TL;DR

Full Story

It’s ok.

You can say it.

We’re fully aware of it:

We get weirdly excited about crypto integrations within legacy payments systems.

Why? Because right now (for the most part) crypto is building outside of the existing system. That is to say, it doesn’t play nice with established infrastructure.

It’s hard to buy with a credit card, banks don’t like you moving money to exchanges, and you need to learn a whole bunch of terminology when starting.

(E.g. ‘gas fees’ = ‘transaction fees’ — why? No idea).

Glass half empty:

This separation from existing systems is a weak point for web3 & crypto.

Glass half full:

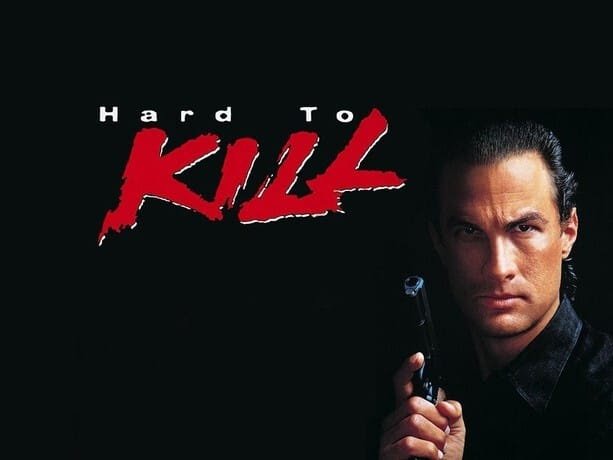

The more legacy systems that rely on crypto, the harder it will be to kill.

Hence our excitement about this latest development:

Mastercard is joining U.S. banking giants (including: Citi, JPMorgan, and Wells Fargo) to develop distributed ledger technology for banking payments using tokenization.

Translation: banks want to start using/relying on crypto rails to process their payments.

Which means:

-

Crypto will become harder to kill.

-

(Theoretically) this should make buying crypto from your bank account WAY easier.

-

This could well set off a race to ‘tokenize everything,’ cause wherever there’re tokenized assets to be traded, there’re fees to collect — and banks LOVE collecting fees.

Very cool!