The CoinMarketCap cryptocurrency community price estimate is based only on the votes of its users. Estimates do not guarantee end-of-month prices.

The value of XRP has recently faced bearish sentiments, resulting in a loss of the crucial $0.50 support level. This decline can be attributed to the overall market conditions, with XRP remaining in the spotlight due to the ongoing lawsuit between Ripple and the Securities and Exchange Commission (SEC).

Given the legal dispute and the high stakes involved, XRP’s price has become a topic of speculation in the broader cryptocurrency market, with market players offering different possible scenarios.

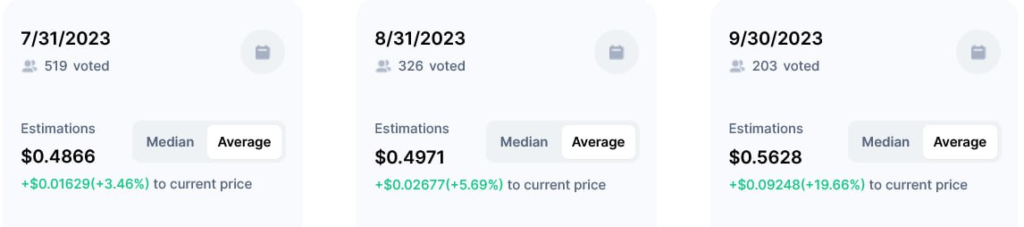

For instance, on the cryptocurrency monitoring platform CoinMarketCap, members of the XRP community anticipate that the token will end in July 2023 with a slightly positive performance compared to its current valuation. At the time of writing, with 519 votes, community members project that XRP is likely to trade at an average price of $0.4866 on July 31, representing a gain of over 3% from the current price.

The community also expects the bullish momentum to persist in the coming months. By the end of August, with 326 votes, members project a gain of over 5% for XRP, reaching a potential price of $0.49. Additionally, 203 members anticipate a resurgence to the $0.50 position, with XRP trading at $0.5628, reflecting gains of nearly 20% from the current price.

Notably, the community members have an average historical accuracy of 91.7% over six-month. The highest accuracy rate, reaching 99.06%, was recorded in April 2023.

XRP price analysis

At the time of writing, XRP was trading at $0.47, showing consolidation of the asset in recent days with gains of less than 0.5% in the last 24 hours. However, on the weekly chart, XRP has experienced a decline of over 2%.

Meanwhile, the one-day technical analysis retrieved from TradingView indicates predominantly bearish signals for XRP. The sentiment summary is at a ‘sell’ rating of 13, with moving averages suggesting a ‘strong sell’ at 11. Oscillators also indicate a ‘sell’ sentiment at 2.

Despite the bearish outlook, on-chain data aggregator Santiment on July 7 indicated that XRP and ADA are likely to rebound following the recent market sell-off. The increased selling pressure and lower prices of XRP and ADA have created favorable conditions for potential price recovery, according to Santiment.

XRP price catalysts

Currently, the ongoing legal case between Ripple and the SEC remains the primary catalyst influencing the price of XRP. The SEC has sued Ripple, alleging the sale of unregistered securities.

In this context, a favorable outcome for Ripple is seen as a bullish sentiment for XRP, while an unfavorable outcome has the opposite effect. Despite the potential repercussions of the case, XRP has demonstrated resilience and emerged as the third most traded cryptocurrency in Q2 2023.

As the community awaits the summary judgment date, various scenarios are being considered by the involved parties. For instance, Pro-XRP attorney John Deaton believes that a victory for the SEC would not benefit XRP holders, potentially leading to a prolonged unresolved status quo lasting two to five years.

Alternatively, if Ripple appeals the case to the Supreme Court, the lawsuit could extend by another two to five years. Nonetheless, Deaton is confident that Ripple would prevail in this scenario.

Read also: How to Buy XRP in 2 Minutes

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.