- Bitcoin faced a critical juncture with potential paths to $76,610 or a drop to $51,970.

- Market data and analyst insights suggested increased selling pressure and a bearish short-term outlook.

Bitcoin’s [BTC] market position is at a critical juncture as it currently traded at $61,394 at press time. After dipping to $60,000, the cryptocurrency has seen a slight increase of over 1% in the past 24 hours.

Despite this minor recovery, Bitcoin has experienced a 9% decline over the past month and a 4.3% drop in the past week.

These movements have drawn significant attention from analysts and traders alike, who are keenly observing Bitcoin’s ability to sustain its current level.

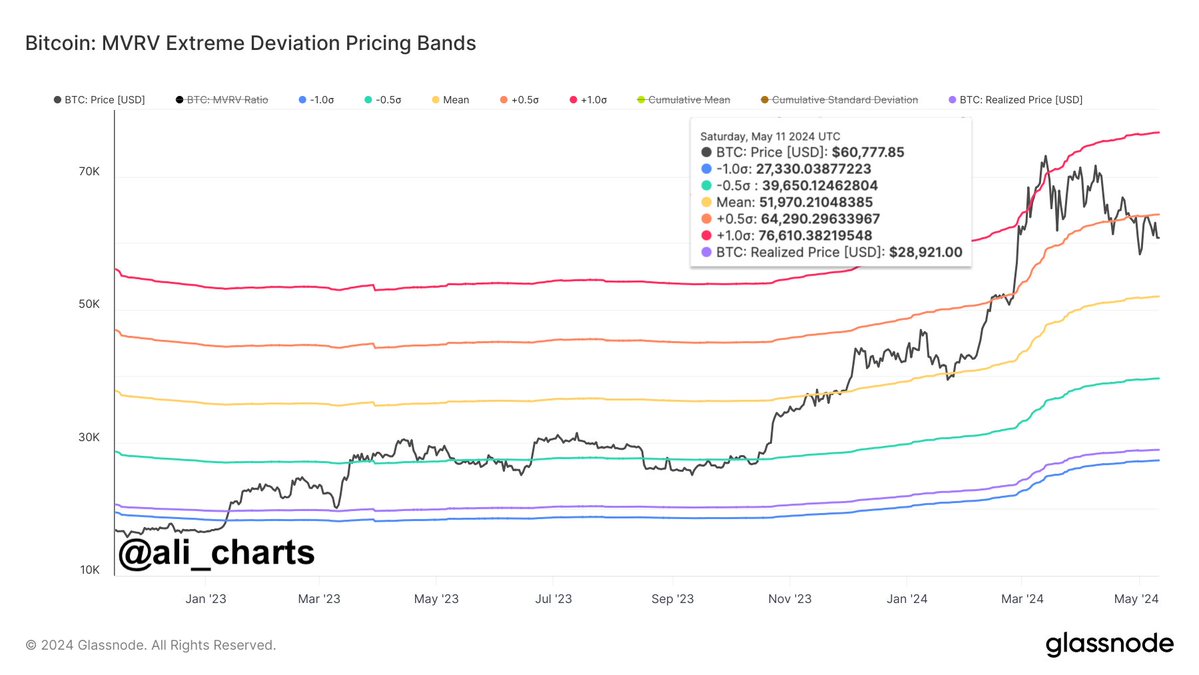

Crypto analyst Ali Martinez recently provided a detailed analysis of Bitcoin’s potential price trajectory.

According to Martinez, if Bitcoin can reclaim $64,290 as a support level, there could be a pathway to a bullish rise toward $76,610.

However, failure to maintain this crucial support level might see the cryptocurrency’s price retract to $51,970.

This places significant emphasis on the $64,290 mark as a pivotal point for determining Bitcoin’s short-term direction.

Source: Ali Charts/X

Signs of bearish pressure?

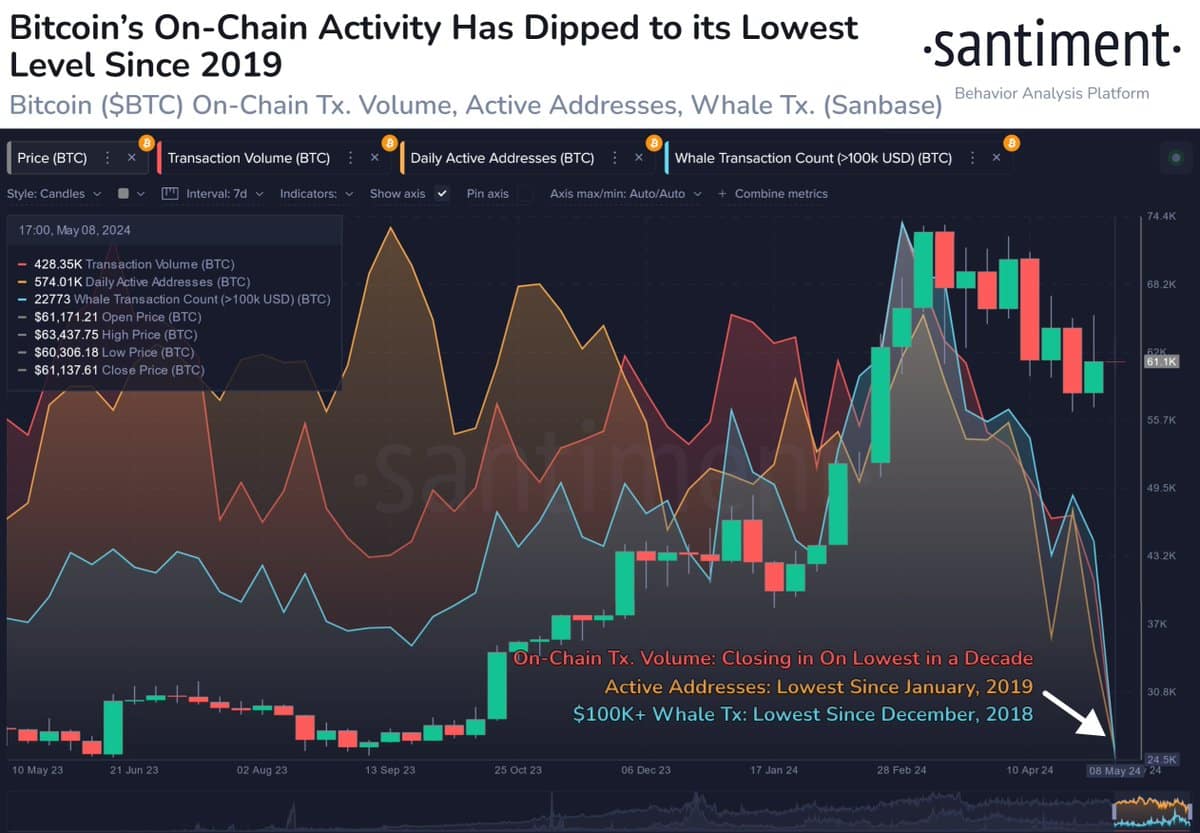

Recent data from Santiment has highlighted a noticeable decline in Bitcoin’s on-chain activity, with transaction levels nearing historic lows.

This reduction in activity suggests that traders are significantly reducing their transactional engagements, a trend observed particularly after Bitcoin’s all-time high.

Source: Santiment

While decreased on-chain activity might not directly predict a downturn, Santiment interprets this as an indication of increasing “fear and indecision” among market participants.

