The global financial landscape is presently undergoing a remarkable transformation, marked by the entry of prominent institutional investors into the realm of cryptocurrencies.

In a recent and highly notable development, BlackRock (NYSE: BLK), the world’s largest asset manager, has taken a significant step forward by formally submitting an application for a Bitcoin exchange-traded fund (ETF).

Moreover, the keen attention of astute market observers has been drawn to various notable developments, including Invesco’s application for a Bitcoin ETF, the strategic maneuvers executed by WisdomTree in its Bitcoin ETF filing, and Deutsche Bank’s recent filing for a crypto custody license.

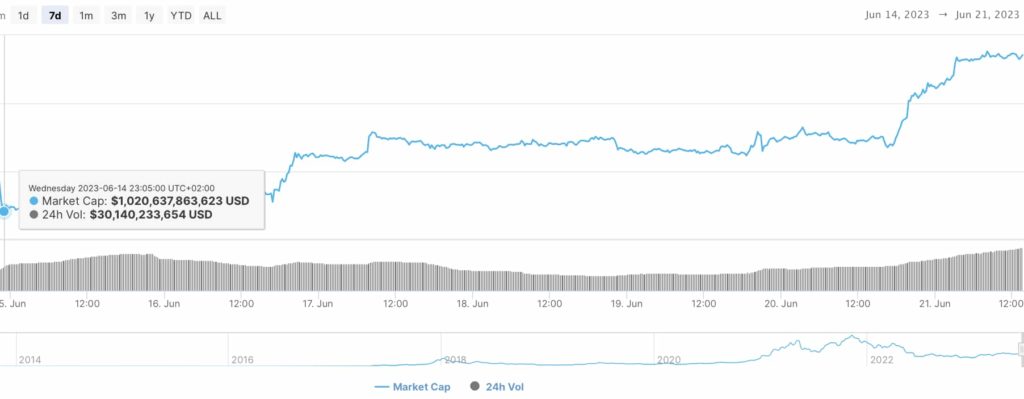

Moreover, it is particularly noteworthy to mention that these recent advancements have translated into a substantial influx of capital into the crypto market. As of June 21, 2023, an impressive $120 billion has flowed into the cryptocurrency market within the span of just one week.

On June 14, the market cap stood at $1.020 trillion, marking a substantial milestone in itself. However, the subsequent week has seen an incredible influx of capital, propelling the market cap to its current value of $1.141 trillion as of June 21.

Market sentiment shifts

This surge in capital demonstrates the growing confidence and enthusiasm surrounding digital assets as investors seek to leverage their potential for significant returns and portfolio diversification.

Another development worth highlighting is the launch of EDX Markets, a crypto exchange that has garnered support from esteemed investors such as Citadel Securities, Fidelity Investments, and Charles Schwab.

In the midst of a broader market rally, Bitcoin (BTC), the leading cryptocurrency, has demonstrated impressive strength by surging over 8% in the past 24 hours. This notable upward movement has resulted in a substantial increase of over $40 billion in Bitcoin’s market value, as it broke through resistance at $29,000.

As expected, the upward trajectory of Bitcoin has had a positive impact on other major altcoins in the market.

Noteworthy altcoins such as Litecoin (LTC), (ADA), Stacks (STX), and Polygon (MATIC) have also experienced significant gains during this period of 8.4%, 7.8%, 19.7%, and 6.8%, respectively. Ethereum (ETH) and Solana (SOL) climbed by more than 5% each over the same time frame.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.