- Bitcoin has recently dipped to $57,770, marking a 21% decline from its peak.

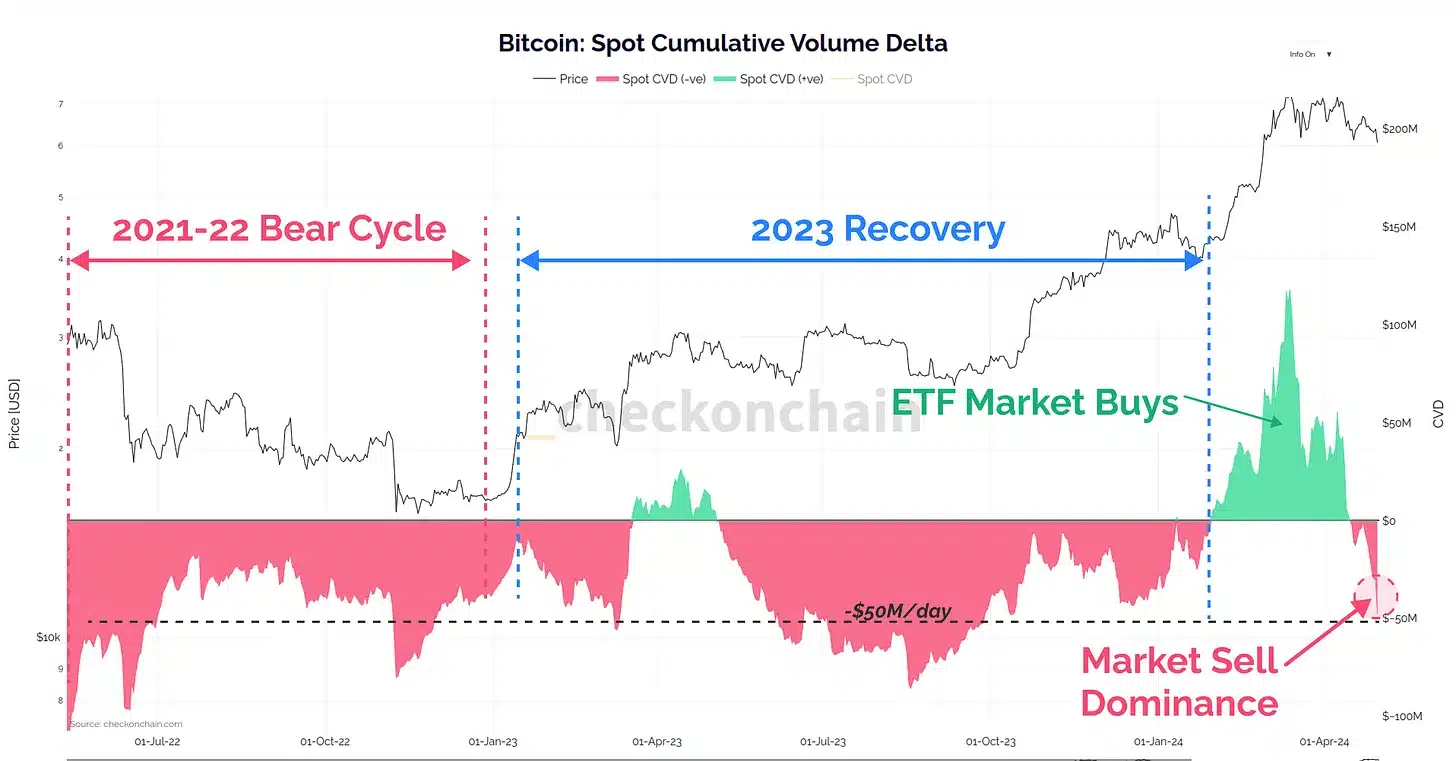

- There is a shift in BTC Cumulative Volume Delta (CVD) to sell side pressure.

The cryptocurrency market has recently witnessed significant volatility, with Bitcoin leading the downturn. Over the past week, Bitcoin [BTC] has seen a decline of about 21% from its March peak, which stood above $73,000, marking a considerable shift in market dynamics.

As of now, Bitcoin trades at approximately $57,770, continuing its downward trajectory with a slight 0.2% drop in the last 24 hours.

Market mechanics and the role of derivatives

James Check, an on-chain analyst, delved into the factors contributing to Bitcoin’s current bearish phase. In a detailed report, Check pointed out the similarities between the current market conditions and the 2021 crash. Back then, an excessive reliance on leveraged positions in futures contracts led to a sharp and painful correction.

