- Multiple flash crashes for BTC occurred across centralized exchanges.

- Sentiment around BTC declined, but price remained stable.

Bitcoin [BTC] has inspired hope from traders in the last few days due to its recent rally.

However, the tides could change soon against BTC’s favor, primarily due to the mishaps occurring on Centralized Exchanges (CEXes).

Some sudden crashes

More specifically, the sentiment around BTC could be impacted negatively due to flash crashes occurring on CEXes.

For context, flash crashes refer to sudden and extreme drops in the price of an asset or security, typically occurring within a very short period of time, often just a few minutes or even seconds.

During a flash crash, prices can plummet dramatically before quickly rebounding.

These events are typically triggered by rapid and large sell-offs, sometimes exacerbated by automated trading algorithms or liquidity shortages in the market.

In the last few weeks, the occurrences of flash crashes of BTC across various exchanges has grown.

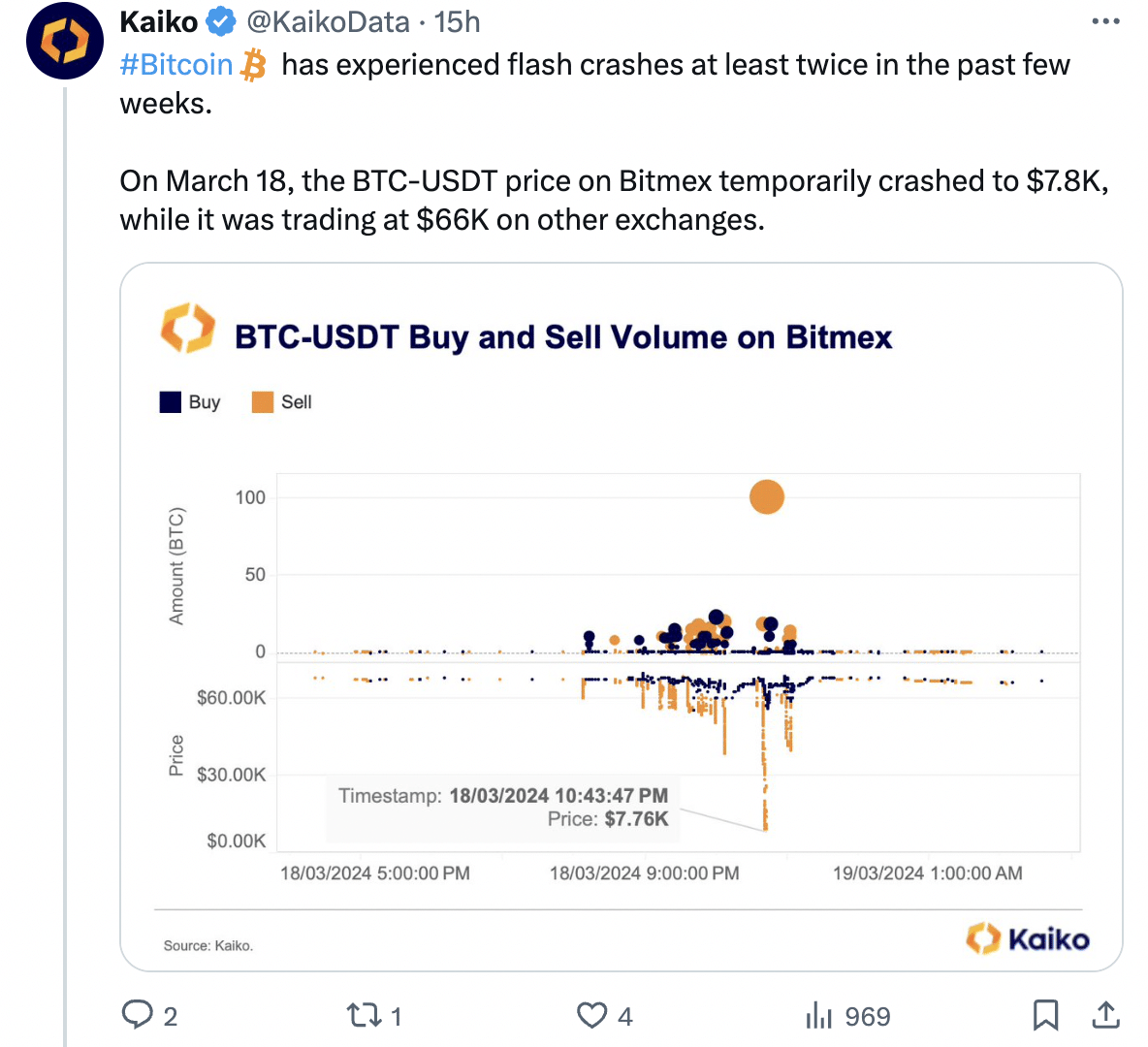

One of the instances of the flash crash occurred on the 18th of March, when the BTC-USDT price on Bitmex experienced a temporary crash to $7,800.

