- BlacRock’s IBIT logs net zero inflows for two days straight as total outflows compound.

- Bitwise exec claims BTC price could hit $250K by the 2028 halving cycle.

For the first time since mid-January, BlackRock’s spot Bitcoin [BTC] ETF (IBIT) has netted zero daily inflows for the past two days.

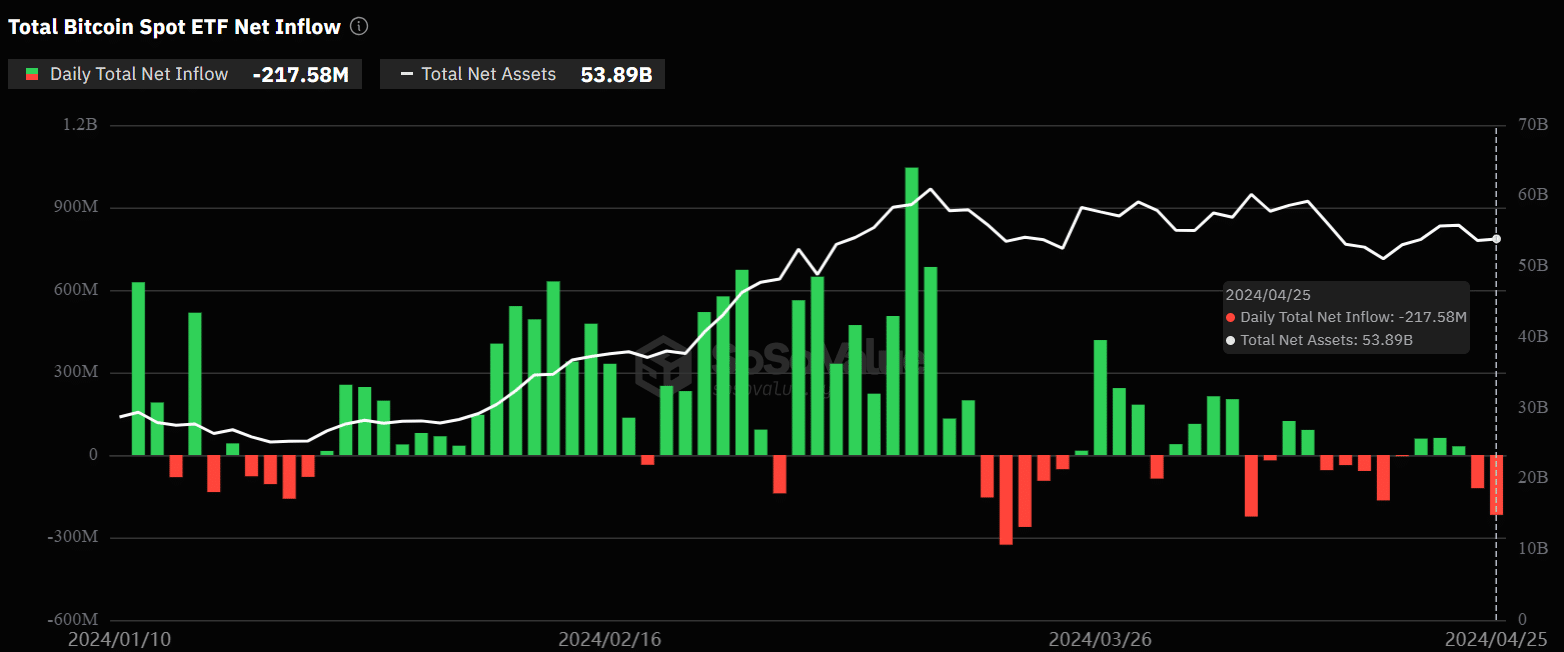

Over the same period, on 24th and 25th April, cumulative flows were negative, with total outflows amounting to $338.2 million per SoSo Value data.

Bitcoin ETF inflows

This has spooked market watchers as others shift focus to next week’s Hong Kong ETF debut and potential demand from other institutions like Morgan Stanley.

But a pseudonymous market analyst, Kamikaze Fiat, has downplayed such prospects, noting that,

“It took $12.5 billion of ETF inflows (and who knows how much native flows) to take BTC from $44K to $73K.

Do you think Morgan Stanley can find that many new BTC buyers? Do you think the HK ETFs will have more than $200m in first-month inflows? I think the below is crackpipe hopium.”

Will the decline in BTC ETF inflows reverse?

US spot BTC ETF flows have recorded a massive decline in Q2.

In Q1, the highest inflows occurred in February, worth $6 billion, followed by March at $4.6 billion. January saw $1.5 billion as the market tried to familiarize itself with the new products.

So far, in Q2, the April ETF inflows stood at $170 million as of 24th April. So, is the demand for BTC ETFs over?

Bitwise CIO Matt Hougan doesn’t think so. In a weekly memo to investment professionals, Hougan claimed that more inflows are feasible in the next few months.

Supporting his claims, part of the Hougan’s statement read,

“I think they’re (US spot BTC ETFs) just getting started. One reason why: ETFs are still not broadly available at national wirehouses like Morgan Stanley or Merrill Lynch. Institutions, meanwhile, are still beginning their due diligence. Both of these areas could represent major long-term sources of demand.”

Additionally, the Bitwise exec predicted extra demand could come from central banks before the 2028 halving and emphasized that,

“I think they’ll start buying Bitcoin before the next halving. Like gold, bitcoin is non-debt money—an asset whose supply can’t be expanded through borrowing. It also cannot be seized by a foreign government the way sovereign bonds can be (and have been recently)”

In such a mainstream adoption scenario, Hougan forecasts that Bitcoin could trade above $250K by the next halving event in 2028.

How will crypto react to next week’s US Treasury move?

In the short-term, BitMEX founder and Maelstrom CIO Arthur Hayes believes that a potential $1.4 trillion liquidity injection by the US Treasury could induce bullish momentum next week.

Referencing three possible scenarios during the next Q2 2024 Refunding announcement by the US Treasury, Hayes noted,

“If any of these three options happen (variable liquidity injections), expect a rally in stocks and, most importantly, a re-acceleration of the #crypto bull market.”

Quarterly refunding announcements are part of the US Treasury’s debt management policy changes, and the markets typically react widely to them.

It will be interesting to see how the next announcement affects Bitcoin into the summer.