- Bitcoin’s rebound sparks debate among investors like Tapiero and Novogratz on future prospects.

- Uncertainties remain about Fed cuts and regulations.

After bleeding in red for weeks, Bitcoin [BTC] appears to be recovering, as indicated by its recent price action. At the time of writing, BTC was trading at $62,150, reflecting a slight increase of 0.39%.

Notably, on the 14th of May, BTC also experienced a brief rally, surpassing the $63,000 mark before retracing slightly.

This recent movement in Bitcoin’s price has sparked considerable discussion and excitement across social media platforms.

Execs diverging views BTC

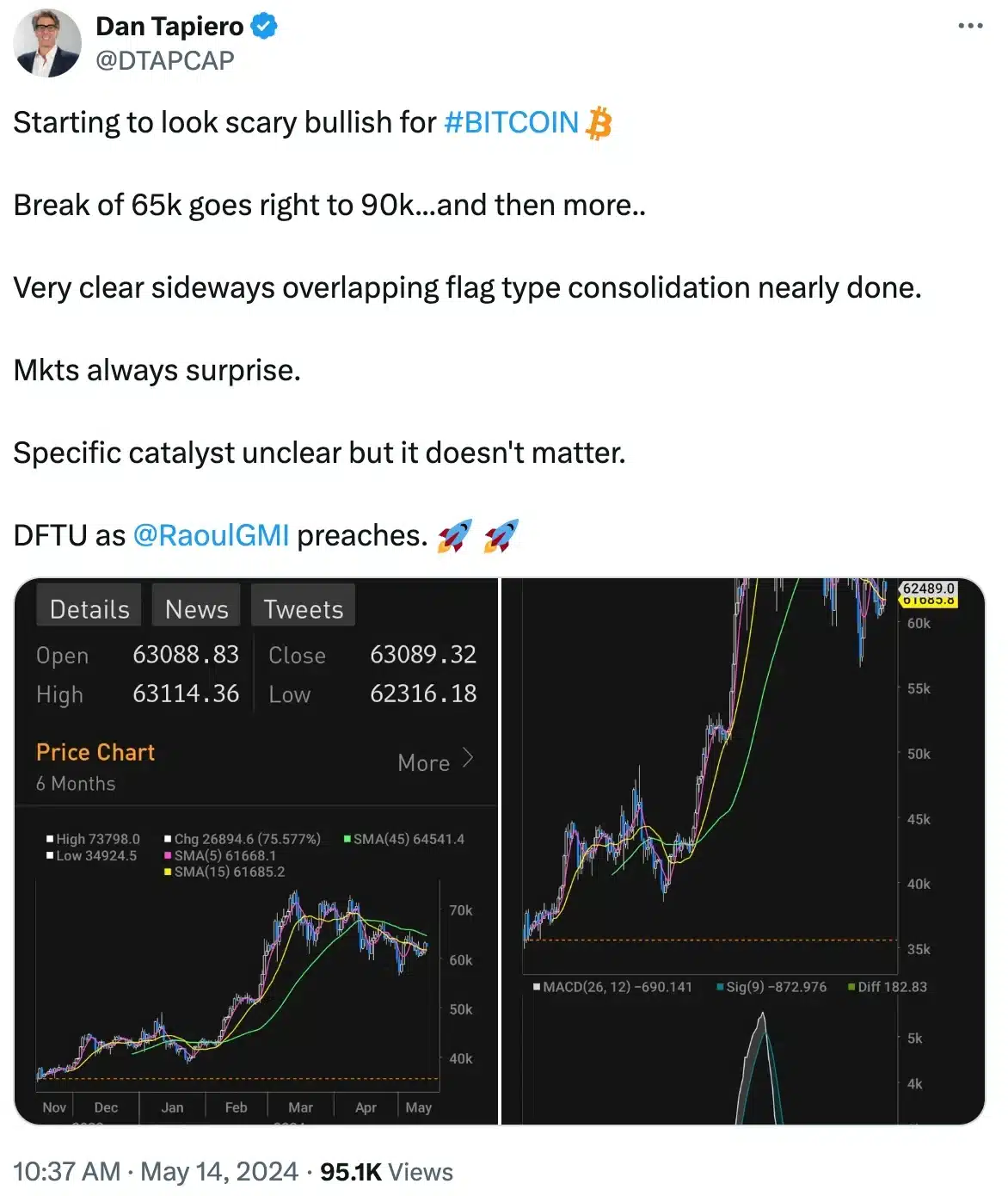

One prominent figure contributing to this discourse is Dan Tapiero, a macro investor and fund manager, who holds the belief that BTC is on the verge of achieving fresh all-time highs (ATHs).

Taking to X (formerly Twitter) he noted,

Source: Dan Tapiero/X

However, Galaxy Digital Holdings Ltd. founder Michael Novogratz predicts BTC will likely trade within a tight range this quarter as traditional finance continues to adopt crypto.

According to Bloomberg, Novogratz said,

“We are in the consolidation phase in crypto. Bitcoin, Ethereum, and everything else, Solana will consolidate, what does that mean?”