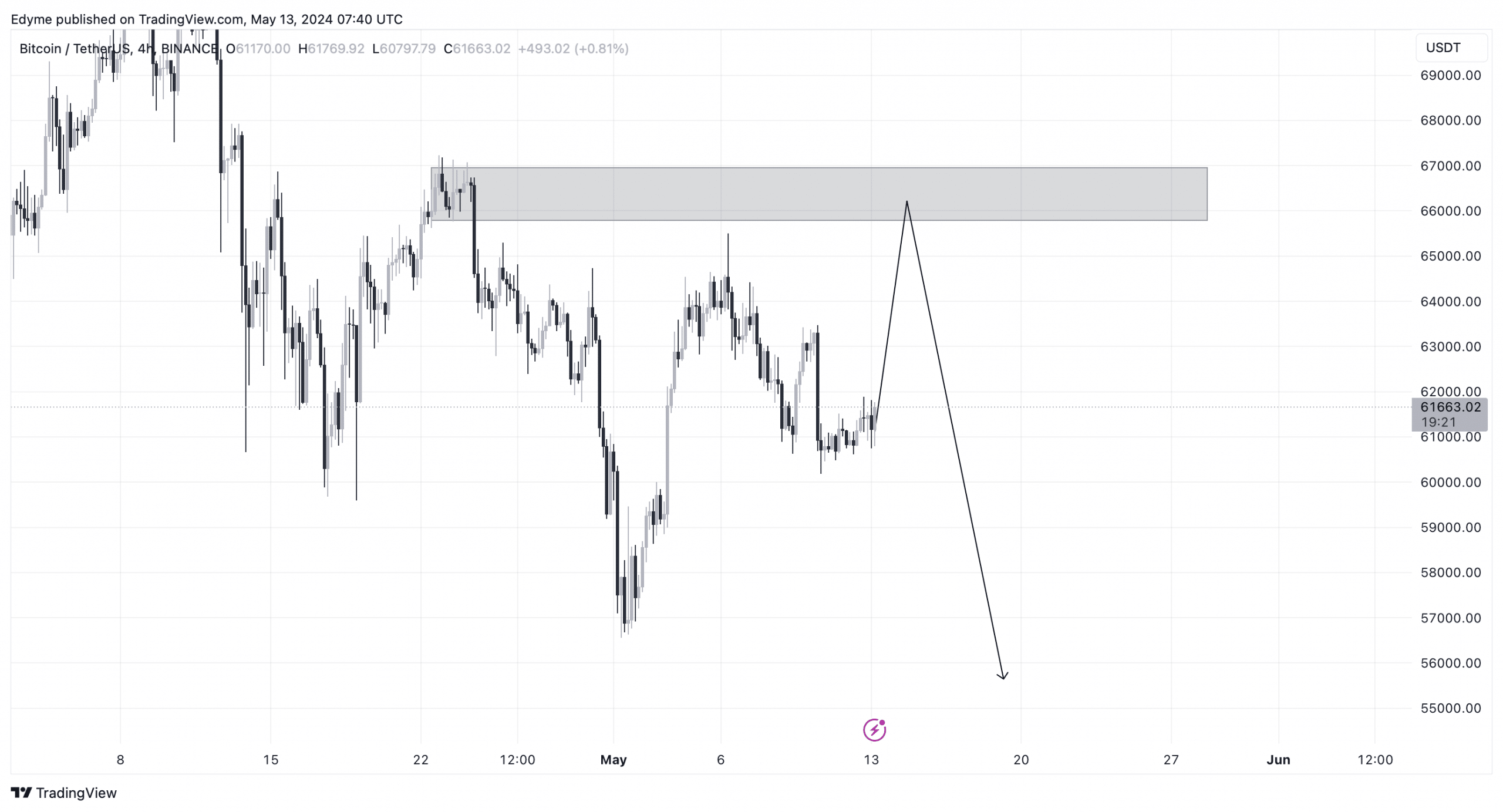

Delving into the technical aspects, Bitcoin appears extremely bullish on the weekly time frame.

However, a closer look at the daily time frame reveals a different story, with the cryptocurrency showing a bearish sub-structure.

There have been three significant breaks of structure to the downside on this time frame, hinting at short-term bearish pressure.

The 4-hour time frame further supports this view, as the current bullish candle might be a temporary move to take out liquidity at higher levels before continuing the downward trajectory.

Source: TradingView

Additional challenges for Bitcoin

Analysis of recent market data has also shed light on the selling pressure surrounding Bitcoin.

According to a recent report from AMBCrypto, which cited data from CryptoQuant, there has been a noticeable increase in Bitcoin’s net deposit on exchanges compared to the seven-day average.

Additionally, both the Coinbase Premium and Korea Premium indices are in the red, indicating a dominant selling sentiment among US and Korean investors.

