TL;DR

Full Story

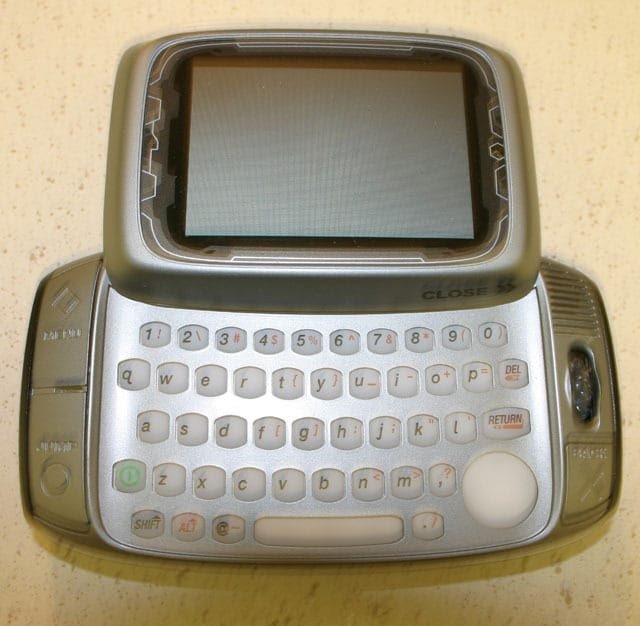

In the late 2000’s, the Hiptop/Sidekick became the first smartphone not to be targeted at business customers, but instead, younger consumers.

It had a screen that you had to slide up to unlock, completing a 180 degree spin in the process (v cool), and its software later evolved into Android.

The piece of news we’re about to cover is relevant to crypto, the same way the Hiptop was relevant to the mobile industry.

The crypto exchange Woo X has tokenized US treasury bills and made them available to retail customers.

Here’s why this seemingly boring development is bigger than you’d think:

There’s this narrative that says all financial products will soon move onto blockchain rails — it’s been touted by Twitter think-boys for years — and more recently: Larry Fink, CEO of BlackRock (the world’s largest asset manager).

But this is one of the first times a legacy financial product (T-bills) have actually been made tradable on the blockchain (aka: tokenized).

And just like the Hiptop proved there was demand for smart devices from broader consumers (beyond just business users), the tokenized T-bill will be a proving ground to show that there is demand within the crypto space for legacy financial products (not just the crypto-native tokens we have now).

If demand can be proven, it’ll show there’s a buck to be made.

And if there’s a buck to be made, large institutions will start racing to tokenize as many legacy financial products as they can.

(Legitimizing the crypto sector and increasing its value in the process).