He added,

“It means probably somewhere between $55,000 and $75,000 until the next set of circumstances, the next set of market events bring us higher.”

Additionally, he attributed the previous all-time high of approximately $73,000 to the launch of US spot Bitcoin exchange-traded funds (ETFs) and the Bitcoin halving event.

Seeing the current market trend, he believes that the market has stagnated due to reduced optimism about potential Federal Reserve rate cuts, despite strong economic indicators.

Bitcoin dominance marks a milestone

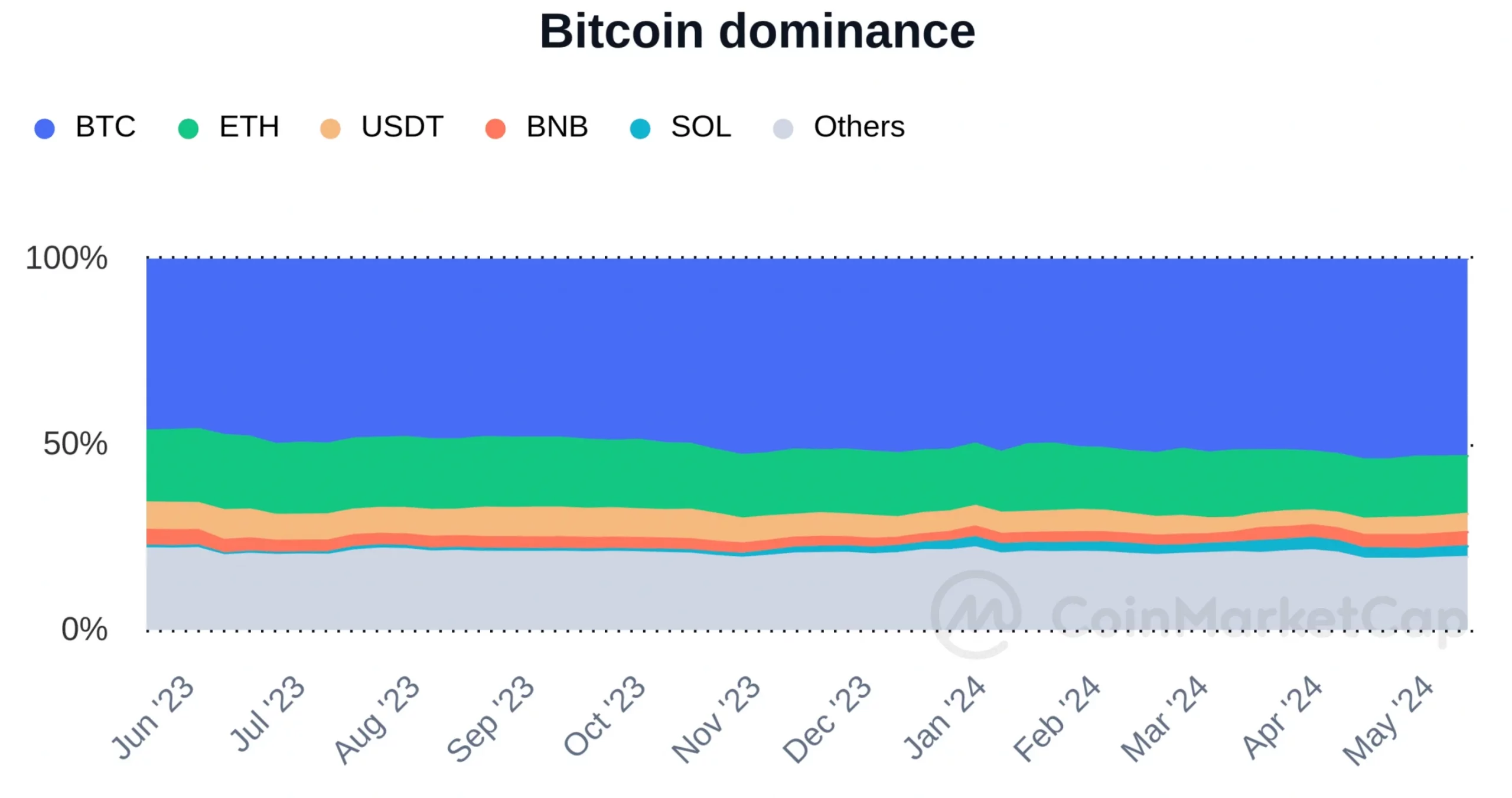

Well, this seems to be kinda untrue as despite fluctuations in BTC’s price, its market dominance has consistently remained above 50%.

According to CoinMarketCap data, Bitcoin currently accounts for approximately 51% of the total cryptocurrency market capitalization.

Source: CoinMarketCap

Hence, BTC’s price might break out of this consolidation phase if either the Federal Reserve starts cutting rates or the upcoming election brings clarity to the crypto regulatory landscape.

What lies ahead for Bitcoin?

In conclusion, while historical trends provide guidance, they do not guarantee future results. Thus, there is a huge probability of market fluctuations and sideways movements in the upcoming days.

And, if we go by Michaler Saylor’s words,

“There are thousands of pension funds in the United States managing ~$27 trillion in assets. They are all going to need some #Bitcoin.”