- Ethereum’s price only moved marginally in the last 24 hours.

- Market indicators hinted that Ethereum’s bull rally might resume soon.

Ethereum [ETH] successfully broke above a bullish falling wedge pattern a few days ago. Since then, the king of altcoins has been on track and has earned investors profit.

If the trend lasts, then ETH has a long way to go.

Ethereum bulls are slowing down

World Of Charts, a popular crypto analyst, recently posted a tweet highlighting how ETH managed to break out of a falling wedge pattern.

The token’s price has consolidated inside the pattern since March and finally broke out a few days ago. Since then, ETH seemed to be on the right track, as its price increased by almost 5%.

However, this gain could just be the beginning, as the breakout has the potential to push ETH’s price by 45%. However, the last few hours showcased less volatility, which somewhat paused ETH’s gaining spree.

According to CoinMarketCap, ETH’s price only moved up marginally in the last 24 hours. At the time of writing, ETH was trading at $3,131.77 with a market capitalization of over $376 billion.

To see whether this sluggish 24-hour price action could lead to a price correction, AMBCrypto checked Ethereum’s on-chain metrics.

Our analysis of CryptoQuant’s data revealed that ETH’s net deposit on exchanges was low compared to the last seven days’ average.

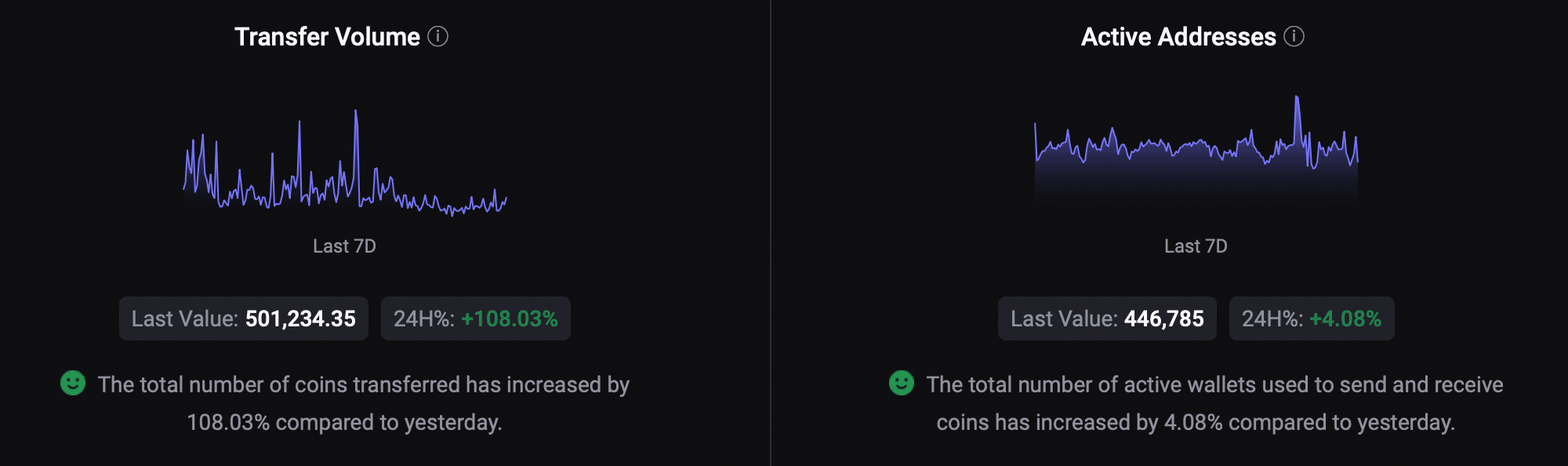

This meant that selling pressure on ETH was low. Additionally, both its Transfer Volume and Active Addresses remained high, which was an optimistic sign.