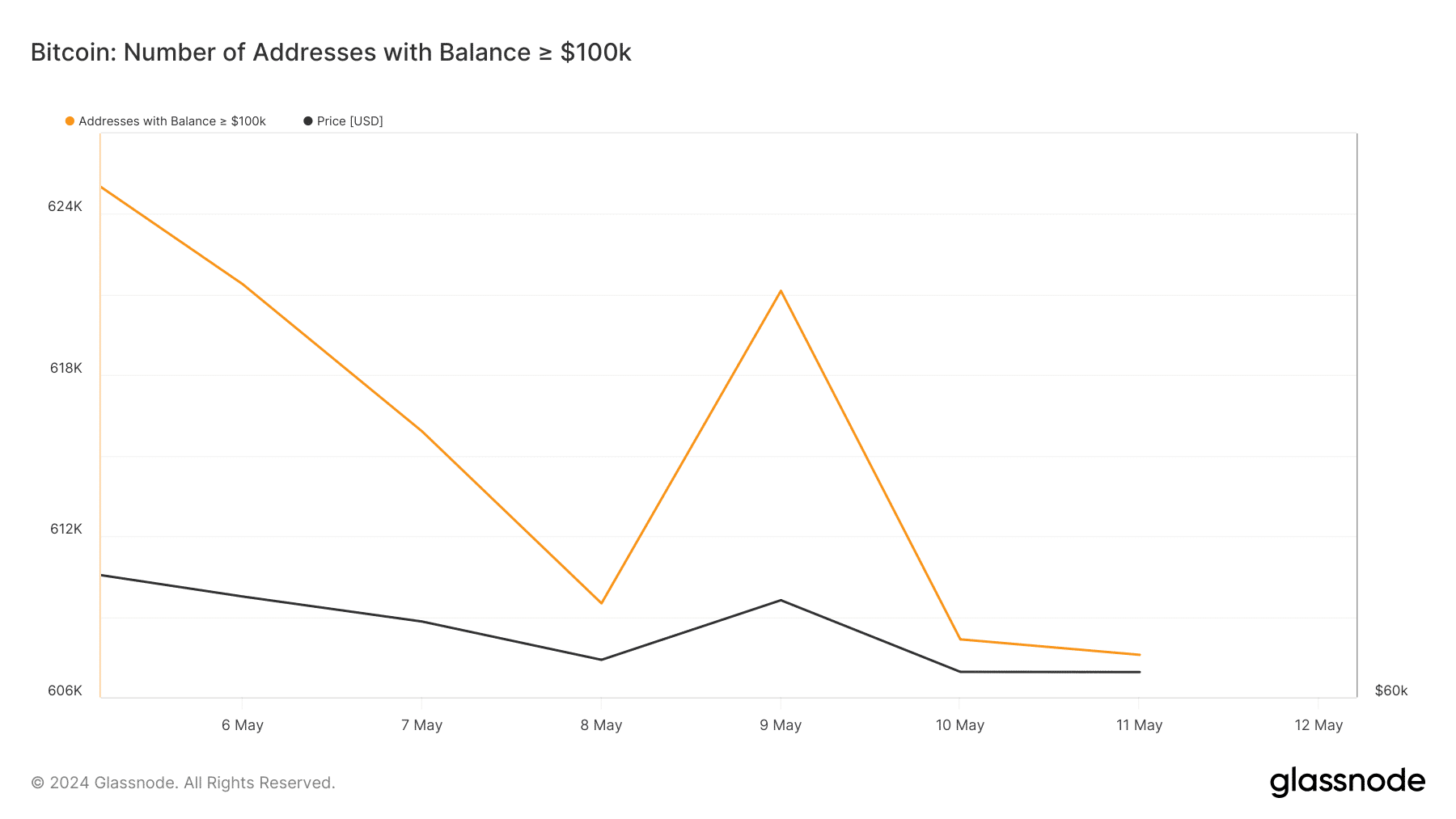

The behavior of Bitcoin whales further complicates the potential for a price recovery.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Notably, Glassnode’s data reveals a sharp decline in the number of addresses holding balances greater than $100,000 over the last seven days.

This trend suggests that major players in the market are offloading their Bitcoin holdings, making it increasingly challenging for the cryptocurrency to reach the $64,000 mark in the short term.

Source: Glassnode