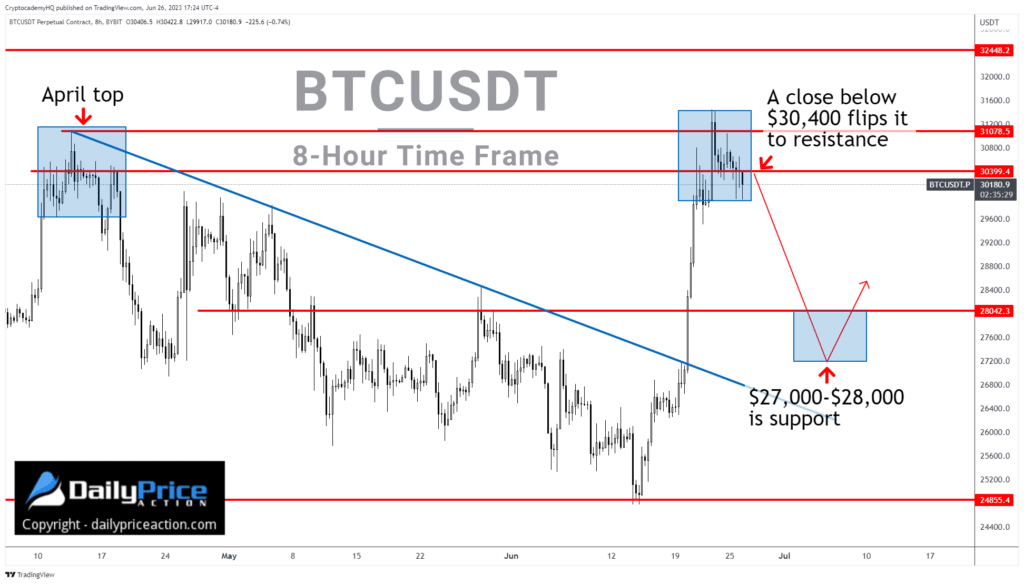

A closely followed crypto analyst is warning that a Bitcoin (BTC) correction may be looming after the crypto king’s strong performance last week.

In a new blog post, trader Justin Bennett says that BTC launched an “impressive” rally since June 15th, surging by about 25% in just less than two weeks.

However, Bennett says that Bitcoin may soon give up some of its gains as he believes the crypto king does not give free rides to those who were late to hop on the rally.

“If so, a pullback into the $28,000 area to flush late BTC longs seems likely.

How the Bitcoin price action develops at $27,000-$28,000 if and when tested will determine where BTC trends in July.”

According to the crypto strategist, his short-term bearish view would be invalidated if Bitcoin manages to take out its immediate resistance at $31,000.

“Alternatively, a sustained break above $31,000 would suggest bulls remain in control and expose $32,500.”

At time of writing, Bitcoin is trading for $30,802.

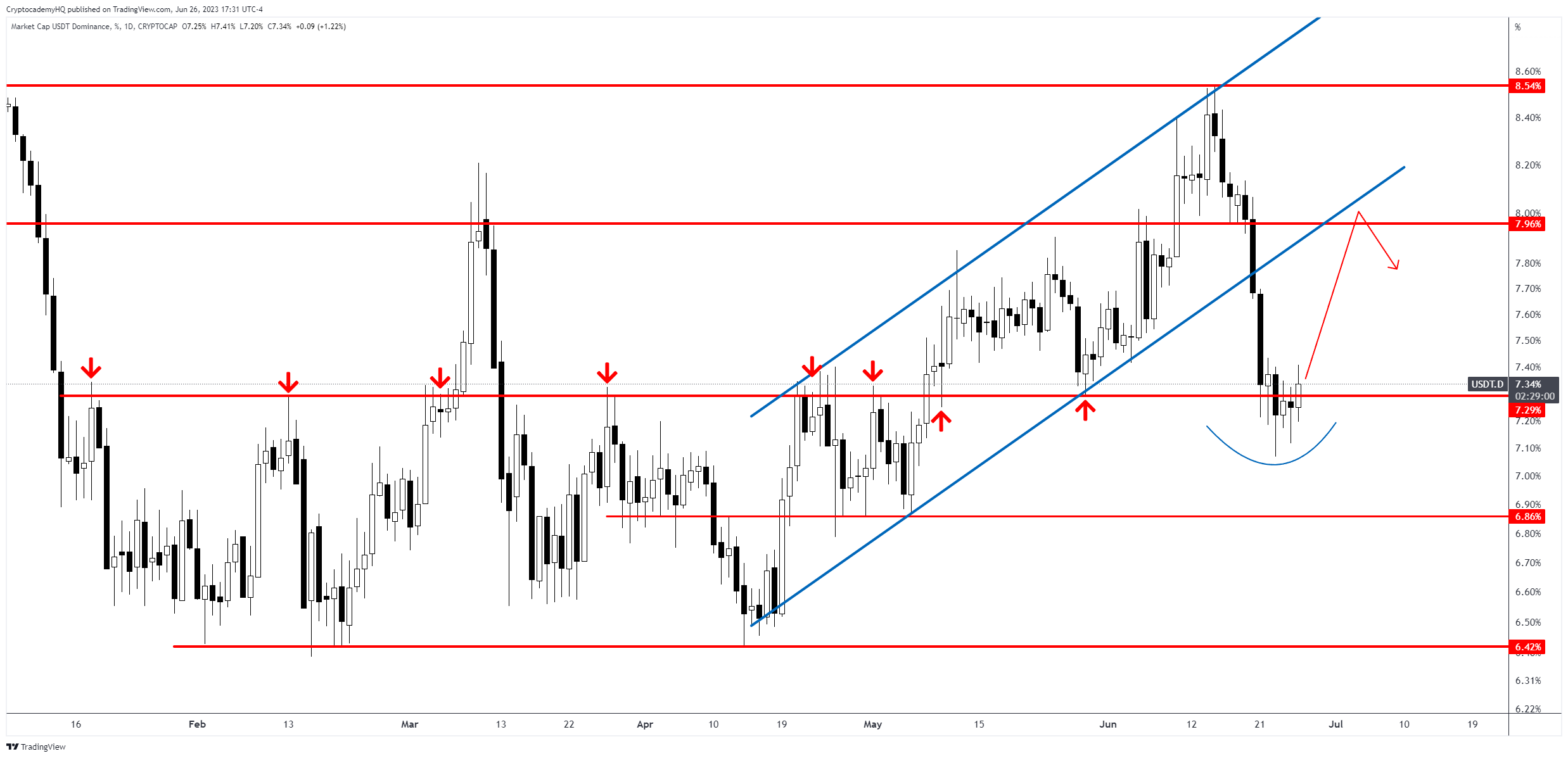

Bennett is also keeping an eye on the Tether dominance chart (USDT.D), which tracks the percentage of capital in crypto stored in the stablecoin USDT. Traders monitor the Tether dominance chart as bullish moves suggest that market participants are unloading their crypto stacks to protect the value of their capital in stablecoins.

Bennett tells his 112,400 Twitter followers that a move above the 8% level for USDT.D could put BTC at risk for a significant correction.

“Watch for a move to the 8% handle, equaling an approximate 10% pullback for Bitcoin.”

At time of writing, USDT.D is hovering at 7.23%.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney