Join Our Telegram channel to stay up to date on breaking news coverage

‘Best crypto to buy now’ is one of the most searched cryptocurrency-related terms in Google, and each day InsideBitcoins lists some options.

With the crypto market constantly evolving, certain tokens stand out as promising choices for investment. Aside from stalwarts like Bitcoin and Ethereum, several emerging altcoins show tremendous potential, offering various investment options. As such, Insidebitcoins dives into the current market trends, exploring some of the best cryptos to consider for investment today.

Best Crypto to Buy Now

In recent news, an appellate court reversed the Securities and Exchange Commission’s (SEC) rejection of Bitcoin-related exchange-traded funds (ETFs), calling it “arbitrary and capricious.” This suggests a change in regulatory stance.

The potential approval of a spot Bitcoin ETF would be significant news for investors. This development holds implications for those deeply involved in crypto and individuals seeking exposure to this evolving financial landscape within traditional investment frameworks.

1. Solana (SOL)

Solana experienced a price surge last year, witnessing a 611% increase. This growth has positioned it favorably, outperforming 91% of the top 100 crypto assets, surpassing Bitcoin and Ethereum. Despite this positive trend, current sentiment analysis suggests a bearish outlook for Solana’s price prediction.

The Fear & Greed Index currently stands at 71, indicating a sentiment of greed in the market. Moreover, Solana is trading above its 200-day simple moving average, showcasing a positive performance relative to its token sale price.

“DePIN infrastructure winners are beginning to emerge, with Solana in the lead.”-@MessariCrypto💪@MessariCrypto’s State of DePIN 2023 highlights DePIN developments on Solana, including ecosystem projects @Hivemapper, @RenderNetwork, & @Helium.

Dive in: https://t.co/yPupKt8dXO pic.twitter.com/vqTUwT1et9

— Solana (@solana) January 5, 2024

The tokens’s circulating supply is 431.80 million SOL out of a maximum supply of 533.68 million. It’s worth noting that Solana’s yearly supply inflation rate is 18.98%, resulting in the creation of 68.89 million SOL in the past year. Despite this inflation, Solana remains the 2nd project in the Proof-of-Stake Coins and Solana Network sectors.

Furthermore, it also ranks 4th in the Layer 1 sector. Over the last 30 days, Solana has experienced 15 green days, constituting a 50% positive performance rate. The project’s liquidity is high, as evidenced by its market cap.

2. Injective (INJ)

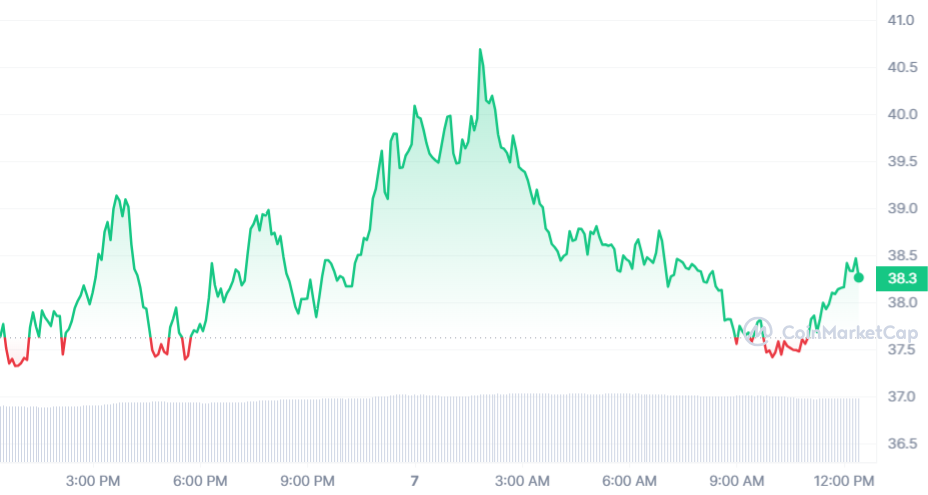

Over the past 24 hours, Injective (INJ) has shown a 1.54% price increase, continuing its positive trend from the past week, where it gained 0.60%. The current value is within reach of its all-time high of $44.57. Market sentiment indicates a bullish trend, and the Fear & Greed Index stands at 71, signaling a state of greed.

