Following the launch of the spot Bitcoin exchange-traded fund (ETF), the value of the maiden cryptocurrency has experienced a decline after briefly revisiting the $49,000 level.

Attention has now shifted to Bitcoin’s (BTC) short-term price trajectory, with the cryptocurrency facing the risk of losing the crucial $40,000 support. Indeed, there was widespread speculation that Bitcoin might drop further after the asset plunged below $41,000 on January 20.

In looking at the Bitcoin price forecast, crypto trading expert FieryTrading, in a TradingView post on January 20, outlined the potential outlook for Bitcoin post-ETF hype.

In his analysis, FieryTrading identified a correlation between bear market bottoms and Bitcoin’s price during halving events.

Analyzing historical data, he highlighted a speculative pattern that could significantly surge Bitcoin’s value, drawing parallels to the second and third halving events.

For example, during the second halving, the expert pointed out a price increase of 300% from the bottom, while in the third halving, it was 200% off the bottom.

He suggested that a move towards $31,000 for Bitcoin is plausible based on the historical trajectory.

“So my assumption would be that the price on the 4th halving, the next one, would be 100% from the $ 15,500 bottom, so around $31,000. With BTC reversing after the ETF launch, a move towards $31,000 is not even that far-fetched, since it functioned as a very important resistance of the majority of 2023 and therefore functions as a magnet,” he said.

Bitcoin catalyst

With the ETF not meeting expectations in terms of Bitcoin price action, attention has shifted to other catalysts, particularly the upcoming halving event scheduled for April. In this case, there are expectations that ETF will be complimented by the halving.

For instance, a previous Finbold report indicated that SkyBridge Capital founder Anthony Scaramucci stated that Bitcoin might trade at $170,000 by 2025, attributing the increase to a combination of the ETF and halving event.

Despite Bitcoin’s reaction to the ETF, the product’s overall performance has been noteworthy, attracting significant trading volume within days.

Bitcoin price analysis

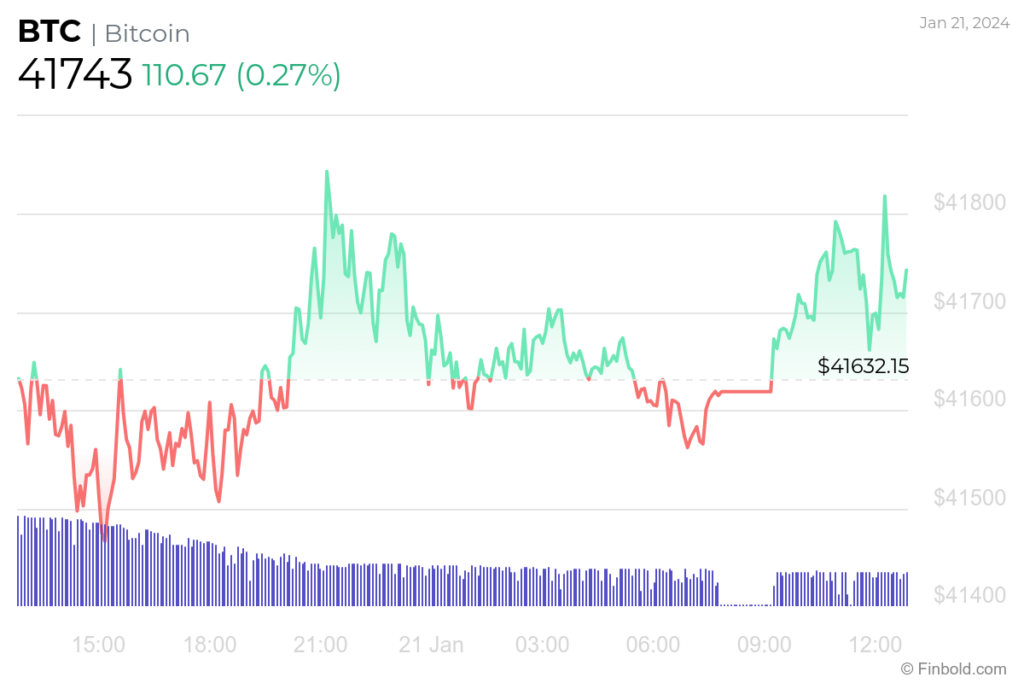

By press time, Bitcoin was trading at $41,743, experiencing daily losses of less than 1% and a weekly decline of over 2%.

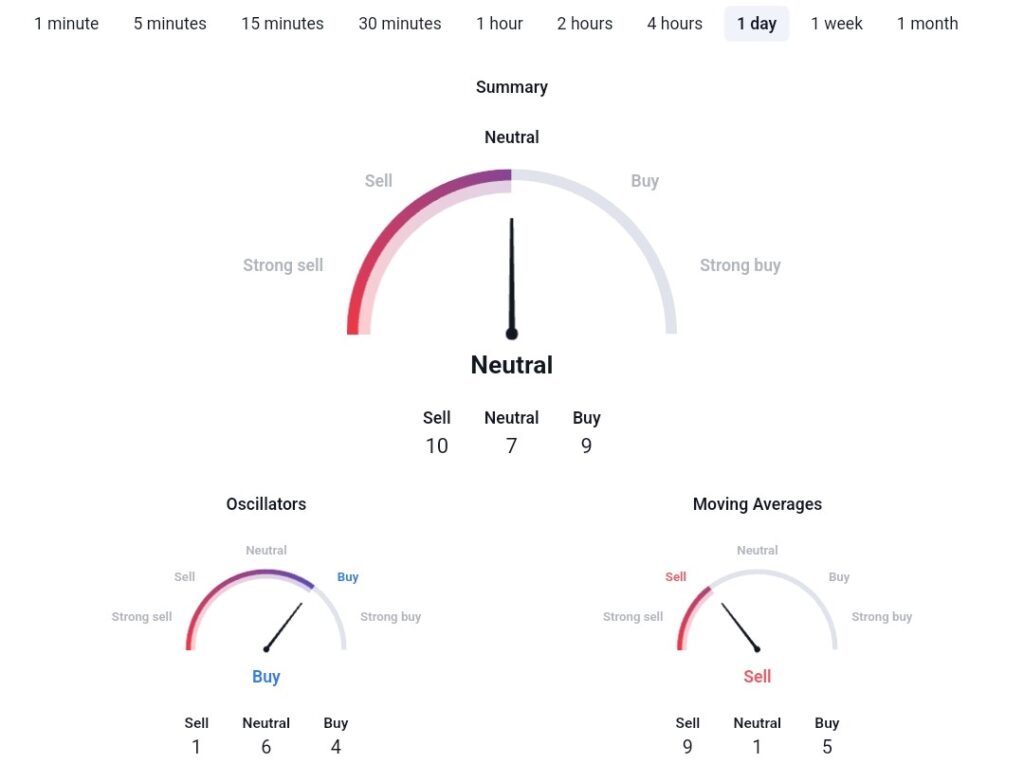

Elsewhere, Bitcoin technical analysis reveals bearish sentiments, with a summary of one-day gauges indicating a ‘neutral’ rating at 7, moving averages signaling a ‘sell’ sentiment at 9, and oscillators holding a ‘buy’ sentiment at 4.

Overall, investors are closely monitoring Bitcoin’s ability to sustain gains above the $40,000 support zone.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.