- friend.tech, a new application on Base, ensured that the L2 transaction outpaced others in the Ethereum ecosystem.

- Base’s TVL surged, as the amount bridged exceeded $253 million.

As it stands, the reign of many Ethereum [ETH] L2s has been put on hold, making way for Coinbase’s L2, Base, to take the mantle. And it’s not just that. The Ethereum Mainnet may have also stepped back for Base to take the crown of increased activity and traction.

Realistic or not, here’s OP’s market cap in ETH terms

How has this come to be?

Friends help Base trump the king

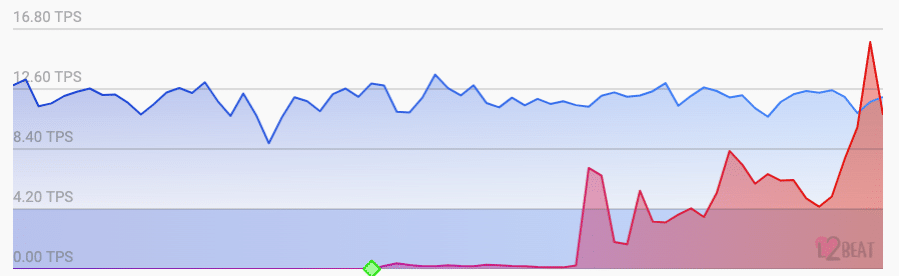

Not to beat around the bush, Base’s Transactions Per Second (TPS) surpassed that of Ethereum on 22 August, according to L2 Beat. As per the chart below, Ethereum’s TPS was 12.05 while Base was 15.88.

Source: L2 Beat

The data revealed that Base’s TPS had increased by 73.56% in the last 24 hours. Ethereum, on the other hand, decreased by 1.47% within the same timeframe. However, there was one particular reason that Base was able to achieve the milestone and its name— friend.tech.

friend.tech is a mobile application built on Coinbase L2. While it prides itself as the “marketplace for your friends,” friend.tech provides an avenue for users to tokenize their identity. And, in turn, can sell shares of themselves to their followers or anyone interested in their community.

Despite being launched only recently, friend.tech has experienced rapid growth and adoption. According to Dune Analytics, the application has amassed 97,316 unique traders. These traders have been involved in over one million transactions, valued at 39.195 ETH.

Source: Dune Analytics

But besides Ethereum, Base has also pegged back the dominance of Arbitrum [ARB] and Optimism [OP]. Previously, AMBCrypto had reported how Base’s emergence had disrupted the L2 flow.

Daily Transactions on @BuildOnBase have surpassed @arbitrum and @optimismFND combined. pic.twitter.com/fSrqMyeeVD

— Delphi Digital (@Delphi_Digital) August 22, 2023

The daily transactions reflect the usage rate of the network on a day-to-day basis. Therefore, the hike in transactions suggested optimism around Base. If it stays the same or increases further, the project might completely overtake its predecessors.

Moreover, the integration of projects like Compound [COMP] and Aave [AAVE] also ensured that the “on-chain summer” leader attracted more users. Now, the shift has extended to transactions.

L2 standings have changed

According to Delphi Digital, daily transactions on Base have outstripped those of Optimism and Arbitrum combined.

How much are 1,10,100 ETHs worth today?

At the time of writing, over $253 million had been bridged on Base. Based on Dune’s data, ETH led the cohort of assets that have appeared on the network. This was followed by stablecoins Tether [USDT] and DAI.

Also, Base’s Total Value Locked (TVL) has risen to $185.32 million, DefiLlama revealed. The surge in TVL implies that participants have come to trust Base despite a series of scams appearing on the network before its public Mainnet launch.