- Trading volumes on crypto exchanges declined for the third month since March.

- Institutional interest in ETH dropped significantly in June, per CME data.

Crypto exchange trading volumes tanked further in June, maintaining a trend that started after March 2024.

Per the CCData report, combined trading volumes dropped for the third consecutive month, declining by 21.8% to $4.22 trillion.

The report attributed the decline to the overall sideways movement and losses for the leading assets, Bitcoin [BTC] and Ethereum [BTC].

‘The combined trading volume fell 21.8% to $4.22tn, as major crypto assets including Bitcoin and Ethereum remained largely rangebound and recorded major drawbacks in June.’

ETH drops harder than BTC as spot eats into derivatives market

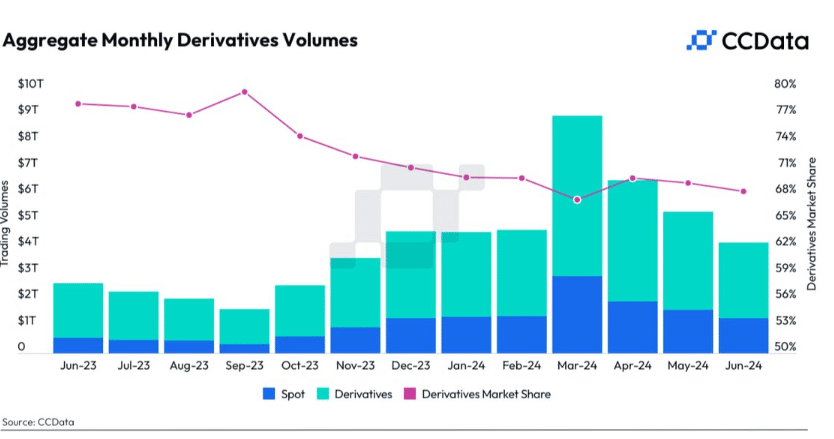

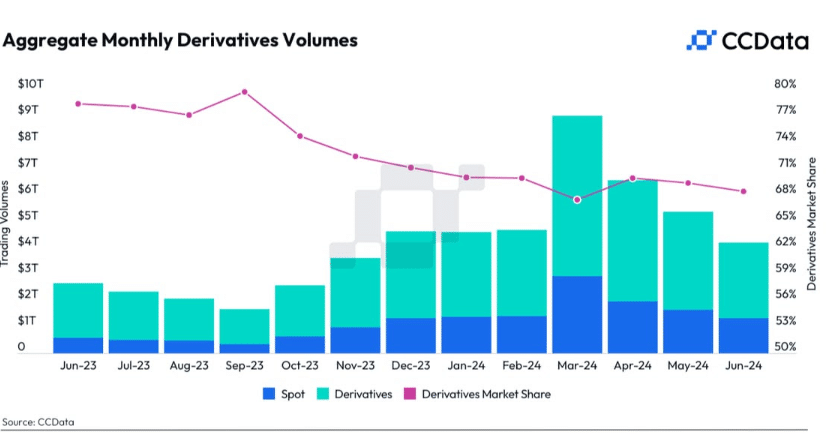

Derivatives trading volume dropped more than the spot sector in June. Per the report, spot trading volume declined by 19.3% to $1.33 trillion.

This was also a three-month consecutive drop from a record high of $2.94 trillion in March.

However, the decline was more pronounced in the derivatives market. Derivatives volumes were down 22.8% to $2.89 trillion. On the spot vs. derivatives volumes, the report read,

‘Derivatives volumes have also been declining relative to spot volumes, as evidenced by the declining market share of derivatives instruments. The derivatives market now represents 68.5% of the entire crypto market (compared to 70.1% in January).’

Source: CCData

The decline was also reflected by a significant drop in liquidity within the derivatives market, as tracked by open interest (OI) rates.

In June, a nearly 10% drop in OI was recorded, with Coinbase taking the largest hit due to massive liquidations.

‘The open interest on derivatives exchanges declined by 9.67% to $47.11bn, following a series of liquidations triggered by a significant drop in cryptocurrency prices observed in June and continuing into July.’

Coinbase’s OI dipped 52.1% to $18.2 million. However, despite a 9.93% drop in OI for Binance, it topped with $19.4 billion in open interest among centralized exchanges.

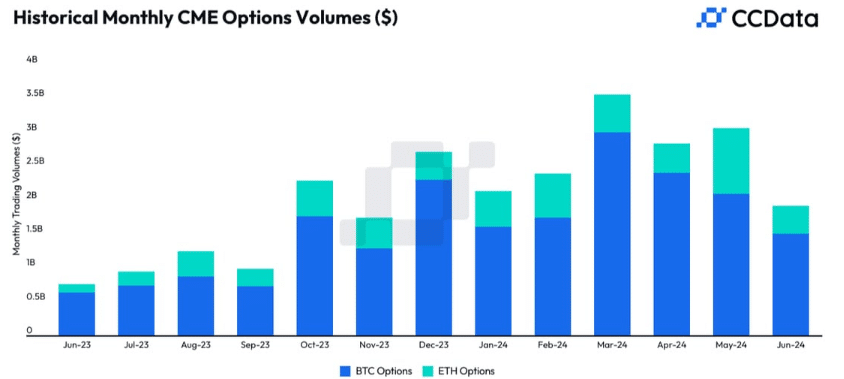

June drawdowns also wiped out considerable options volumes that surged in May, especially for ETH after surprise ETH ETF partial approvals.

CME data showed institutional interest in ETH, based on options volume, dropped significantly in June.

‘BTC options volume on the exchange fell significantly in June, decreasing by 28.2% to $1.50bn. ETH options volume experienced an even larger decline, plummeting by 58.0% to $408mn.’

Source: CCData

However, analysts have tipped the final approval and launch for ETH ETFs next week. It could bolster the trading volumes across the spot and derivatives market.

But it remains to be seen how the market will react to this development.