Source: CryptoQuant

Troubles still persist for Ethereum

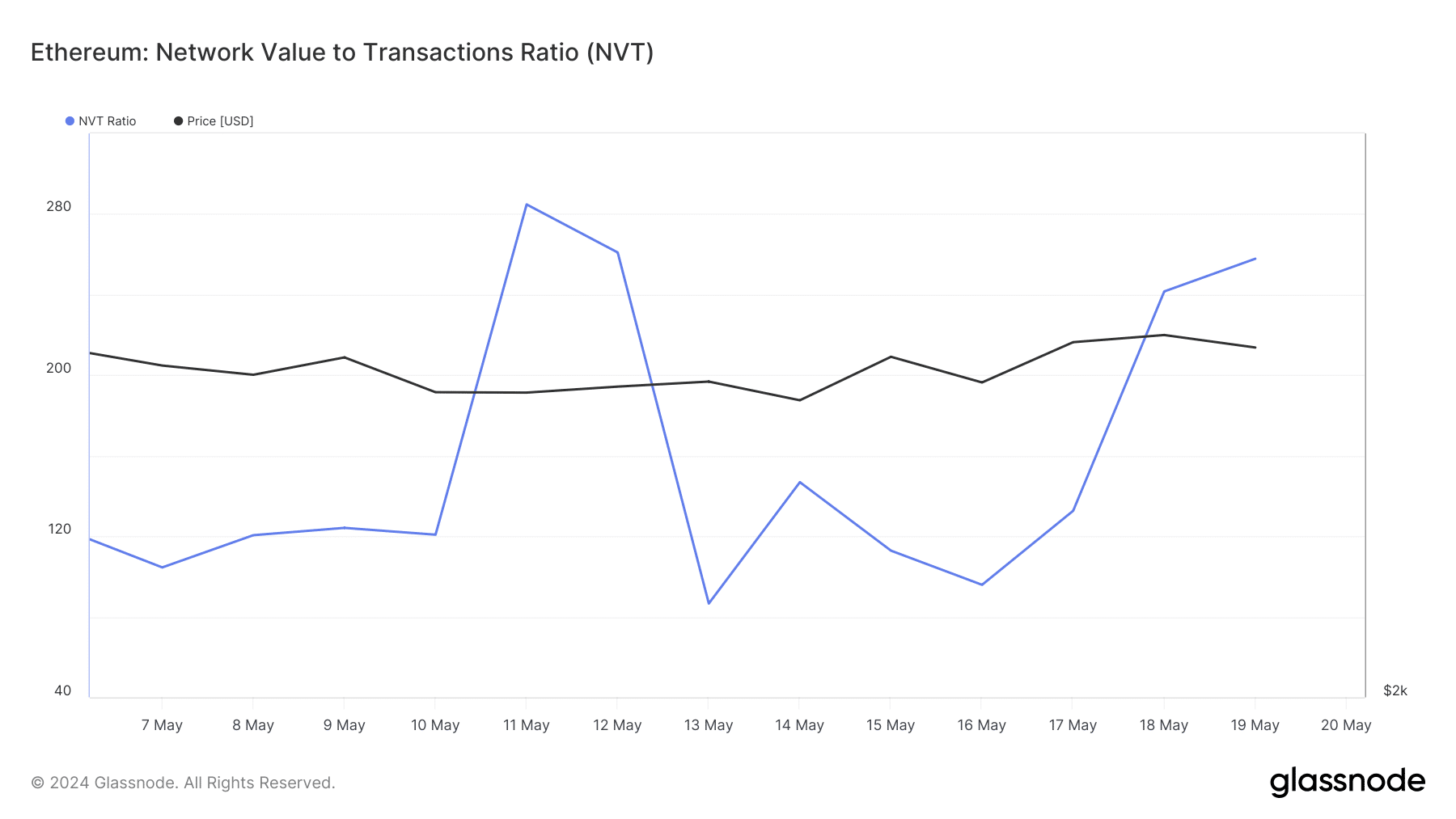

Though the aforementioned metrics looked promising, a few of the others raised concerns. AMBCrypto’s look at Glassnode’s data revealed that ETH’s NVT ratio had increased sharply over the last few days.

For the uninitiated, the NVT ratio is computed by dividing the market cap by the transferred on-chain volume, measured in USD.

A rise in the metric meant that ETH was overvalued, which indicated a possible price correction soon.

Source: Glassnode

Apart from this, another key indicator looked bearish. Ethereum’s fear and greed index had a value of 83% at press time, meaning that the market was in an “extreme fear” phase.

Whenever the metric hits such levels, it suggests that an asset’s price has high chances of dropping.

