Blockchain

Key Factors:

The Layer 2 assault towards ecosystems on the whole, and Ethereum particularly, is extra intense than ever. Arbitrum has at all times been thought to be the highest Layer 2 resolution for Ethereum since its inception.

The venture has aimed to present buyers a community that’s cheap, fast, and scalable, all of which Ethereum is at present struggling with regardless of its Merge replace in September 2022.

Because of this, builders have rushed to Arbitrum to create decentralized apps (dApps), and it’s presently rated sixth in complete worth locked (TVL) by DeFi Llama.

There’s at present anticipation that it’ll subject its personal ARBI token, however customers are ready for the community affirmation.

Let’s have a look at Coincu and study why it’s at present a Layer 2 stronghold that even Optimism can’t beat.

What’s Arbitrum?

The Arbitrum community is a layer-2 characteristic created by the New York-based firm Offchain Labs to alleviate the congestion on the Ethereum community by enhancing how good contracts are verified.

The platform makes use of the Ethereum mainnet’s safety however permits good contracts to execute on a separate layer to alleviate community congestion.

This technique is named ‘transaction rollups,’ and it consists of batches of transactions and information which might be validated on the decrease layer earlier than being despatched to the mainnet of layer-1, on this case, the Ethereum mainnet.

Arbitrum intends to supply three scaling options: rollup (OPU), channels, and sidechains.

- State Channels: Customers should transmit an Ethereum Snapshot right into a Multi-sign Contract. This state will include essential data such because the tackle’s steadiness. A system of this kind allows free off-chain transactions with immediate completion and better privateness.

- Sidechains: Separate blockchains with their very own unbiased consensus guidelines the place Ethereum transactions could also be routed and monitored to alleviate the load on the Ethereum mainnet.

- Rollups: like refined non-custodial sidechains, can considerably enhance the Ethereum mainnet’s throughput capability. Optimistic Rollups, zkRollups, Plasma, and Validium are the 4 fundamental types of rollups recognized up to now in aggregation.

The Ethereum group is now centered on Arbitrum’s Rollup (OPU).

Arbitrum pays ETH to nodes who actively validate the chain’s good contracts (generally known as aggregators), and they’re in command of including blocks to the primary tier – the Ethereum mainnet.

How does it work?

Arbtrium is a venture that makes use of Optimistic Rollups know-how.

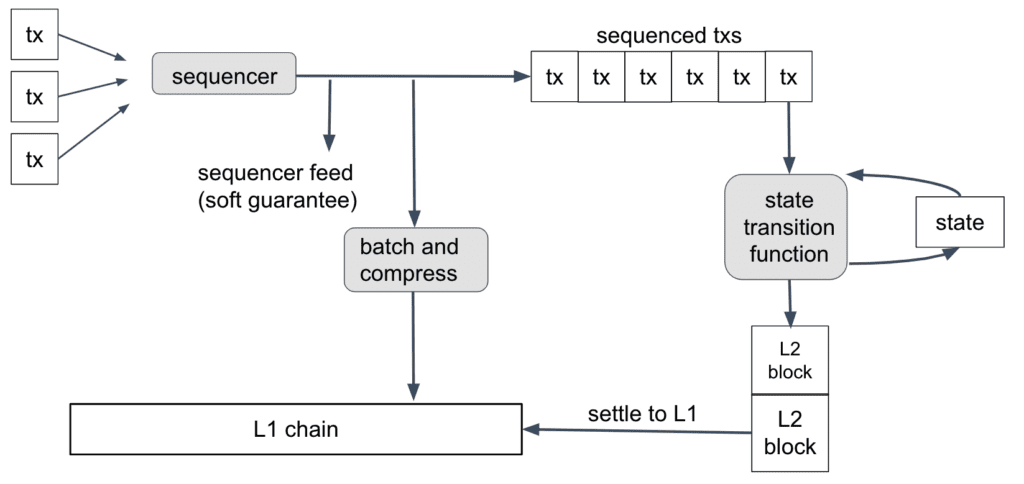

Rollups are a type of off-chain transaction processing that entails taking transactions produced on the primary blockchain exterior and processing them on a separate Rollups layer, after which the information and transactions are bundled or “rolled up” right into a single block to transmit to Layer 2 for certification.

