- Year-to-date inflows went past the $5.7 billion mark.

- The total assets under management hit a 26-week high.

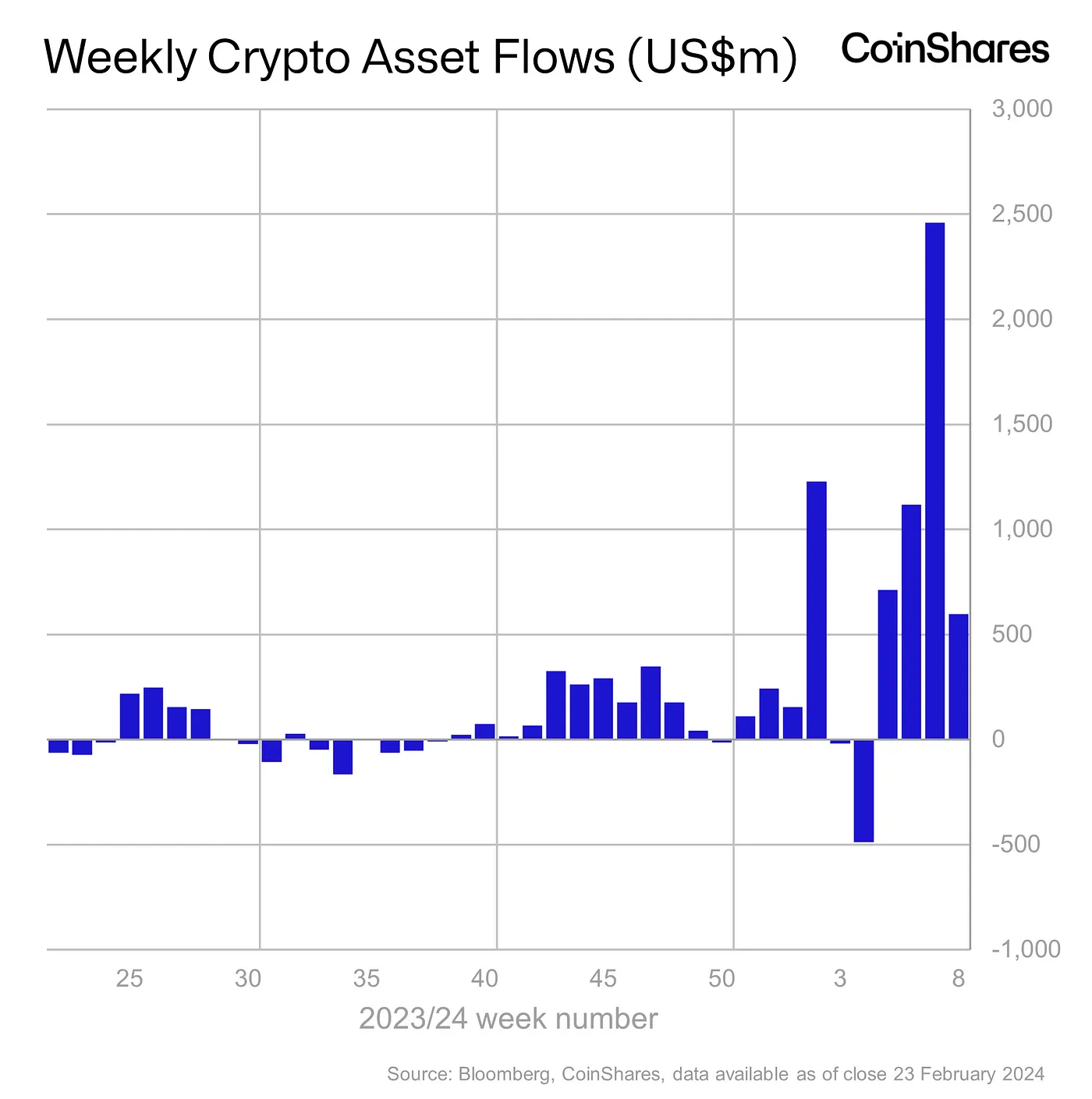

Digital asset investment products recorded the fourth straight week of net inflows as institutional interest in spot Bitcoin [BTC] continued to mount.

According to the latest report by crypto asset management firm CoinShares, investors poured $598 million into cryptocurrency-linked funds last week, taking the year-to-date (YTD) inflows past the $5.7 billion mark.

This figure already represented 55% of the record inflows seen during 2021 — the year when the crypto market achieved its top.

The total assets under management (AuM) hit a 26-week high of $68.3 billion, inching closer to the peak of $87 billion recorded in November 2021.

AUM is an important performance gradient of a fund. The higher the value of AuM, the more investments it tends to attract.

U.S. corners the majority of inflows

The U.S. remained the focus, with the recently-launched spot Bitcoin ETFs accounting for the bulk of the investments at $610 million.

To the market’s relief, outflows from Grayscale Bitcoin Trust (GBTC) ebbed considerably last week, totaling $436 million.

To add context to the decline, about $640 million was plugged out of the incumbent issuer on a single day last week.

Hits and misses

The largest institutional crypto product Bitcoin enjoyed investments of $570 million last week, bringing YTD inflows to $5.6 billion.

The leading crypto asset’s sideways trajectory impacted market sentiment, causing a marked drop from $2.3 billion inflows recorded in the week prior.

Funds linked to the second-largest cryptocurrency Ethereum [ETH] also saw impressive inflows, totaling $17 million last week.

On the other hand, the outage-induced FUD triggered a second consecutive week of outflows from Solana [SOL]-tied crypto products.

The global crypto market lifted 6.32% in the last 24 hours on significant gains made by leading assets, data from CoinMarketCap showed.

If the rally sustains, the upcoming week will likely see considerably higher inflows into the digital assets market.