- BTC’s buying sentiment in the derivatives market was dominant.

- Bitcoin was down by over 1% in the last 24 hours, and a few indicators were bearish.

After a long wait, Bitcoin [BTC] has risen above the $28,000 mark, sparking excitement among investors. Data from Santiment revealed that the uptrend happened when a large number of BTC tokens were accumulated in the recent past. Though high accumulation was the driving force that powered the uptrend, other factors were at play at the same time.

Is your portfolio green? Check the BTC Profit Calculator

Bitcoin is getting off the leash!

Bitcoin is finally showing signs of recovery as its price has rallied over the last few days. The recent uptrend helped the coin lift its price above $28,000. At the time of writing, BTC was trading at $28,324.76 with a market capitalization of over $552 billion.

According to Santiment’s tweet, a major reason behind the uptrend was BTC’s hike in accumulation.

🐳 #Bitcoin‘s number of wallets holding at least 100 $BTC has jumped to 15,970 after the largest single day jump of 2023 on Saturday. Since this accumulation, $BTC‘s price is +5.3%, and they may not be done. We will continue to monitor. https://t.co/l0drhvkf7E pic.twitter.com/0mDAmys7N4

— Santiment (@santimentfeed) October 18, 2023

To be precise, the number of wallets holding at least 100 BTC has jumped to 15,970 after the largest single-day jump of 2023 on 14 October. Soon after the accumulation, the coin’s price spiked by more than 5%.

A look at BTC’s on-chain performance revealed that quite a few other factors were also helping the coin to move up. For instance, its exchange reserve was decreasing, meaning that it was not under selling pressure.

This happened while its transfer volume increased, which by and large is a positive signal. Bitcoin’s taker buy/sell ratio also turned green, suggesting that buying sentiment was dominant in the derivatives market.

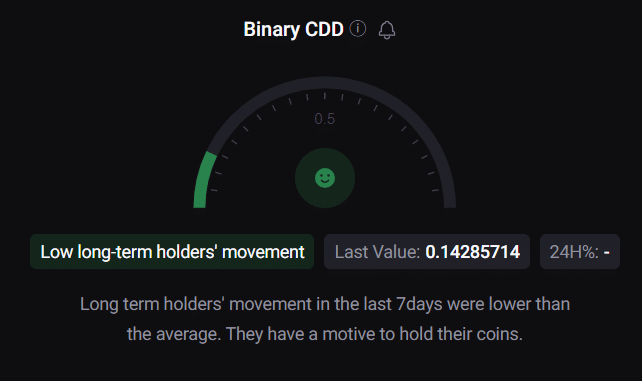

BTC’s binary CDD was green too. This meant that long-term holders’ movements in the last 7 days were lower than average.

Source: CryptoQuant

The weather was quick to change

Though Bitcoin’s price registered a promising rally, the scenario was quick to change. The king of cryptos’ price dropped by more than 1.2% over the last 24 hours. This was also accompanied by a drop in BTC’s trading volume, suggesting that investors were unwilling to trade the coin.

Read Bitcoin’s [BTC] Price Prediction 2023-24

A check of BTC’s daily chart provided clarity on what investors should expect from the coin in the days to follow. Bitcoin’s Money Flow Index (MFI) registered a downtick.

Its Chaikin Money Flow (CMF) was also resting below the neutral mark, increasing the chances of continued southward price movement. Nonetheless, the MACD was optimistic as it displayed a bullish crossover.

Source: TradingView