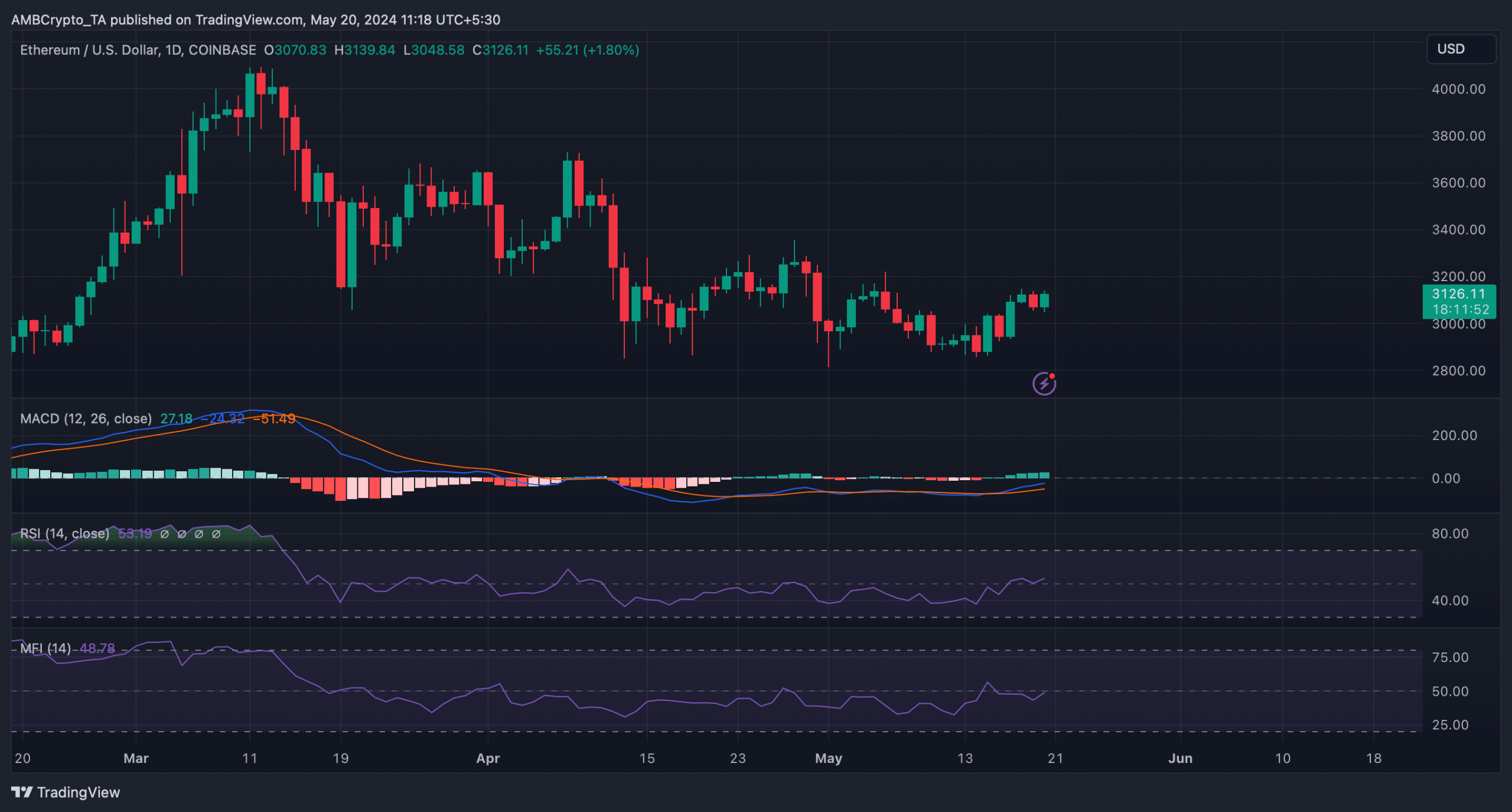

Therefore, AMBCrypto planned to check ETH’s daily chart to better understand whether a price correction was around the corner.

Is your portfolio green? Check the Ethereum Profit Calculator

The MACD displayed a bullish crossover. Additionally, ETH’s Relative Strength Index (RSI) registered an uptick from the neutral mark. Its Money Flow Index (MFI) also followed a similar trend.

These indicated that the chances of a major price correction were slim.

Source: TradingView