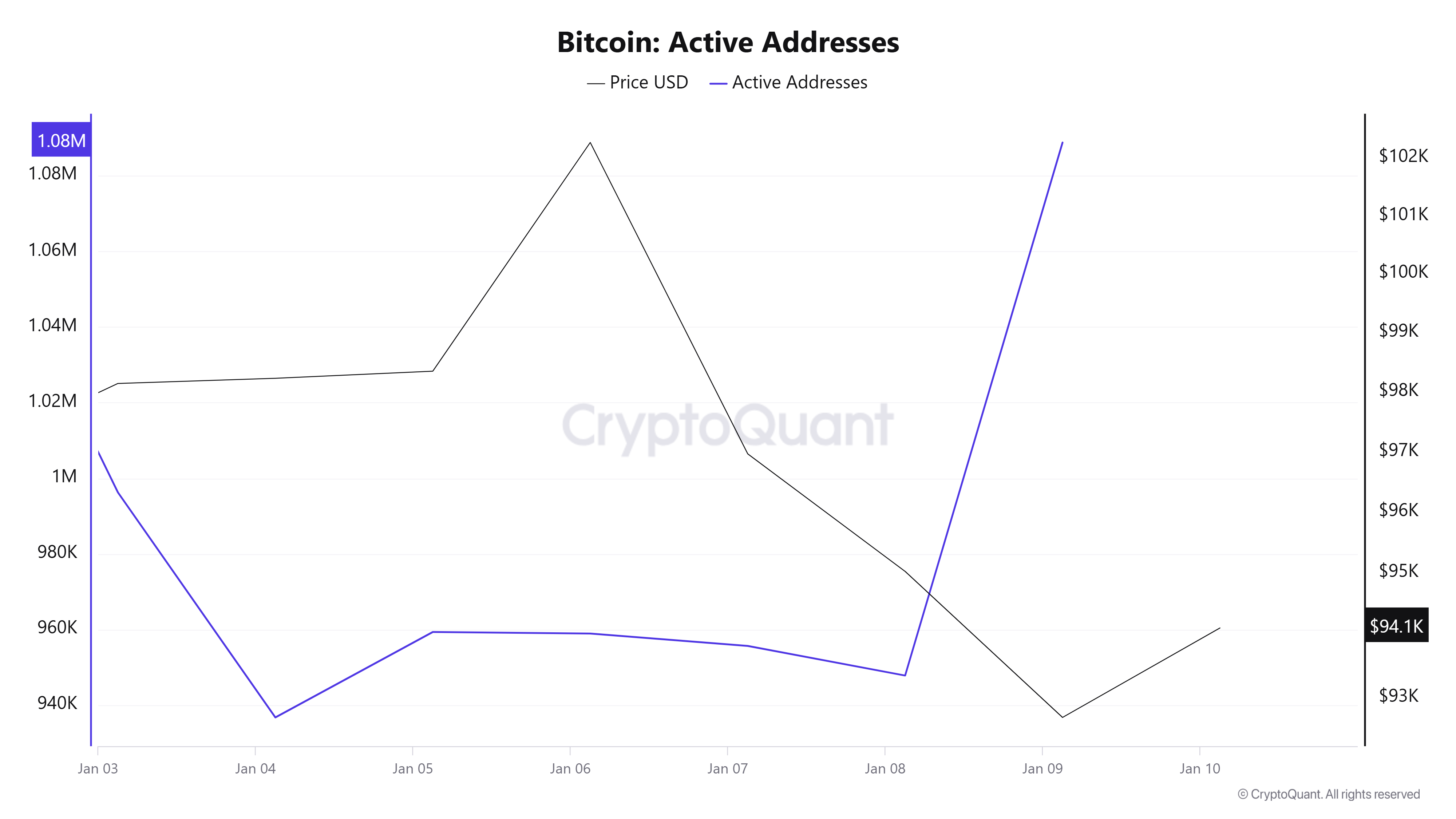

Signs of a short-term reversal at $3,000

Zooming down to the daily chart, Ethereum’s price action indicates a potential short-term bullish reversal.

The $3,000 psychological level appears pivotal, as ETH trading activity has increased slightly over the last 24 hours.

Source: TradingVew

CryptoQuant data supports this, showing a sharp surge in active addresses during the same period. Increased network activity often signals renewed interest, potentially stabilizing prices or sparking an upward move.

