June 13 (Tue) morning market trends (compared to the previous day)

- NY Dow: $34,066 +0.5%

- Nasdaq: $13,461 +1.5%

- Nikkei Stock Average: ¥32,434 +0.5%

- USD/JPY: 139.5 -0.02%

- USD Index: 103.6 +0.08%

- 10-year US Treasury yield: 3.73 -0.1% per annum

- Gold Futures: $1,971 -0.2%

- Bitcoin: $25,886 -0.5%

- Ethereum: $1,738 -1.5%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow rose slightly to +189.5 dollars. The Nasdaq also closed at +202 dollars. This week we have important events such as the US CPI tonight and the FOMC interest rate announcement on the 15th.

economic indicators

- June 13, 21:30 (Tue): May Consumer Price Index (CPI)

- Wednesday, June 14, 21:30: May Wholesale Price Index (PPI)

- June 15, 3:00 (Thursday): US Federal Open Market Committee (FOMC) policy interest rate announcement

Here are the May consumer price index (CPI) forecasts:

- CPI (vs. previous month): previous +0.4% forecast +0.3%

- CPI (year-on-year): previous +4.9% forecast +4.2%

- Core (MoM): Previous +0.4% Forecast +0.4%

- Core (YoY): Previous +5.5% Forecast +5.2%

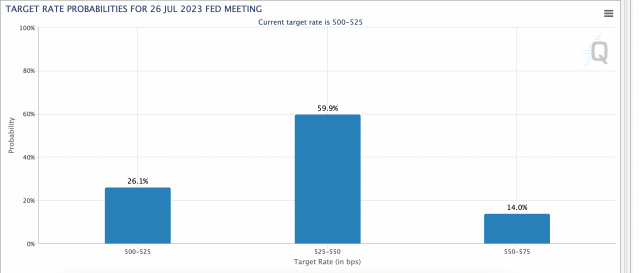

At the moment, expectations for a pause in June rate hikes are hovering around 79%, but if the CPI slows more than expected, a pause in rate hikes would be more justified. On the other hand, the probability of an additional interest rate hike at the July FOMC meeting is about 60%.

Source: CME

Brett Ryan, senior U.S. economist at Deutsche Bank, said the pause in rate hikes at the June meeting was “as officials continue to scrutinize tensions in the banking sector to see if there are any potential problems,” according to Bloomberg. “With the labor market still strong and the disinflation that Powell has been talking about, the FOMC still has work to do.” It is said that It’s still a long way from the Fed’s target of 2% inflation.

US stocks

The stock market rose today. The Nasdaq 100 index climbed nearly 2% as major IT and tech stocks drove stocks higher on hopes of a pause in interest rate hikes. Individual stocks compared to the previous day: Nvidia +1.84%, c3.ai +1.6%, AMD +3.42%, Tesla +2.2%, Microsoft +2.2%, Alphabet +1.1%, Amazon +2.5%, Apple +1.5%, Meta + 2.3%.

Tesla continues to rise today, rising for 12 days in a row and the longest streak ever. News of GM and Ford making their electric vehicles compatible with Tesla’s Superchargers and the fact that all Model 3s are now eligible for the US tax credit are some of the good news.

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Cryptocurrency-related stocks all fall

- Coinbase|$50.5 (-5.1%/-5.1%)

- MicroStrategy | $277.7 (-1.6%/-1.6%)

- Marathon Digital | $9.3 (-0.5%/-0.5%)

Virtual currency-related stocks continue to fall in the aftermath of last week’s “SEC shock”.

Social investment platform eToro has announced that it will stop offering ALGO, MANA, MATIC, and DASH in the United States from June 12, in response to the SEC’s Binance Coinbase lawsuit.

From 6:00AM ET on Wednesday July 12th, 2023, US customers will no longer be able to open new positions in Algorand (ALGO), Decentraland (MANA), Dash (DASH) and Polygon (MATIC). Customers can continue to hold and sell existing positions in these coins. (2/5)

— eToro US (@eToroUS) June 12, 2023

Earlier this week, US investment app Robinhood announced plans to delist Solana (SOL), Polygon (MATIC) and Ada (ADA).

connectionUS Robinhood to delist Solana Polygon Ada

connection: Weekly Cryptocurrency News | Attention is focused on the US SEC’s Binance Coinbase lawsuit, confirmation of large-scale BTC remittance, etc.

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”