- Cardano takes advantage of upper hand in lower fees compared to rival Ethereum.

- ADA slips below key support level after struggling to find bullish momentum.

The crypto market is currently at a stage where a network’s weakness may pave the way for another to thrive. The rivalry between Ethereum and Cardano is perhaps an ideal example of this, with the latter undercutting the former’s user base.

How many are 1,10,100 ADAs worth today

Cardano is one of the top blockchain networks that is currently benefiting from the rising Ethereum gas fees. Investors are reportedly switching to the likes of Cardano which is a more cost-efficient network largely thanks to one key weapon in its arsenal. Cardano’s hydra upgrade made the network more scalable.

Ethereum Gas Fees Skyrocket – Investors Flock to Cardano #Cardano #cardanofeed #ADA #crypto #cardanocommunity #bitcoin #CoinMarketCap #blockchain #cryptocurrency #CardanoADA #btc $ADAhttps://t.co/VOJSbAmDBy

— Cardano Feed ($ADA) (@CardanoFeed) May 9, 2023

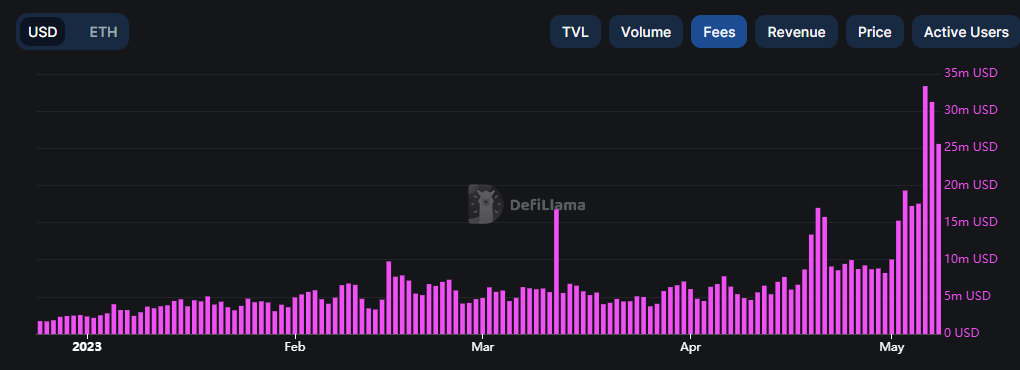

Here’s a comparison of the fees collected on both networks. Ethereum fees have been growing exponentially in the last few days. This growth has partly been linked to increased network congestion due to the memecoin hype.

Source: DeFiLlama

Meanwhile, Cardano fees stood pale in comparison to Ethereum. While ETH fees recently peaked at $35 million, Cardano fees recently peaked at slightly above $13,000.

Source: DeFiLlama

Granted, the number of users on Cardano was much lower than those on Ethereum. Nevertheless, the fee surge on Ethereum still underpins a major downside as far as fees are concerned, hence the growing preference for Cardano.

Let’s look at other areas that underscore the growing preference for Cardano. Its daily active addresses have been growing in the last seven days confirming more network activity. Its social dominance metric registered increased excitement especially on 9 May, the same day that Ethereum gas fees peaked.

Source: Santiment

ADA bears prevail despite improving prospects

ADA has been lending favor to the bears for the last few days. It has notably been slipping below an ascending support line after failing to secure enough bullish momentum to support a pivot. As such, the growing wave of adoption has not been robust enough to shield ADA from the bears.

Source: TradingView

Will the selling pressure continue? ADA’s Money Flow Index (MFI) reverted to the downside in the last few days but at press time, it rested on its midpoint where it was likely to pivot. However, supply distribution still indicated mixed activity among the top addresses.

Is your portfolio green? Check out the Cardano Profit Calculator

Whales in the 10 million to 100 million range are worth keeping an eye on because they contributed most of the selling pressure. The same whale category leveled out in the last few days, indicating that the bulls might have a chance at redemption.