- Growing anticipation surrounds the potential approval of spot Ethereum ETFs on 23rd July.

- ETH price rises by 0.08%, trading at $3,499, with bullish momentum indicators.

Amidst the growing anticipation surrounding the potential approval of spot Ethereum [ETH] Exchange Traded Funds (ETFs) on 23rd July, there has been a lot of buzz in the cryptocurrency space.

Impact of Ethereum ETF

It is also estimated that ETH ETF is likely to draw significant investor interest, potentially channeling more capital into the broader altcoin market.

Shedding light on the same, a crypto researcher on X, using the handle @wacy_time1, said,

“About $5 billion is expected to flow into the ETH ETF within the first six months.”

This estimate is based on the market capitalization ratio between Bitcoin [BTC] and Ethereum, which is approximately 75% to 25%.

Since investors have poured $59 billion into the BTC ETF, the proportional estimate for the ETH ETF, after accounting for $10 billion already invested in Grayscale’s ETHE, is around $5 billion.

This influx of investment is anticipated to have a substantial impact, not only on ETH but on the broader altcoin market as well.

Steps taken by BlackRock

Additionally, asset management firms including BlackRock, are actively preparing for the launch of their ETH ETFs. In its S-1 registration statement filed on 17th July, BlackRock detailed the fee structure for its Ether ETF.

“The Sponsor’s Fee is accrued daily at an annualized rate equal to 0.25% of the net asset value of the Trust and is payable at least quarterly in arrears in U.S. dollars or in-kind or any combination thereof.”

This strategic move underscores BlackRock’s commitment to establishing a competitive presence in the emerging Ether ETF market, positioning itself alongside other firms each offering varied fee structures to attract investors.

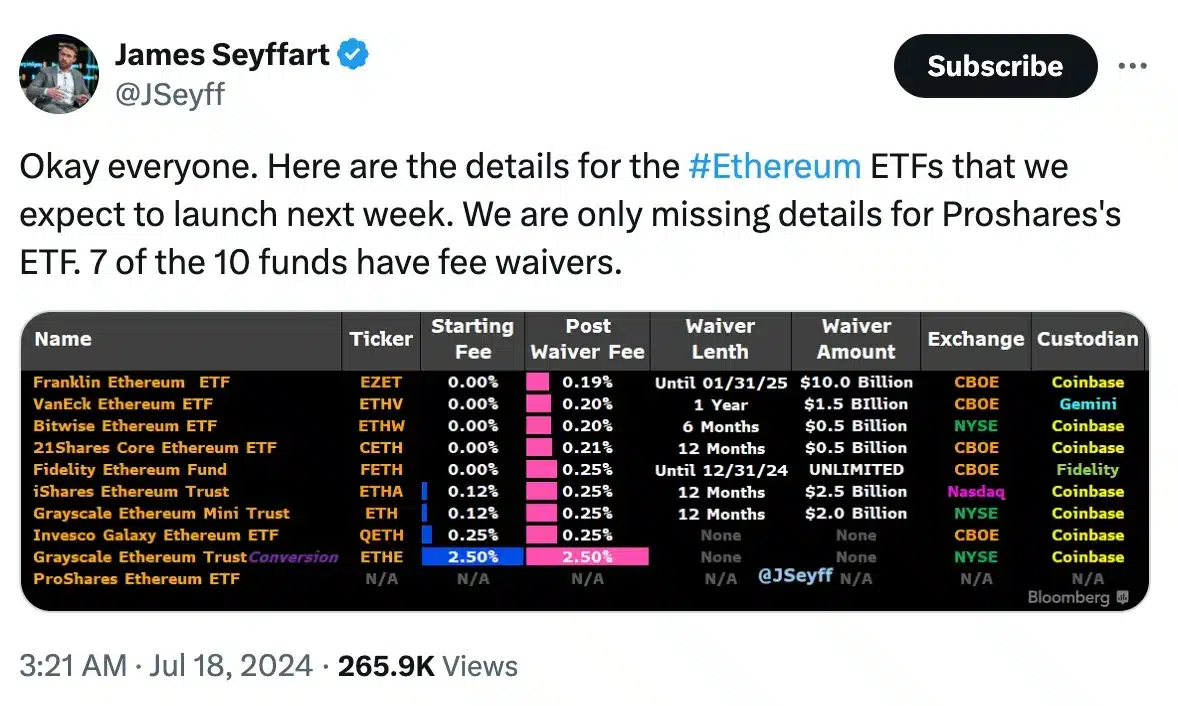

Source: James Seyffart/X

As per reports, BlackRock has announced that its spot Ether ETF will charge a 0.12% fee for the first year or until it reaches $2.5 billion in net assets.

Other asset managers following suit

Franklin Templeton’s spot Ether ETF will offer the lowest fee at 0.19%, while both the Bitwise and VanEck Ethereum ETFs will charge a 0.20% fee.

The 21Shares Core Ethereum ETF will have a fee of 0.21%. Meanwhile, Fidelity and Invesco Galaxy ETFs will each offer a 0.25% fee, matching BlackRock’s standard rate after the initial period.

Amidst the positive developments surrounding ETH ETFs, the price of Ether has also seen a positive impact. According to CoinMarketCap, ETH has risen by 0.08% in the past 24 hours, trading at $3,499.

Additionally, technical indicators such as the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) suggest that bullish momentum is present, indicating continued optimism in the market.

Source: Trading View