This resolution allows Ethereum good contracts to scale by exchanging messages between Ethereum good contracts and layer 2 Arbitrum good contracts. The majority of transaction processing happens on layer 2, with the outcomes recorded on the primary chain significantly enhancing velocity and effectivity.

Arbitrum, like many different blockchains, permits unbiased nodes to take part. Validator nodes monitor the chain’s standing, whereas full nodes help within the aggregation of layer 1 transactions. When the remainder of the person’s transaction charges are dispersed to different community individuals, corresponding to validators, aggregators that transmit transactions to layer 1 will get incentives paid in ETH.

Arbitrum provides a difficult stage for rollup blocks, permitting different validators to guage the accuracy of a block and subject a problem whether it is incorrect. If the block is proved to be misguided or a problem is confirmed to be unjustified, the dishonest validator’s stake will likely be taken, making certain validators at all times play pretty or face the penalties.

The Arbitrum digital machine (AVM) is the platform’s personal distinctive digital machine. That is the execution surroundings for Arbitrum good contracts, and it’s constructed on prime of EthBridge, which is a set of good contracts that join with Arbitrum. Good contracts written in Ethereum are instantly translated to function on the AVM.

Highlights of the venture

Arbitrum’s “multi-round rollup” approach dramatically reduces the price of Fraud Proofs. The venture seeks a low-cost resolution with a broad software (assist for extremely advanced txns).

Fully appropriate with the Ethereum digital machine (EVM), experience with good contracts on L1, and compatibility with ETH instruments. Arbitrum can also run EVM code instantly, eliminating the necessity to recompile good contracts.

Arbitrum additionally has a sooner asset withdrawal time than different Rollup options.

By growing a layer 2 resolution, the Arbitrum growth staff is aiming to decrease entry limitations. Because of this, they’ve ready intensive growth documentation for Arbitrum, and builders could start using the present Ethereum device.

Ecosystem

Instruments

Many instruments recognized to Ethereum builders, most of that are accessible on Arbitrum, have been built-in with featured platform initiatives.

Pockets

dApps

Bridge

Challenge growth

Arbitrum now ranks 1st amongst Ethereum’s layer-2s, with a complete worth of TVL keys within the protocol at roughly $3.6 billion. Considerably, TVL on Arbitrum outperforms Optimism, which is in second place.

The principle motive for the big hole between the 2 initiatives is perhaps attributable to retroactive. After the introduction of the token by Optimism, a flood of DeFi cash returned to Arbitrum in quest of the subsequent likelihood.

Aside from the explanations said above, this ecosystem can also be extremely strong with an extended interval to get into operation, and the items and objects on Arbitrum are additionally fairly diversified, helping this layer-2 in attracting money circulation swiftly.

There are different distinctive Layer-2s scaling choices for Ethereum, however on the time, Polygon is the one platform formally mainnet, and Ethereum’s extreme congestion has positioned Polygon in a stronger place than ever, which Polygon has additionally taken use of. However every little thing has modified now.

In response to money circulation statistics between Ethereum and layer-2, Polygon now has the best market share with round 52.7%, adopted by Arbitrum (21.2%) and Optimist (16.9%). As will be noticed, the money circulation nonetheless favors Arbitrum above the opposite new Layer-2s.

Arbitrum’s backers embrace two business leaders in enterprise capital: Coinbase Ventures and Pantera Capital. Concerning the Ecosystem, the chain has a ample variety of very important parts. These are the elements driving its growth.

Conclusion

Arbitrum is a promising proposal that is perhaps realized within the close to future. On the similar time, the venture has made its preliminary steps by collaborating with a number of vital business companions to include these initiatives into layer 2.

However, this venture is at present a piece in progress. The ecosystem has numerous basic parts, nonetheless, they’re merely folks variations with little funding in growing items and customers. Furthermore, Arbitrum doesn’t but have its personal venture token. So it’s nonetheless new and has a number of room to broaden.