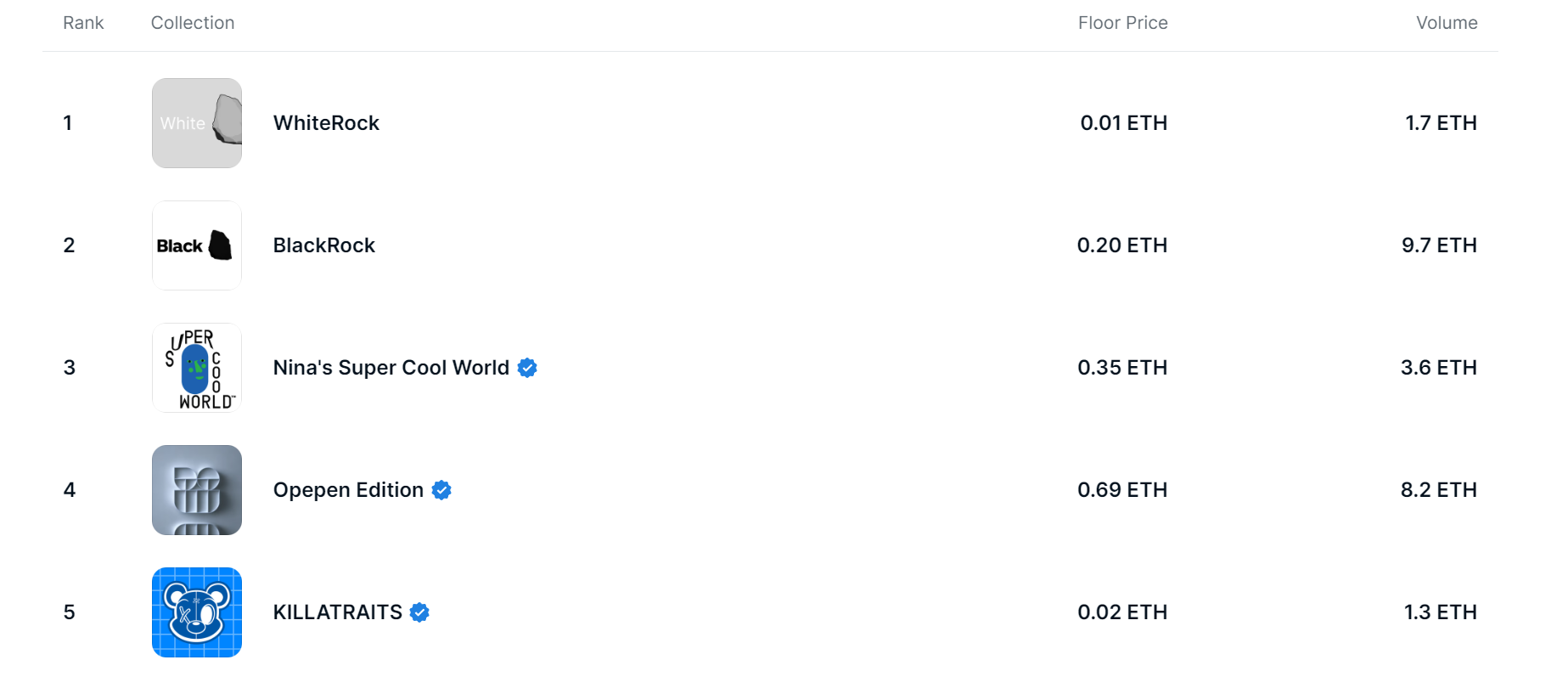

According to data on Opensea, WhiteRock is the number 1 collection, leading BlackRock, but BlackRock currently has a floor price 10 times higher (0.2 ETH compared to 0.01 ETH) and almost 6 times the volume. (9.7 ETH vs. 1.7 ETH).

Ranking of trending NFT collections. Source: Opensea

This boom is largely attributed to financial services giant BlackRock’s filing for a spot Bitcoin ETF with the U.S. Securities and Exchange Commission (SEC) on June 15.

The Securities and Exchange Commission (SEC) has rejected any application to establish a spot Bitcoin ETF. However, in the case of Blackrock, this time, the SEC approval rate for a Bitcoin ETF application is relatively high because of its careful preparation. Blackrock’s ETF application could serve as a key event in crypto 2023 and possibly beyond.

This event not only helps to keep the “rock” themes trending on NFT collections, but it also provides a great deal of optimism for companies that also offer wealth management services in the traditionally dynamic market to enter the promising Bitcoin market.

In less than a week, a series of large funds such as Fidelity, Citadel, Charles Schwab, Deutsche Bank, MasterCard, WisdomTree,… have all applied to open a spot Bitcoin ETF with the SEC and have caused BTC price to increase continuously since $26,000 to $30,200 in just 2 days, BTC price is up more than 20% this week.

7 days BTC price chart. Source: CoinMarketCap

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.