Additionally, the price of INJ has surged by an impressive 2,687%, outperforming 99% of the top 100 cryptocurrencies. This performance includes surpassing Bitcoin and Ethereum. Furthermore, Injective’s current circulating supply is 83.76 million INJ out of a maximum supply of 100.00 million INJ.

Congrats to @Injective_ | $INJ on achieving 400M+ On-Chain Transactions!

Pretty impressive 👏👏👏 pic.twitter.com/rENiiF9qz3

— Injective Now (@InjectiveNow) January 6, 2024

The yearly supply inflation rate is currently at 14.72%, creating 10.75 million INJ in the last year. Moreover, INJ trades above the 200-day simple moving average, reflecting positive market momentum. The token has also displayed favorable performance compared to its token sale price.

Over the last 30 days, there have been 18 green days, constituting 60% of the observed period. With high liquidity based on its market capitalization, Injective ranks 5th in the DeFi Coins sector. INJ also ranks 2nd in the Layer 2 sector and 1st in the AI Crypto sector.

3. NEAR Protocol (NEAR)

Arbitrum Orbit has recently incorporated NEAR Data Availability (DA) into its tech stack. This integration offers developers a more efficient and scalable data availability solution. Also, it is designed explicitly for developers utilizing Arbitrum Orbit to deploy customizable rollups based on Arbitrum’s technology.

One advantage for rollup builders is the potential for reduced data availability costs, contributing to a decrease in overall rollup overhead. Developers on Arbitrum Orbit can enhance their rollup’s cost-effectiveness and reliability by adopting NEAR DA as a comprehensive, out-of-the-box modular solution.

NEAR DA’s compatibility and support for high-quality projects launching application further position it as a valuable addition. The integration has also been associated with substantial trading volumes for NEAR.

Furthermore, the token experienced a 0.29% price increase in the last 24 hours. NEAR’s price has demonstrated a 117% increase over the past year, outperforming 66% of the top 100 crypto assets. Moreover, the token is trading above its 200-day simple moving average and has experienced 17 positive days in the last 30 days.

NEAR combines both monolithic and modular blockchain scaling.

NEAR is also the only full stack monolithic chain, offering maximum throughput with minimal overhead and seamless composability across all layers for applications.

Watch the full version here:… pic.twitter.com/HsFYCMec3f

— NEAR Protocol (@NEARProtocol) January 2, 2024

NEAR Protocol has a circulating supply of 1.00 billion out of a maximum supply of 1.00 billion NEAR. The yearly supply inflation rate is reported at 20.99%, creating 174.33 million NEAR in the past year. Currently, NEAR Protocol ranks 16th in the Layer 1 sector based on market capitalization.

4. Bitcoin Minetrix (BTCMTX)

BTCMTX presents an innovative approach to cloud mining, incorporating tokenization to tackle prevalent concerns associated with other cloud mining platforms. The project aims to create a safe and transparent space for people to do Bitcoin (BTC) mining in a decentralized way.

However, the substantial stake garnered by Bitcoin Minetrix exceeds 400,000 BTCMTX tokens. The platform boasts an initial annual percentage yield (APY) of 103,225%, subject to change based on increased token staking.

A significant allocation of 42.5% of BTCMTX tokens is earmarked for mining operations. It ensures the project’s focus on building a robust mining infrastructure. Another substantial portion, 35%, is dedicated to marketing efforts and the expansion of BTCMTX.

Additionally, 15% is allocated for rewarding active community involvement, while the remaining 7.5% is set aside for BTCMTX staking rewards. Currently, Bitcoin Minetrix has raised over $7,750,811.71 out of the targeted $8,005,978. The token is offered at a rate of $0.0127 per token, with a 3-day window before the subsequent price increase.

