This week’s fluctuations in the crypto market have kept investors on the edge of their seats, particularly in the wake of the spot Bitcoin ETF approval, which has sent significant shockwaves through the industry. The legal battle between Coinbase and the SEC, coupled with the ongoing saga involving Binance and the SEC, has added an extra layer of suspense, heightening anticipation within the crypto community for the next turn of events.

Amid this chaos, The Spot Bitcoin Exchange-Traded Fund (ETF), a new product in the financial market, has just wrapped up its first week of trading. Positioned as a financial milestone, it holds the potential to bridge the gap between the crypto realm and mainstream finance. As the inaugural week of trading wraps up, the implications and possibilities of this new investment avenue are creating ripples throughout the financial landscape.

1. Breaking News This Week

Traders anticipate a March start for Federal Reserve interest rate cuts, but uncertainty lingers after stronger-than-expected December retail sales.

- Singapore Rejects Bitcoin ETFs

The Monetary Authority of Singapore disapproves of listing Bitcoin ETFs, citing cryptocurrency’s ineligibility as assets for ETFs.

- SEC Extends Ethereum ETF Decision

The SEC extends the decision deadline for Fidelity’s spot Ethereum ETF proposal to March 5, coinciding with other Bitcoin ETF applications.

- Binance Launches in Thailand

Gulf Binance, a Binance and Gulf Innova joint venture, launches crypto exchange services in Thailand for public access.

- Accelerated SEC Timeline for Bitcoin ETF Options

SEC aims for potential approval of spot Bitcoin ETF-based options by the end of February.

- Ripple Objects to SEC Request

Ripple responds to SEC’s motion to compel, arguing it seeks irrelevant information and challenges the need for new data.

- SEC vs. Coinbase Complexity

SEC and Coinbase await a judge’s decision on whether secondary-market trades of a dozen tokens on the exchange violate securities law.

2. Blockchain Performance

In this section, we will analyze two things primarily: the top-performing blockchains based solely on their 7-day change and the top performers among the top five blockchains with the highest TVL.

2.1. Top Blockchain Performers by 7-Day Change

| Blockchain | 7-Day Change (in %) |

| Mode | +357% |

| Viction | +185% |

| PulseChain | +120% |

| ICP | +109% |

| DogeChain | +59.50% |

Among the top blockchain performers by 7-day change, Mode takes the lead with an impressive +357%, followed by Viction at +185%. PulseChain demonstrates a notable +120%, while ICP and DogeChain show positive trends with +109% and +59.50%, respectively.

2.2. Top Performers: 7-Day Change in Top 5 Blockchains with Highest TVL

| Blockchain | 7d Change | TVL (in Billion) |

| Ethereum | -0.35% | $32.884b |

| Tron | -3.49% | $7.827b |

| BSC | -2.11% | $3.476b |

| Arbitrum | +1.67% | $2.631b |

| Solana | +3.19% | $1.362b |

In the realm of top-performing blockchains by 7-day change and highest TVL, Ethereum maintains stability with a slight decrease of -0.35%, boasting a substantial $32.884 billion TVL. Solana shows robust growth at +3.19%, securing a $1.362 billion TVL. Other contenders like Arbitrum, Tron, and BSC exhibit varying 7-day changes, ranging from -3.49% to +3.19%.

3. Crypto Market Analysis

3.1. Bitcoin Price and Dominance

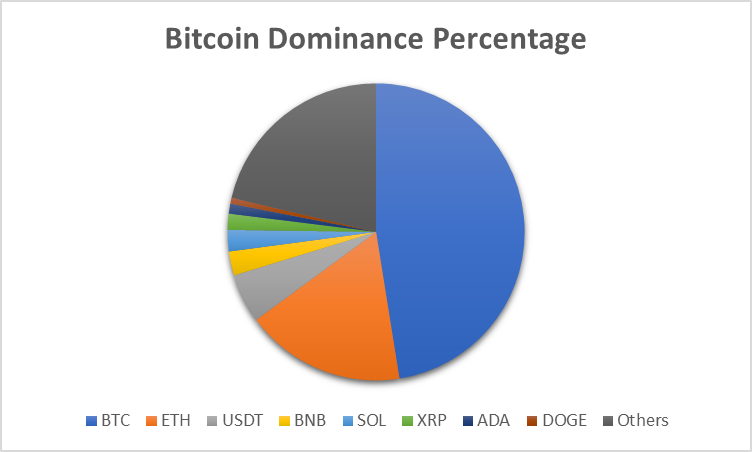

| Cryptocurrency | Price | Market Cap | Dominance Percentage | 7d- Change in Market Cap |

