Key Points:

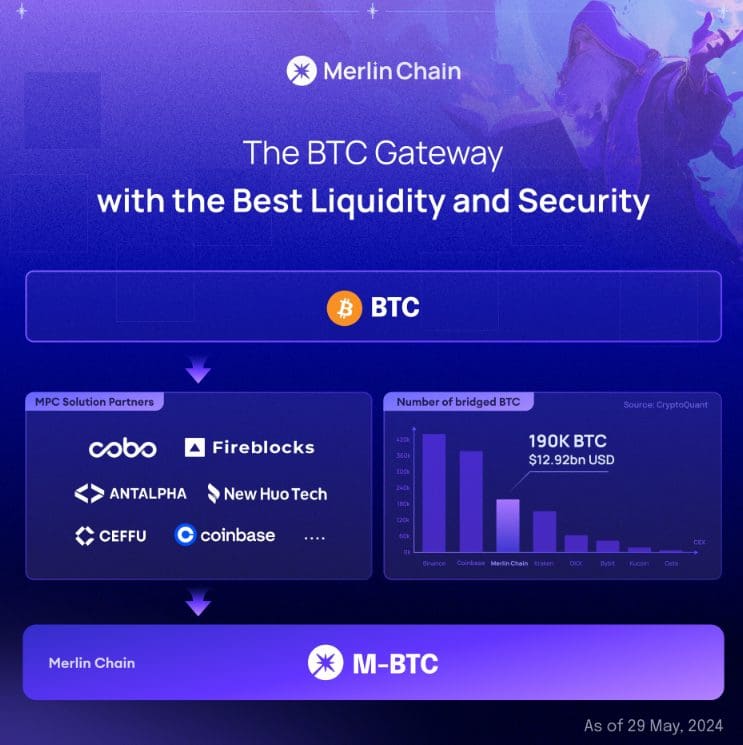

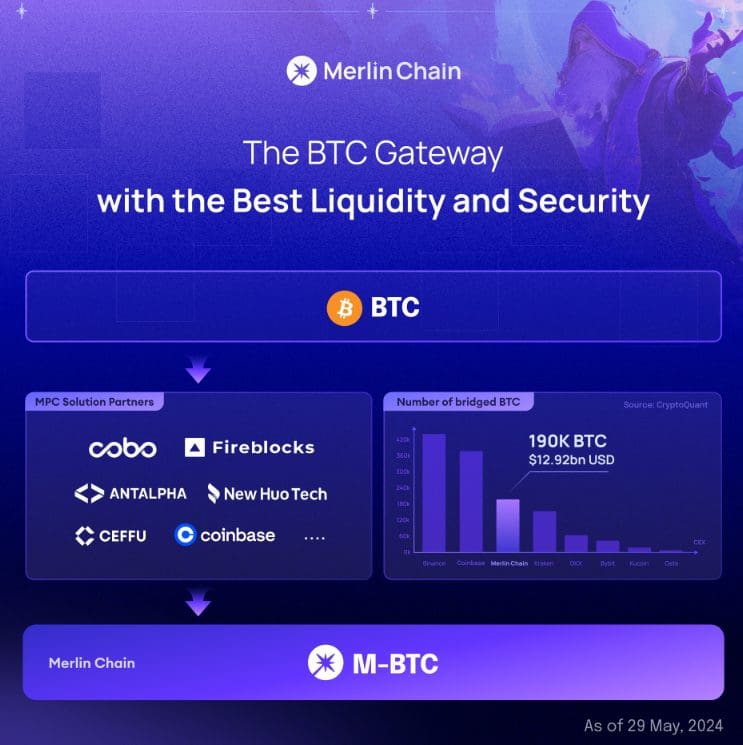

- Merlin Chain sees over 190,000 BTC transferred, totaling $12.9 billion, rivaling top exchanges like Binance and Coinbase.

- BTC converts to M-BTC and SolvBTC, with $630 million already flowing across 10+ public chains, enhancing liquidity and yield opportunities.

- With plans to integrate more public chains, Merlin Chain offers wider liquidity options and redefines DeFi accessibility.

Merlin Chain has witnessed an unprecedented surge in BTC transfers over the past 45 days.

With over 190,000 BTCs transacted, totaling a staggering $12.9 billion, Merlin Chain has emerged as a formidable player in the crypto landscape, trailing only behind industry giants Binance and Coinbase.

𝗠𝗲𝗿𝗹𝗶𝗻 𝗖𝗵𝗮𝗶𝗻 𝗶𝘀 𝗻𝗼𝘄 𝘁𝗵𝗲 𝟯𝗿𝗱 𝗹𝗮𝗿𝗴𝗲𝘀𝘁 𝗕𝗧𝗖 𝗵𝘂𝗯 𝘄𝗶𝘁𝗵 𝗺𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝟭𝟵𝟬,𝟬𝟬𝟬 𝗕𝗧𝗖 𝗯𝗿𝗶𝗱𝗴𝗲𝗱, 𝗷𝘂𝘀𝘁 𝗯𝗲𝗵𝗶𝗻𝗱 𝗕𝗶𝗻𝗮𝗻𝗰𝗲 𝗮𝗻𝗱 𝗖𝗼𝗶𝗻𝗯𝗮𝘀𝗲.

In the past 45 days, more than 190,000 BTC (over 12.9 billion USD) has… pic.twitter.com/RRpWrfFAUw

— Merlin Chain (@MerlinLayer2) May 29, 2024

The rapid ascent of Merlin Chain underscores its rising prominence among cryptocurrency enthusiasts seeking efficient and cost-effective solutions for BTC transactions. Surpassing leading centralized exchanges like OKX and Bybit, Merlin Chain’s decentralized infrastructure offers users a compelling alternative for managing their digital assets.

Innovative Tokenization Strategy Drives Liquidity Surge

Central to Merlin Chain’s appeal is its innovative approach to tokenization. BTC transferred across the network is converted into the second-layer mapping token M-BTC, a process that enhances liquidity and expands utility. Moreover, a portion of M-BTC is further transformed into SolvBTC, a multi-chain interest-bearing token, amplifying the potential returns for investors.

The network boasts over 5,275 M-BTC and 4,009 SolvBTC, collectively valued at approximately $630 million. These assets have seamlessly flowed into more than 10 public chains, including Ethereum, BNB Chain, Arbitrum, Manta, Mode, Linea, B^2, and Zk.link. This strategic diversification ensures enhanced liquidity across multiple ecosystems while catering to the diverse needs of users.

Merlin Chain aims to expand its footprint by integrating with additional public chains, thereby broadening the scope of its liquidity pool. By offering seamless interoperability and robust liquidity provisions, Merlin is poised to redefine the landscape of decentralized finance (DeFi), empowering users with greater financial autonomy and flexibility.