A closely followed crypto strategist says that Bitcoin (BTC) is giving off a bullish reading that has previously preceded a massive surge in price.

Pseudonymous analyst Cheds tells his 314,800 followers on the social media platform X that Bitcoin’s relative strength index (RSI) indicator on the weekly chart is now in “overbought” territory.

The RSI is a momentum indicator that traders use to spot trend continuation or reversal.

Cheds says that when Bitcoin flashed the same signal in October 2020, Bitcoin skyrocketed and printed gains of more than 5x.

“Observation:

BTC weekly RSI entering power zone (70+, also known as overbought).

Overbought = bullish.

The last time this happened the price ran from $12,000 to $64,000.

Though the price context is different, it is worth observing.”

Traditionally, an overbought asset suggests that it is trading well above its fair value and investors tend to think that a correction is in sight. However, Cheds argues that the opposite applies to Bitcoin.

“Overbought means bullish. The only way to become overbought is to be bullish, and trends tend to continue. Most of BTC’s biggest price gains historically have come while ‘overbought’ for what it’s worth.”

At time of writing, Bitcoin is trading for $37,002.

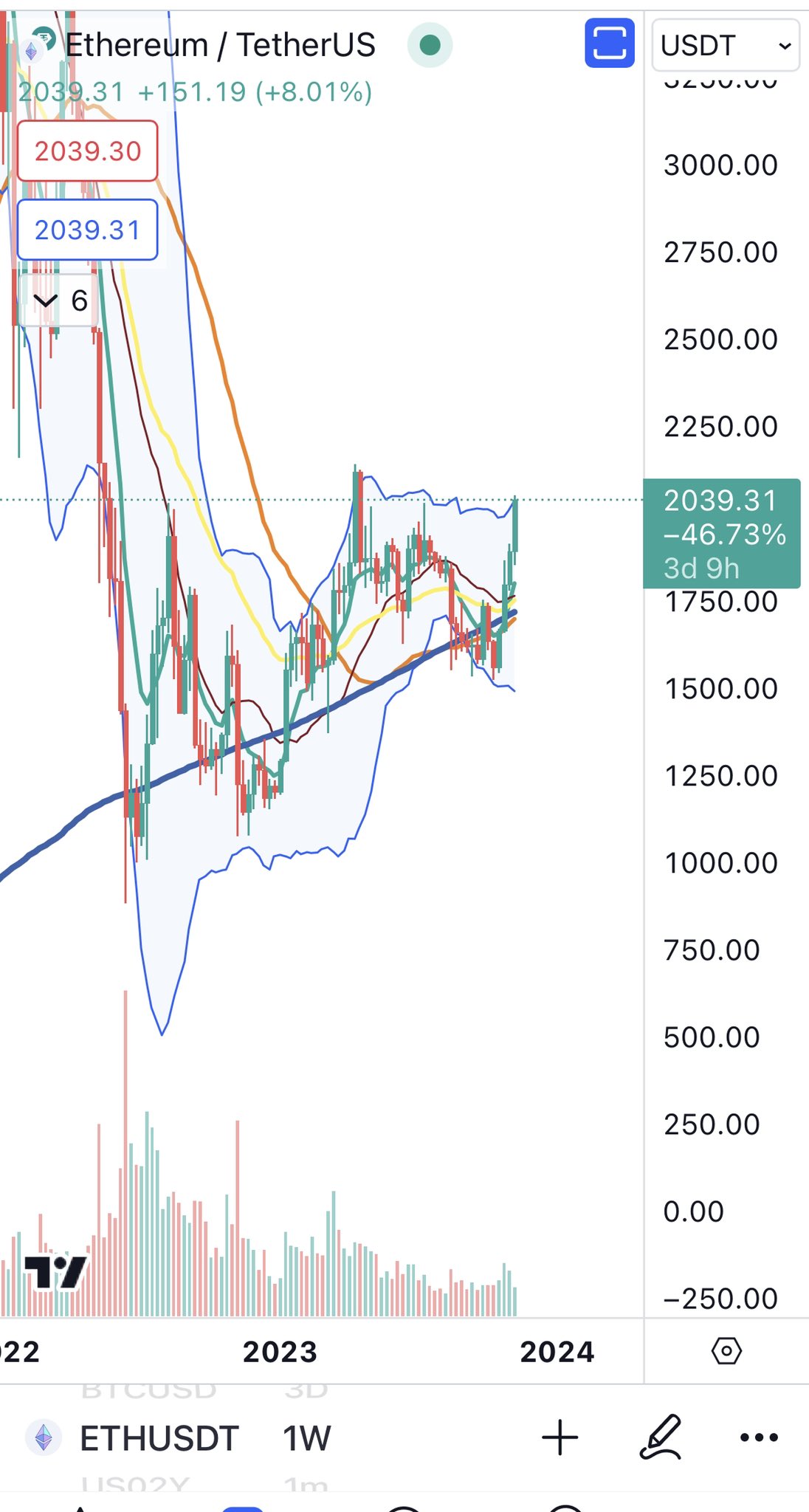

Looking at the smart contract platform Ethereum (ETH), Cheds says that bulls will likely start to flex their muscles once the second-largest crypto by market moves above as key price level.

“ETH sideliners can use a break and hold of $2,150 area as a long thesis.”

At time of writing, Ethereum is worth $2,037.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney