Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Despite all the turbulence Solana (SOL) witnessed over the past six months, it remains a top-10 asset by market cap in the crypto sphere. This speaks volumes of investors’ and holders’ trust in Solana, dubbed the “Ethereum killer” by some of its more ardent users.

This was reflected well on the price charts. Heading into 2023, SOL was hovering around the $10 support zone. It was already in the grips of a downtrend that stretched back to November 2021, back when SOL was trading at $200. Just as investors began anticipating further losses across the crypto-market in January, Bitcoin began to climb past $17k and shifted the shorter-term sentiment to bullish.

Solana benefited massively from this shift and recorded gains of 175% in 21 days. However, it could not breach the $26-$28 resistance zone, which has acted as support since June-November 2022.

Read Solana’s [SOL] Price Prediction 2023-24

Recently, several altcoins, including Solana, were alleged to be securities in the United States Securities and Exchange Commission’s (SEC) latest lawsuit against Binance. The spotlight afterwards switched to the decentralization narrative, which is at the heart of blockchain technologies.

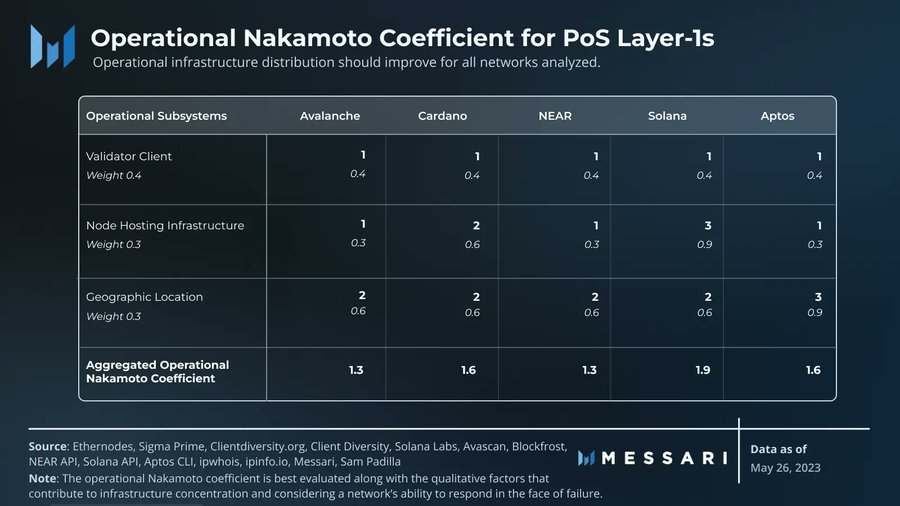

Meanwhile, the on-chain analytics firm Messari published a report last month, analyzing the degree of decentralization among different chains. Proof-of-stake (PoS) network Solana, with an aggregate Nakamoto coefficient of 1.9, seemed to have outperformed its peers.

The most bullish scenario of 2023, according to AMBCrypto’s prediction bot, could see SOL valued at $75.5. However, we can ask another bot for its take on the price, the network health, and the trajectory of Solana after giving it some relevant data points.

Can we coax ChatGPT into a Solana price prediction if we give it enough information?

ChatGPT has been a remarkable chatbot and the updates of the past month have made ChatGPT 4.0 quite impressive. It is a powerful tool for learning and has been trained on a vast array of topics. Yet, it must be said that the bot is engineered to mimic a human, and is not necessarily guaranteed to be factually accurate. The jailbreak version of ChatGPT would likely be even more inaccurate as it is specifically instructed to not say no to anything the user requests.

And yet, it is possible to obtain some guesses from the chatbot on what the future might hold if it is given an idea of what the present and recent past have been like.

So, what does ChatGPT make of Solana? Does it see a route to recovery after its recent setbacks? Based on transaction fees and transaction speeds, ChatGPT seems to think Solana will be an Ethereum killer.

Source: OpenAI

We are yet to inform it of the challenges that Solana and SOL investors have faced in recent months. Let’s start with the biggest dent in investor confidence –

FTX, where the freefall began

Sam Bankman-Fried was one of the most vocal proponents of the Solana network. He was seen as a credible and smart investor and entrepreneur who was CEO of one of the largest crypto exchanges, FTX. Even though Binance reigned supreme in terms of volume and token pairs, FTX was giving it a run for its money. Competition is also good for the industry and serves the customers.

A lot has changed since then, and the SEC has charged Mr. Bankman-Fried with defrauding the equity investors of FTX, further alleging that he commingled FTX customer funds with Alameda’s to make undisclosed venture investments. He faces more than 100 years in jail if convicted on all counts.

Not only has the reputation of Solana taken a hit, but the foundation also sold a significant amount of SOL to FTX Trading and Alameda Research. This amounted to 58.08 million SOL, or 11% of the circulating supply at the time FTX filed for bankruptcy. It was valued at close to $1.1 billion at that time.

As expected, the price of Solana nosedived in November and declined by 45% from November 11 to 31 December, falling from $18.08 to $8. With rumors of FTX’s insolvency circulating from November 5, SOL had already lost 50% the previous week, when it had been trading near the $38 mark. This took SOL’s total losses from 5 November 2022 to 31 December 2022 to 79.4%.

Source: OpenAI

ChatGPT certainly sounds optimistic, and early 2023 went extraordinarily well for investors. And yet, some network issues cropped up, just as they had in 2022.

SOL gained by 180% in January and February 2023, exceeding all expectations

From 1 January to 20 February, Solana gained 179.88% on the price charts and rallied from $9.69 to $27.12. This explosive rally has been credited partially to Bonk, a meme coin introduced within the Solana ecosystem modeled after Shiba Inu.

A part of the total 99 trillion supply was airdropped into the wallets of Solana users in December. The transaction count per day had been on a downtrend in the second half of December, but this began to turn around in early January.

Is your portfolio green? Check the Solana Profit Calculator

Soon enough, the transactions were picking up pace once more. It was reported that the introduction of the fun meme coin did much to bring the community away from the dark, depressing shadow the FTX debacle had cast on Solana.

When fed with on-chain data as well as price action in recent months, the jailbroken version of ChatGPT was able to muster an opinion on the performance of Solana in Q2 2023.

Source: OpenAI

The network has faced troublesome outages in recent months, and investor confidence will likely be strongly shaken. The chat bot agreed.

Source: OpenAI

When forced to make a guess about Solana’s price in June, it said,

Source: OpenAI

The $25 prediction might not be too far off the mark in the weeks to come, especially if Bitcoin bulls can push BTC above the $29.2k mark. Predictions and guesswork aside, what does price analysis tell us about Solana?

Some imbalances remain in the south

Source: SOL/USD,TradingView

Several altcoins, including Solana (SOL), have been labeled as securities in the U.S. Securities & Exchange Commission’s (SEC) latest lawsuit against Binance.

SOL’s value has dipped nearly 35% since the SEC’s enforcement action against Coinbase and Binance. At press time, the token was trading at $14.55, with a market cap of $5.8 billion and a 24-hour trading volume of $246 million.

The on-chart indicators reflected the weariness of the token. Its Relative Strength Index (RSI) lies just above the neutral 50-level.

Despite massive setbacks, development on multiple fronts such as Solana Saga, the NFT market, and partnerships have continued without batting an eye.

In hindsight, the past few months could turn out to have been an enormous New Year’s sale on SOL. However, investors must temper their expectations as a crypto bull market is not yet in sight.