- U.S. BTC ETFs saw $156 million in outflows last week amidst market drawdown.

- GBTC saw inflows for two days straight as markets improved.

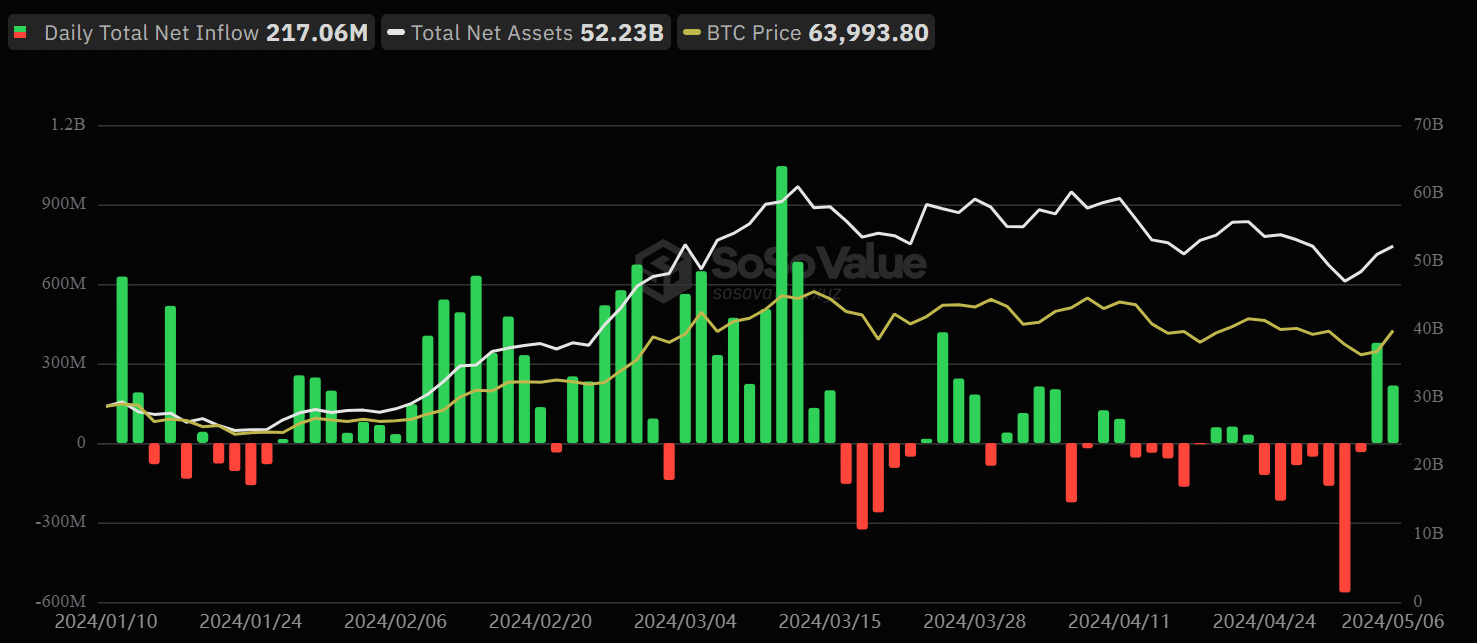

The new U.S. Bitcoin [BTC] ETFs saw $156 million in outflows last week, but that seems to change as Grayscale’s GBTC bleeding comes to an end.

According to the CoinShares report, last week’s outflows were significant as the BTC price dropped below the average buying price of the ETF issuers.

The report mentioned that automatic sell orders could have spiked last week’s BTC drawdown.

“We estimate the average purchase price of these ETFs since launch to be US$62,200 per bitcoin; as the price fell 10% below that level, it may have triggered automatic sell orders.”

BTC hit a low of $56.5K on May Day, inducing a market-wide bloodbath and liquidations. Every U.S. spot BTC ETF saw massive outflows on May Day, marking BlackRock’s IBIT’s first outflow since January.

Across the board, total outflows on May Day hit $563.7 million, with Fidelity and Grayscale leading the pack at $191.1 million and $167.4 million, respectively.

However, the outflows eased later in the week, bringing last week’s overall outflow to $156 million, per the report.

Will GBTC’s U-turn fuel the Bitcoin ETF recovery?

Market sentiment improved as BTC recovered from $56.5K to $65K. However, Grayscale’s GBTC pulled the biggest surprise during the recovery.

It saw the first inflow of $63.9 million last Friday and confirmed another inflow on Monday worth $3.9 million.

Grayscale’s U-turn caught Bloomberg analysts by surprise, too. One of the analysts, Eric Balchunas, noted,

“But looks like inflows again today, too. They do have an extensive marketing budget. That, combined with the recent rebound and no more people looking to leave, could be why.”

Source: SoSo Value

The recovery further fueled investor appetite, as net inflows hit $378.2 million last Friday. The U.S. BTC ETFs remained green on Monday and recorded another net inflow of $217 million.

At the time of writing, BTC was back in its previous price consolidation range of $60K—$71K but slipped below $64K after grabbing liquidity at $65.5K.

Should BTC’s recovery extend to the range-high, U.S. BTC ETFs could reverse last week’s $156 million outflows.