This scenario seems to be somewhat different today. While there’s a noticeable increase in long-side liquidations, Check observes that the overall futures open interest isn’t alarmingly high compared to the market size, indicating that derivatives might not be the primary driver of the current sell-off.

Instead, Check suggests looking at the on-chain and spot market data for clearer insights.

He notes a significant shift in the Cumulative Volume Delta (CVD), which has swung into sell-side pressure, indicating that sell orders are outpacing buys by approximately $50 million per day.

This shift is a reversal from the heavy buying activity that accompanied Bitcoin’s ascent to its all-time high.

The ETF influence and future outlook

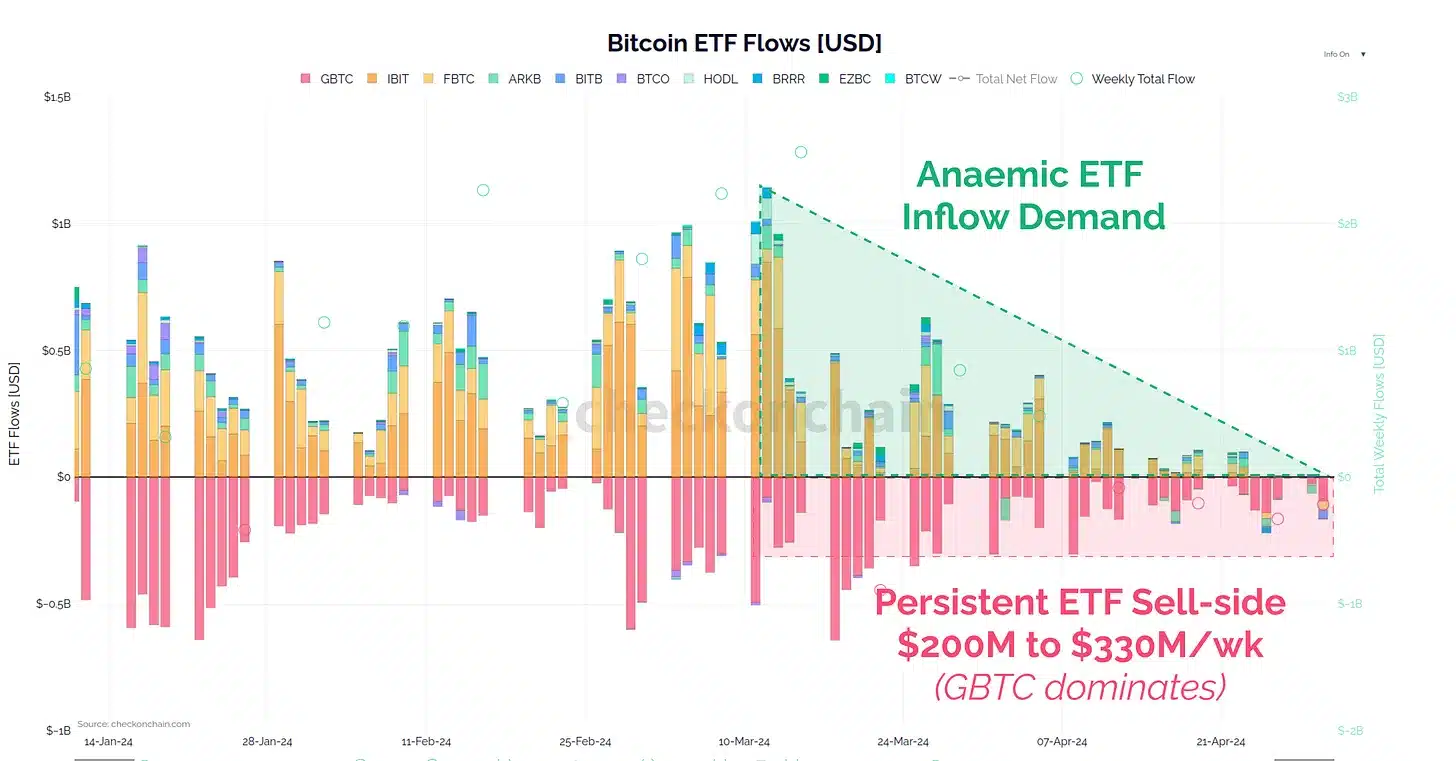

The market’s response to the recent ETF activity also sheds light on investor sentiment. Bitcoin ETFs have experienced subdued demand, with notable outflows in recent weeks.

The Grayscale Bitcoin Trust (GBTC) and other ETFs have seen a combined outflow of about $200 million to $330 million, suggesting a cooling interest among institutional investors.

