Abstract:

- The Shanghai-Capella improve scheduled for April 12 ought to unlock over $30 billion in staked ETH on Ethereum’s beacon chain.

- Shoppers are suggested to improve their nodes forward of Shapella’s arrival, core developer Tim Beiko stated.

- It’s unclear if promoting stress may improve after the unlock allows withdrawals for over 16 million stETH.

Ethereum’s extremely anticipated Shanghai improve is scheduled for epoch 194048 at round 11 pm UTC on April 12, barely two days away at press time.

ETH proponents and core builders have angled the Shanghai-Capella replace as one other watershed second for crypto’s second-largest blockchain after Bitcoin (BTC). The community already efficiently applied the Merge, Ethereum’s change from a proof-of-work consensus mannequin to proof-of-stake which occurred on September 15, 2022.

Shapella, a mixture of the Shanghai and Capella upgrades, will unlock over 16 million ETH deposited within the chain’s staking contract since December 2020, or so builders say. The huge staked ETH fortune is price almost $30 billion at present costs. ETH was up 1.30% and traded at $1860 on Monday.

Nevertheless, withdrawing stETH was not possible and required one other technological improve – Shapella.

The tokens additionally make up over 13% of ETH’s complete token provide. Entities have locked ETH a staggering quantity of ETH since 2020 to safe their place as Ethereum validators – the individuals who assist handle ETH’s community by authenticating transactions and securing the chain.

Ethereum Validators And Centralization

These validators turned a vital a part of Ethereum after the Merge, successfully changing miners who function related duties in a PoW blockchain. Whereas the rising variety of validators past 500,000 and stETH exceeding 16 million tokens may point out elevated curiosity in ETH, the approaching unlock additionally raises considerations of promote stress out there.

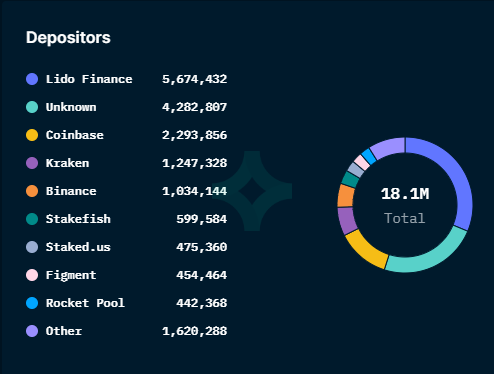

The focus of stETH within the palms of some entities additionally may pose centralization considerations. Certainly, Nansen knowledge exhibits that providers like Lido Finance, Coinbase, Kraken, and Binance are the highest 5 staked ETH depositors.