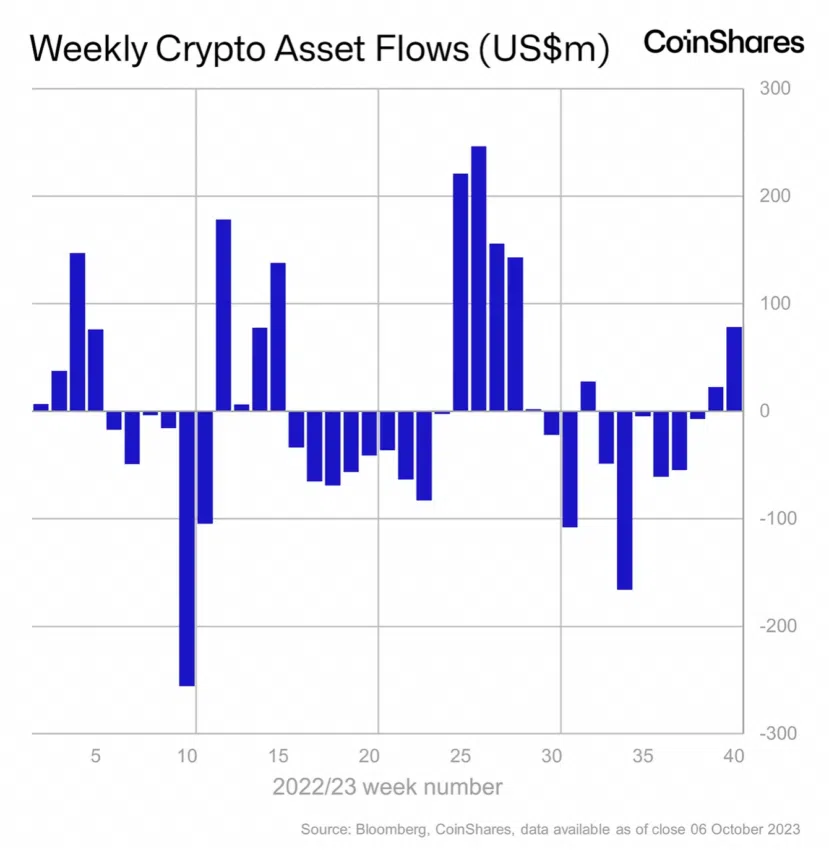

Crypto assets attracted $78 million in inflows last week, marking a 3.7-fold increase compared to the prior week, which saw only $21 million in inflows.

“Digital asset investment products saw inflows for the second week totalling US$78m, while trading volumes for ETPs also rose by 37% to US$1.13bn for the week,” CoinShares declared.

Crypto Inflows on the Rise Despite Lacklustre Ethereum ETF Launch

According to a recent report by Coinshares, crypto inflows experienced their most significant surge since July over the seven consecutive days from September 30th to October 6th.

However, it noted that last week’s launch of Ethereum Futures-based exchange-traded funds (ETFs) fell short of the anticipated significant market impact:

“The Ethereum futures ETF launches in the US attracted just under US$10m in the first week, highlighting a tepid appetite.”

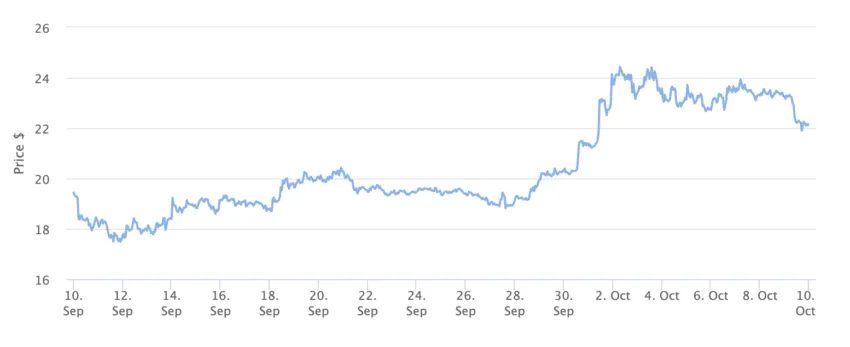

On the other hand, Solana witnessed a rapid surge in inflows, achieving its highest levels since March 2022. It recorded weekly inflows of $24 million, solidifying its position as the “altcoin of choice.”

At the time of publication, Solana’s price is $22.15.

Just last week, it marked crypto inflows for the first time in six weeks, amounting to $21 million.

In the preceding week, there were outflows totaling $9 million. According to CoinShares, European investors reportedly contributed $16 million in inflows during this week, while US investors withdrew $14 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.