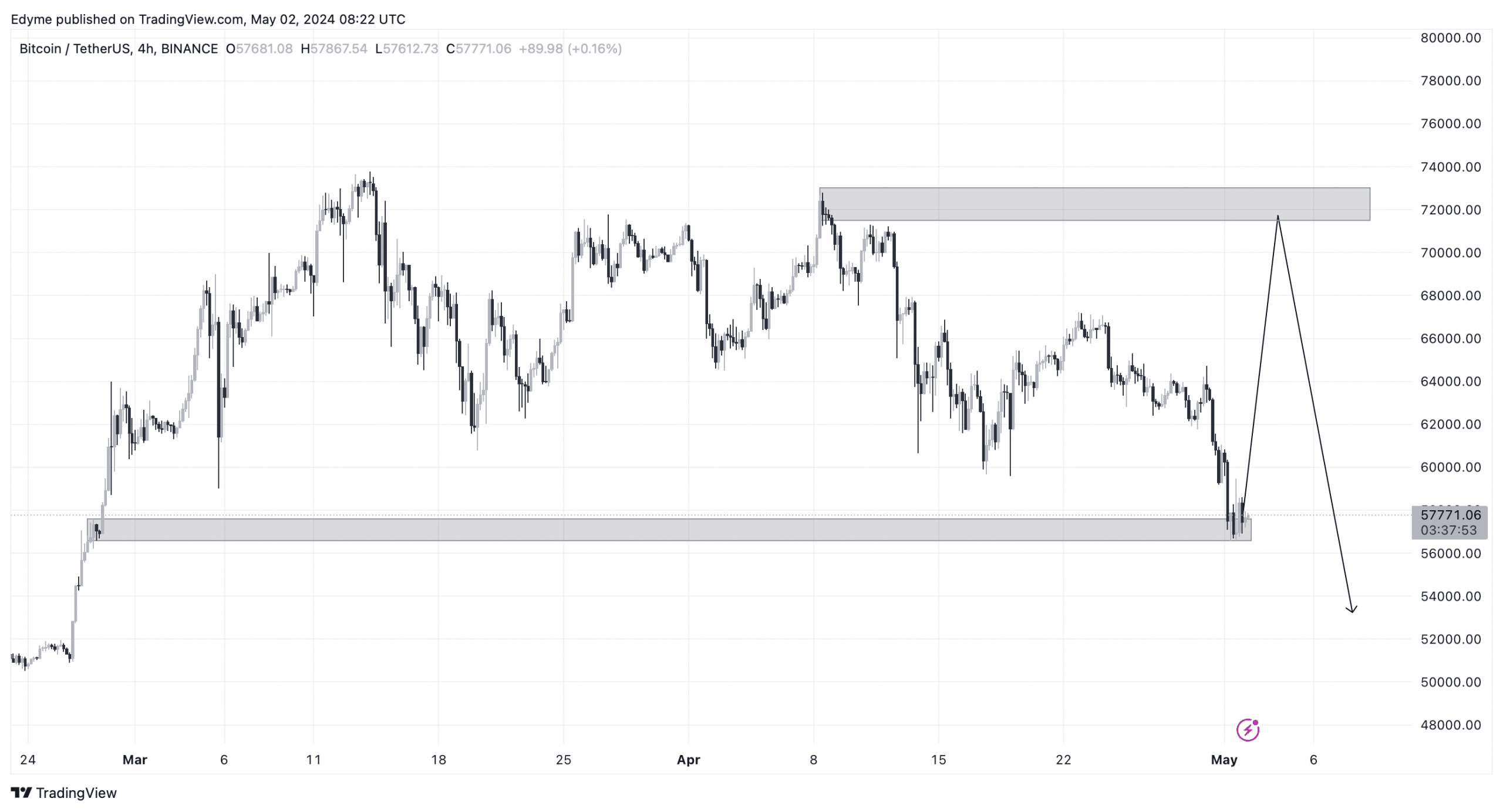

Despite the gloomy current outlook, there appears to be chances of a potential rebound. On the technical front, Bitcoin has broken structure to the downside.

However, on the 4-hour chart, it has encountered a critical support zone, specifically an order block, which historically has led to price rebounds.

Is your portfolio green? Check out the BTC Profit Calculator

Notably, this position could catalyze a temporary rally, allowing Bitcoin to gather more liquidity at higher levels before possibly continuing its descent.

Prominent analysts, including Michael van de Poppe echoes this rally side, suggesting that the market might be nearing a bottom. Van de Poppe highlighted that altcoins are beginning to show strength against Bitcoin, which often precedes broader market recoveries.