| BTC | $41,517.05 | $814,183,398,032 | 47.6% | -3.7% |

| ETH | $2,472.54 | $297,227,466,946 | 17.47% | -3.1% |

| USDT | $0.993 | $94,931,461,114 | 5.36% | -0.0% |

| BNB | $312.61 | $48,091,288,144 | 2.63% | +4.5% |

| SOL | $91.56 | $39,659,679,333 | 2.33% | -1.2% |

| XRP | $0.5464 | $29,726,797,725 | 1.76% | -4.8% |

| ADA | $0.5104 | $17,911,980,946 | 1.09% | -6.9% |

| DOGE | $0.078 | $11,222,007,173 | 0.65% | -2.7% |

| Others | 21.34% |

Bitcoin (BTC) leads with a price of $41,517.05, commanding a substantial market cap of $814.18 billion and a dominance percentage of 47.6%. Its 7-day change in market cap is a negative index of -3.7. Ethereum (ETH) follows with a price of $2,472.54, a market cap of $297.23 billion, and a 7-day change in market cap of -3.1%. Binance Coin (BNB) stands out with a positive 7-day change of +4.5%, priced at $312.61, and a market cap of $48.09 billion.

3.2. Top Gainers & Losers of the Week in Crypto Market

Here is the list of top gainers and losers of the week in the cryptocurrency market. The analysis is made using the 7-day Gain and 7-day Lose indexes.

3.2.1. Top Gainers of the Week in Crypto

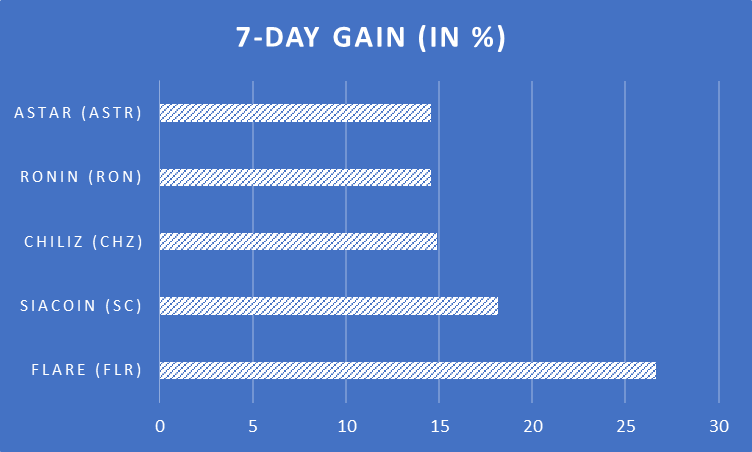

| Cryptocurrency | Price | 7-Day Gain |

| Flare (FLR) | $0.02213 | 26.62% |

| Siacoin (SC) | $0.01095 | 18.13% |

| Chiliz (CHZ) | $0.09643 | 14.87% |

| Ronin (RON) | $2.10 | 14.57% |

| Astar (ASTR) | $0.174 | 14.56% |

This week’s top gainers in the crypto space include Flare (FLR) with a 7-day gain of 26.62%, Siacoin (SC) at $0.01095 with an 18.13% increase, Chiliz (CHZ) at $0.09643 showcasing a 14.87% gain, Ronin (RON) with a 14.57% increase at $2.10, and Astar (ASTR) at $0.174 with a 14.56% gain.