At this point in time, it was still trading at $66,000 on other exchanges.

In a recent post on X (formerly Twitter), the exchange attributed the sudden drop in prices to aggressive selling from a few accounts.

Numerous large sell orders, ranging from 10 to 20 BTC, were executed, including one exceptionally large order of 100 BTC, approximately valued at $6.6 million.

Another instance of this occurred in the European market where BTC-EUR prices on Coinbase fell from €63,000 to €48,000.

Source: X

Bad optics

These mishaps that have occurred on CEXes may contribute to a negative perspective around Bitcoin, especially amidst new market participants and retail investors.

Anyone who is new to the crypto sector may initially start their journey by buying a few blue chip coins such as BTC and ETH on their accounts.

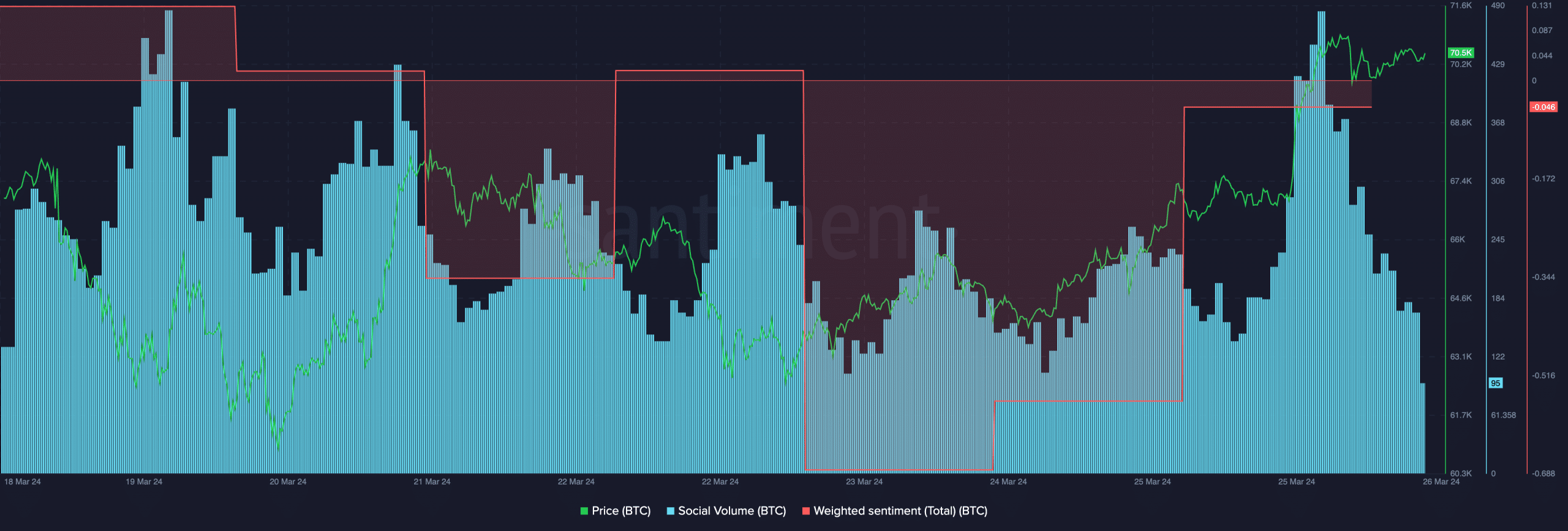

If price crashes occur for these coins, it could erode the trust of new users and deter users from venturing further into crypto. This negative perspective was further showcased by the Weighted Sentiment indicator.

Read Bitcoin’s [BTC] Price Prediction 2024-25

AMBCrypto’s analysis of Santiment’s sentiment data indicated that the negative comments around BTC had outnumbered the positive ones.

These factors could prove to be a hurdle to BTC’s rally, going forward.

Source: Santiment