- Ethereum saw a downturn despite strong beginnings.

- The postponement of ETH ETFs by the SEC sparked mixed reactions within the crypto community.

After a strong kickoff on the first day of Q3 of 2024, Ethereum [ETH] has flipped back to a bearish trend once again. As reported by CoinMarketCap, ETH, at press time, dropped by 1.11% over the last 24 hours.

However, despite this recent downturn, technical indicators like MACD and RSI suggested a potential shift from sellers to buyers.

Source: TradingView

At press time, Ethereum was approaching a critical resistance level at around $3538, and a breakthrough could signal the onset of a bullish phase for the largest altcoin.

Why is ETH down?

Providing some light on the current price situation of ETH, analysts Eric Balchunas and James Seyffart confirmed that the SEC has set a new deadline — the 8th of July — for submission of the forms.

“Unfort think we gonna have to push back our over/under till after holiday. Sounds like SEC took extra time to get back to ppl this wk (altho again very light tweaks) and from what I hear next wk is dead bc holiday = July 8th the process resumes and soon after that they’ll launch @JSeyff.”

Community reaction

Needless to say, this news was not received well by the community, who echoed a sentiment similar to ETF Store president Nate Geraci,

“It shouldn’t take this long.”

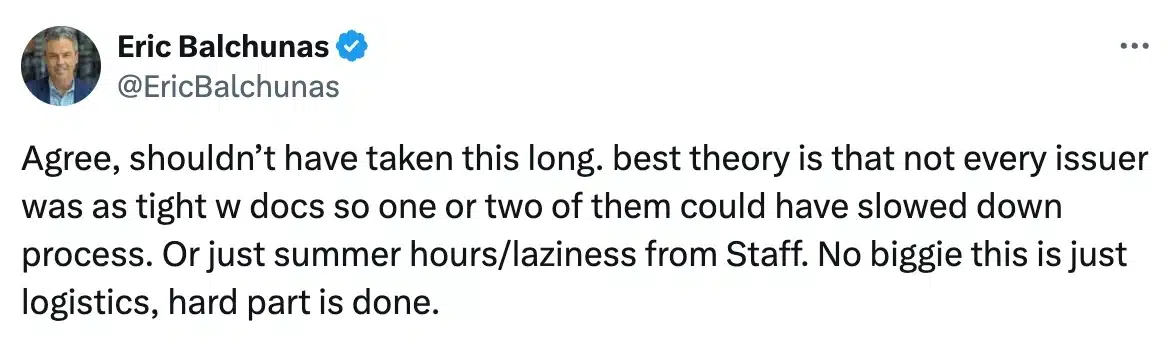

Therefore, to reassure the community, Eric Balchunas said,

Source: Eric Balchunas/X

As the latest trend unfolds, the crypto community is once again on edge, eagerly anticipating the approval of the ETH ETF.

@StrongHedge best put it when he said,

“Only a few days until $ETH ETF kicks in. Stop looking at $BTC, start looking at $ETH.”