3.2.2. Top Losers of the Week in Crypto

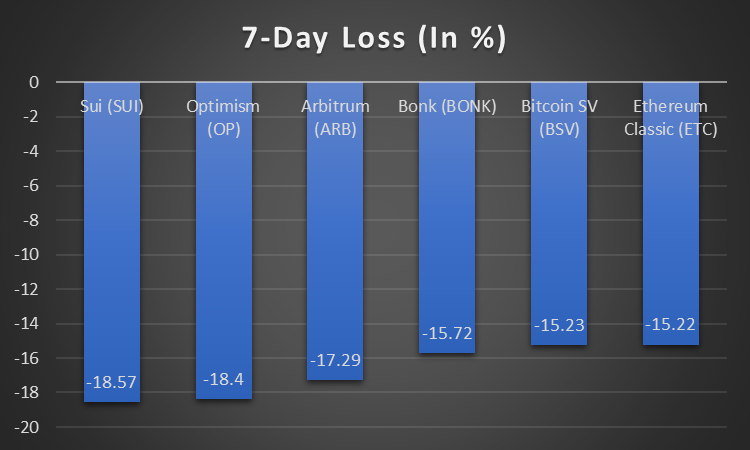

| Cryptocurrency | Price | 7-Day Loss |

| Sui (SUI) | $1.08 | -18.57% |

| Optimism (OP) | $3.13 | -18.40% |

| Arbitrum (ARB) | $1.79 | -17.29% |

| Bonk (BONK) | $0.00001133 | -15.72% |

| Bitcoin SV (BSV) | $71.57 | -15.23% |

| Ethereum Classic (ETC) | $24.69 | -15.22% |

This week’s top losers in the cryptocurrency market are led by Sui (SUI) with a 7-day loss of -18.57%, followed closely by Optimism (OP) at $3.13 with an -18.40% decrease. Arbitrum (ARB), Bonk (BONK), Bitcoin SV (BSV), and Ethereum Classic (ETC) also experienced losses ranging from -15.22% to -17.29%, indicating a challenging week for these assets.

3.3. Stablecoin Weekly Analysis

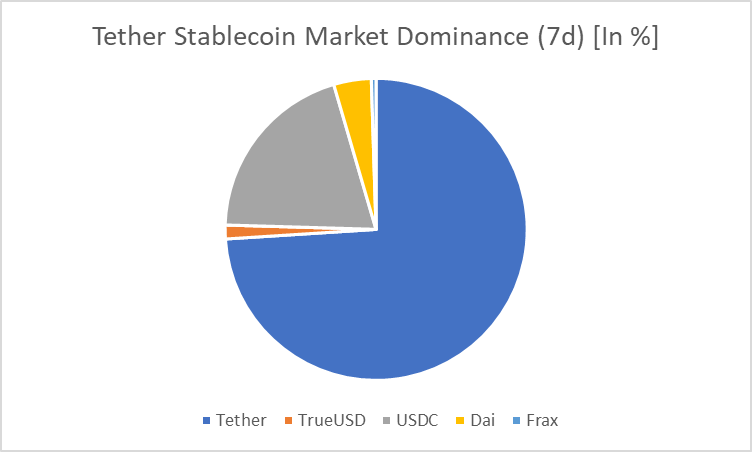

| Stablecoin | Market Capitalisation (7d) | Market Dominance (7d) [in %] | Trading Volume (7d) |

| Tether | $94,967,646,331 | 72.25% | $45,051,204,444 |

| TrueUSD | $1,876,926,357 | 1.44% | $128,811,385 |

| USDC | $25,524,310,090 | 19.54% | $7,508,298,350 |

| Dai | $5,166,646,630 | 3.93% | $157,000,259 |

| Frax | $648,627,425 | 0.49% | $11,020,426 |

In the week’s stablecoin performance analysis, Tether (USDT) stands out with a commanding trading volume of $45.05 billion, emphasizing its widespread utility. Tether also holds the highest market capitalization at $94.97 billion, securing a 72.25% market share. USDC follows closely with a notable trading volume of $7.51 billion and a substantial market capitalization of $25.52 billion, commanding a 19.54% market dominance.

4. Bitcoin Spot ETF Weekly Analysis

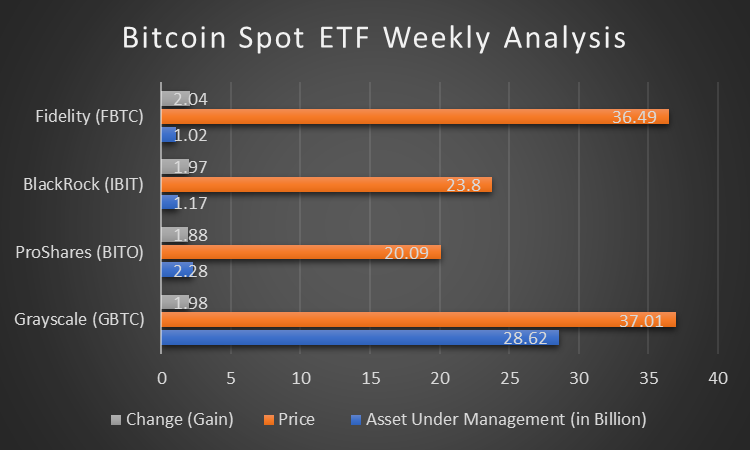

| Bitcoin Spot ETFs | Asset Under Management (in Billion) | Price | Change (Gain) |