Source: CryptoQuant

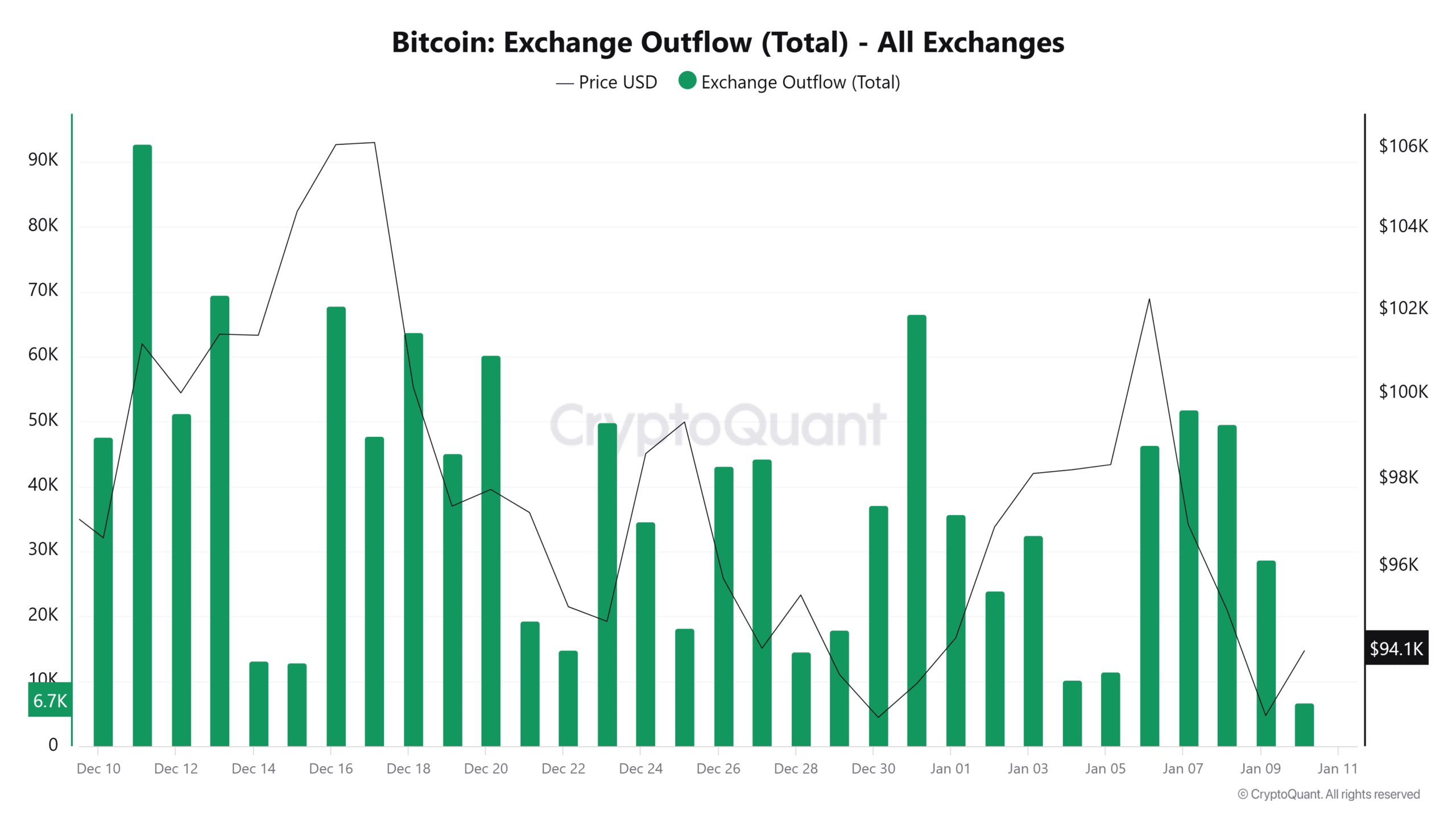

Rising exchange outflows indicate profit-taking

While short-term signals are relatively bullish, the on-chain metrics tell a different story for the long term.

According to CryptoQuant, ETH’s exchange outflows spiked in the last 24 hours, indicating increasing selling pressure as investors book profits around the $3K psychological level.

Historically, these outflow cycles alternate between peaks and dips, and the current upswing could signify an accumulation of sell-side activity.

Source: CryptoQuant

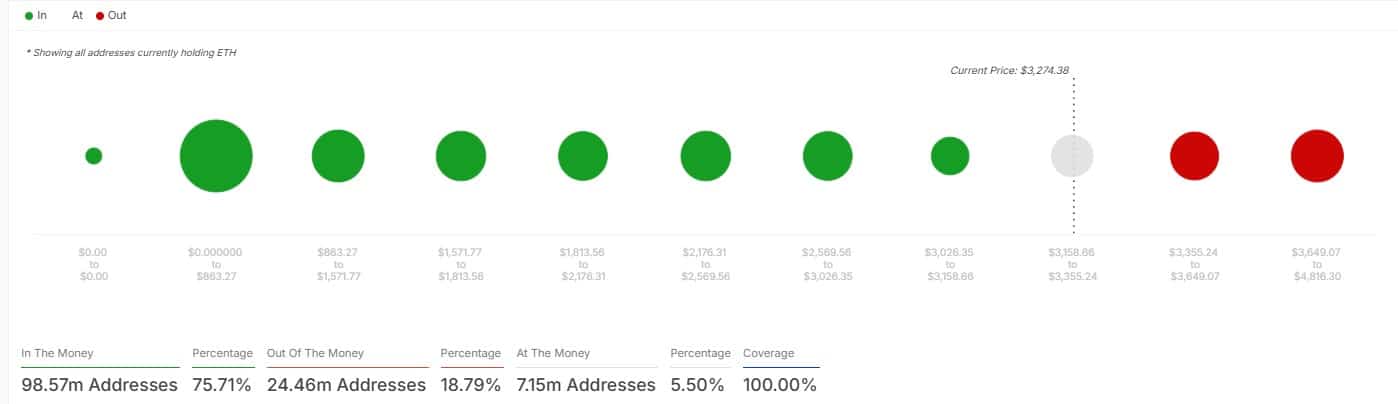

ETH holders remain profitable despite…

Despite short-term corrections, most ETH holders remain in profit. Data from IntoTheBlock reveals that 76% of all addresses holding ETH are profitable at current price levels. This mirrors the confidence among long-term investors and indicates a strong foundation for Ethereum’s potential continuous rally.

Source: IntoTheBlock

Read Ethereum’s [ETH] Price Prediction 2025–2026

The short- and long-term price action of Ethereum hinges on a couple of key levels. The $2.8K flag support level could pave the way for a significant rally if it holds, while increased network activity around the $3K psychological level supports a bullish outlook.

With most holders still in profit, ETH long-term trajectory remains optimistic.