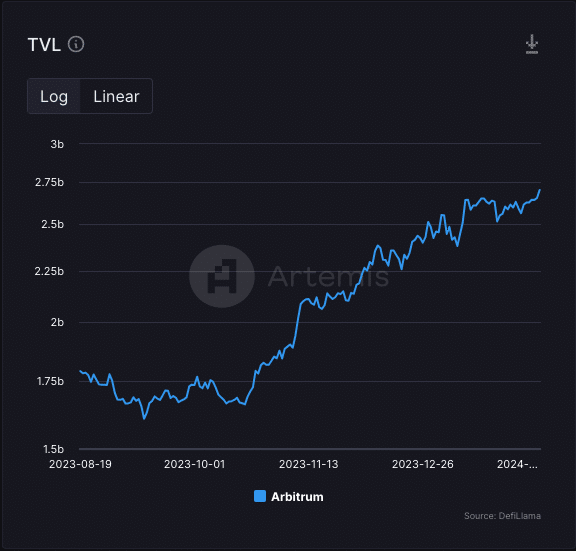

- Increasing liquidity driven by STIP helped Arbitrum’s TVL hit $2.7 billion.

- Active addresses decreased, as well as development activity.

Four months after Arbitrum’s [ARB] Short Term Incentive Program (STIP), its Total Value Locked (TVL) has reached another all-time high. According to AMBCrypto’s analysis of Artemis dashboard, Arbitrum’s TVL was $2.7 billion.

For those unfamiliar, TVL measures the overall health of a DeFi protocol. To arrive at this value, the metric looks at the total value of digital assets locked in a particular network.

More liquidity, more dominance

Long story short, a decreasing TVL suggests a shortage of liquidity in the protocol. It also implies that market participants do not trust the protocol to return enough yield.

However, the increase in Arbitrum’s TVL suggests otherwise. AMBCrypto noticed that the chain’s TVL increased by 9.85% in the last 30 days. This also made it the most valuable protocol of all the Layer Two chains (L2s).

Source: Artemis.xyz

While Optimism [OP] and zkSync Era also experienced an increase, they did not match up to Arbitrum in that regard. AMBCrypto’s mention of Arbitrum’s STIP earlier was intentional. This was because the program seemed to be the driving force behind the surge in TVL.

In October 2023, we reported how the Arbitrum Foundation developed STIP. One of the major reasons for the decision was to stimulate ARB usage and attract liquidity to the Arbitrum blockchain. A few weeks later, the TVL jumped, indicating that the decision seemed to have paid off.

Again, in December 2023, the Arbitrum DAO approved a supplementary budget to expand the STIP initiative. By funding additional projects, the project has been able to attract more developers and users to its side.

At press time, data from Dune Analytics showed that the total allocation was 68.68 million ARB. Out of that, 38.64 million has been claimed while 10.43 million ARB tokens remain unused.

Source: Dune Analytics

Developers and users take a break

In my perspective, if more of the unused tokens are engaged, Arbitrum’s TVL might rise higher. This would also make it difficult for Optimism and zkSync Era to catch up.

As of this writing, Optimism’s TVL was $796.15 million while zkSync Era’s was $131.60 million.

Further, on-chain data from Santiment showed that development activity on the chain had decreased. On the 29th of January, the development activity was 8.50. This reading implied that new features were being shipped out on Arbitrum. But at press time, the metric was down to 7.35.

Should the project attract more developers as it aims, then the metric might soar back to the previous high. Concerning the active addresses, Santiment showed that the metric had fallen to 17,200. On the 8th of February, active addresses were as high as $36,000.

Source: Santiment

Realistic or not, here’s ARB’s market cap in OP terms

The decline suggests that direct participants in ARB transactions had decreased. If the number of active users continues to fall, it might be difficult for Arbitrum network activity to increase.

But in the long term, more liquidity and developers for the blockchain might change the state of things for the better.