| Grayscale (GBTC) | $28.62B | $37.01 | +1.98% |

| ProShares (BITO) | $2.28B | $20.09 | +1.88% |

| BlackRock (IBIT) | $1.17B | $23.80 | +1.97% |

| Fidelity (FBTC) | $1.02B | $36.49 | +2.04% |

In this week’s Bitcoin Spot ETF analysis, Grayscale (GBTC) leads with $28.62 billion in Assets Under Management and a price of $37.01. Notably, Fidelity (FBTC) displays a remarkable 2.04% gain, with $1.02 billion AUM and a $36.49 price. ProShares (BITO) and BlackRock (IBIT) also show positive changes at 1.88% and 1.97%, respectively. This reflects a dynamic week, with Fidelity standing out for its impressive gain in value.

5. DeFi Market Weekly Status Analysis

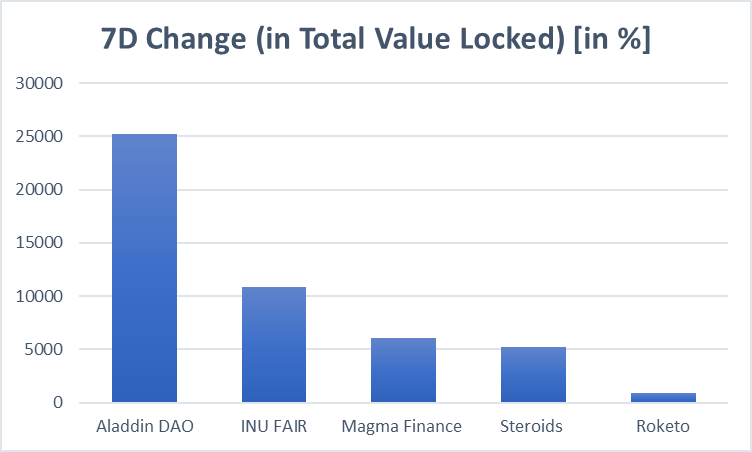

| DeFi Protocols | 7d Change (in Total Value Locked) [in %] |

| Aladdin DAO | +25212% |

| INU FAIR | +10852% |

| Magma Finance | +6066% |

| Steroids | +5204% |

| Roketo | +851% |

This week’s DeFi market analysis shows impressive growth in Total Volume Locked (TVL) across various protocols. Aladdin DAO leads with a remarkable +25212% 7-day change, followed by INU FAIR at +10852%, Magma Finance at +6.66%, Steroids at +5204%, and Roketo at +851%.

6. NFT Marketplace: A Basic Weekly Analysis

| NFT Marketplaces | 7-day Rolling Volume | 7-day Rolling Trade | Volume Change | Market Share (based on 1-day Volume) |

| Blur | 34705.91 | 42920 | +11.91% | 54.19% |

| Blur Aggregator | 19661.24 | 23917 | +35.32% | 17.83% |

| Opensea | 10870.06 | 35894 | -6.81% | 15.45% |

| Cryptopunks | 2470.67 | 36 | +57.37% | 7.89% |

| Gem | 1931.81 | 7354 | -11.34% | 1.84% |

In this week’s basic analysis of the NFT marketplace, notable trends emerge. Blur and Blur Aggregator show substantial volume increases of +11.91% and +35.32%, respectively, with market shares of 54.19% and 17.83%; in contrast, Opensea experiences a -6.81% volume change but maintains a significant market share of 15.45%. Cryptopunks exhibit a remarkable +57.37% volume change, claiming a 7.89% market share. Gem, however, sees an 11.34% volume change, holding a 1.84% market share.

6.1. Top NFT Collectible Sales this Week

| NFT Collectibles | Price (in USD) |

| CryptoPunk #6912 | $475,676.56 |

| CryptoPunk #4506 | $349,195.00 |

| Art Blocks #78000643 | $243,379.25 |

| Azuki #5889 | $236,049.33 |

| CryptoPunks #6889 | $227,976,52 |

In this week’s NFT collectible sales, notable transactions include CryptoPunk #6912 at $475,676.56, followed by CryptoPunk #4506 at $349,195.00. Art Blocks #78000643 secured a significant value of $243,379.25, while Azuki #5889 and CryptoPunks #6889 fetched prices of $236,049.33 and $227,976.52, respectively.