Since the launch of Ordinal inscriptions, Bitcoin-based non-fungible tokens (NFTs) have proliferated, with the blockchain documenting $3.82 billion in NFT sales across more than 3 million transactions. Bitcoin has now ascended to the fourth-largest blockchain by total NFT sales.

From Counterparty to Ordinal: Bitcoin NFTs Hit $3.82 Billion in Sales

In the first week of June 2024, data revealed that the Bitcoin blockchain generated $3.82 billion from NFT sales. Although NFTs on Bitcoin were previously available through technologies like Counterparty, the introduction of Ordinal inscriptions has significantly increased the popularity of BTC-based NFTs, even amid a general decline in the digital collectibles market. The $3.82 billion has positioned BTC within the top five blockchains for NFT sales, securing the fourth spot just below the Ronin chain.

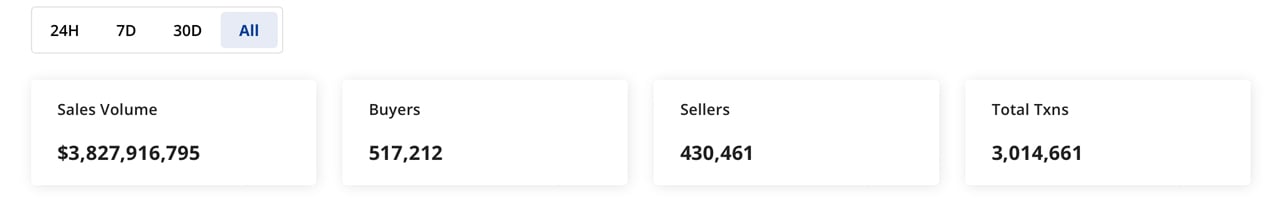

All-time Bitcoin-based NFT sales data collected by cryptoslam.io.

Out of the $3.82 billion, it is estimated that just over 2% of Bitcoin-based NFT trades are wash trades, totaling $81.95 million. The leader in NFT sales by all-time metrics, Ethereum, commands a significant $43.81 billion in NFT sales, but 43% of that aggregate is considered wash trades. Bitcoin NFTs have seen 517,207 buyers and 430,455 sellers across over 3 million transactions. Of the 3 million transfers, 15,828 of those transactions were considered wash trades.

The most expensive NFT ever sold on the Bitcoin blockchain was a digital collectible called Budgie, which sold three months ago for $1.44 million. A Bitcoin-based digital collectible of one of Van Gogh’s paintings was the second most expensive sale to date, selling for $1.19 million six months ago. Two more Van Gogh paintings followed, and each sold for just over $1 million per token.

Interestingly, some sales show that the buyer would have been better off keeping their BTC. For instance, the fifth most expensive NFT sale on the Bitcoin blockchain was sold a year ago for $966,962, but the buyer paid 35 BTC, which is now worth $2.37 million. There are also several BTC-based NFT collections with multi-million-dollar market capitalizations. According to Magic Eden metrics, Nodemonkes is the largest with its $178.4 million market valuation.

The Runestone NFT collection is the second largest with $128.2 million, followed by Ordinal Maxi Biz NFTs with a market cap of $98 million. To round out the top five, Bitcoin Puppets and Quantum Cats follow with $94.7 million and $68.2 million, respectively. Other notable collections include Bitmap and Bitcoin Frogs with market caps of $55 million and $40.2 million, respectively. A market cap of an NFT collection is the floor value price times the number of digital collectibles in the compilation, even though some specific NFTs in the collection may have sold for much higher values than the current floor.

The impressive rise of Bitcoin in the NFT marketplace underscores a significant shift in the digital collectibles landscape, driven largely by the innovative use of Ordinal inscriptions. As the blockchain carves out a robust niche among the giants, the evolving dynamics between traditional leaders like Ethereum and emerging platforms highlight a diversifying ecosystem. This adaptation not only broadens the horizon for investors but also sets the stage for a more intricate interplay of digital asset values and market behaviors, suggesting a vibrant future for Bitcoin-based NFTs amid changing tides in the overall market.

What do you think about the rise in Bitcoin-based NFTs over the past year? Let us know what you think about this subject in the comments section below.