Only 4 days left until Stage 18 of #BitcoinMinetrix ends!

What barriers do you see hindering widespread #Bitcoin adoption? 🤔🚧 pic.twitter.com/j2QMSIDydb

— Bitcoinminetrix (@bitcoinminetrix) January 7, 2024

Investors had the opportunity to acquire 70% of the total token supply, amounting to 2.8 billion BTCMTX. The acquisition could be made using Ethereum (ETH) or Tether (USDT), with a minimum investment of $10. This strategic token distribution aligns with Bitcoin Minetrix‘s emphasis on strengthening mining infrastructure and fostering the progressive growth of its platform.

Visit Bitcoin Minetrix Presale.

5. Beam (BEAM)

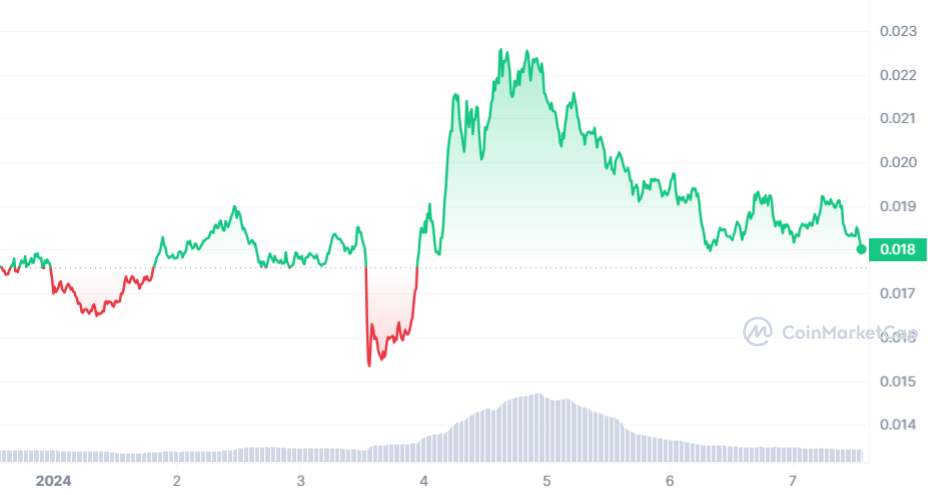

Initially conceived as a simple concept, Beam has evolved into a chain-agnostic ecosystem hosting various games, products, and applications. The announcement of a strategic collaboration with prominent investor Pantera Capital marks a notable development for Beam. Pantera Capital’s involvement as $BEAM holders brings support in areas such as recruitment, connecting with existing and future games, etc.

Furthermore, Beam has experienced 15 positive trading days out of the last 30, indicating a 50% increase. However, the current sentiment for Beam’s price prediction leans bearish, while the Fear & Greed Index registers at 71 (Greed).

Excited to welcome another major community onto the @BuildOnBeam ecosystem!

Welcome @MoonsamaNFT 🌕 https://t.co/vruRGGrGSf

— Merit Circle (@MeritCircle_IO) January 7, 2024

Additionally, Beam’s circulating supply is 49.52 billion out of a maximum supply of 62.75 billion BEAM. The project ranks #3159 in the Ethereum (ERC20) Tokens sector and #506 in the Binance Smart Chain sector. It also ranks #311 in the Gaming sector and #152 in the Metaverse sector.

Beam peaked on December 14, 2023, at an all-time high of $0.027259. Conversely, its lowest recorded price occurred on October 29, 2023, at an all-time low of $0.004338. The post-all-time high lowest price was $0.014365, and the highest BEAM price since the last cycle low was $0.023080.

Read More

New Crypto Mining Platform – Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Secure Cloud Mining

- Earn Free Bitcoin Daily

- Native Token On Presale Now – BTCMTX

- Staking Rewards – Over 100% APY

Join Our Telegram channel to stay up to date on breaking news coverage