- Ethereum fees dropped to its lowest point since October.

- There has also been an overall decline in fees on L2s.

Ethereum [ETH] has long been known for its high transaction fees. However, there has been a recent shift in this trend, with the average fee on the network seeing a significant decline.

This decrease prompted the question of whether transaction volume on the platform has decreased, or if Layer 2 solutions are absorbing the associated fees.

Ethereum’s average fees decline

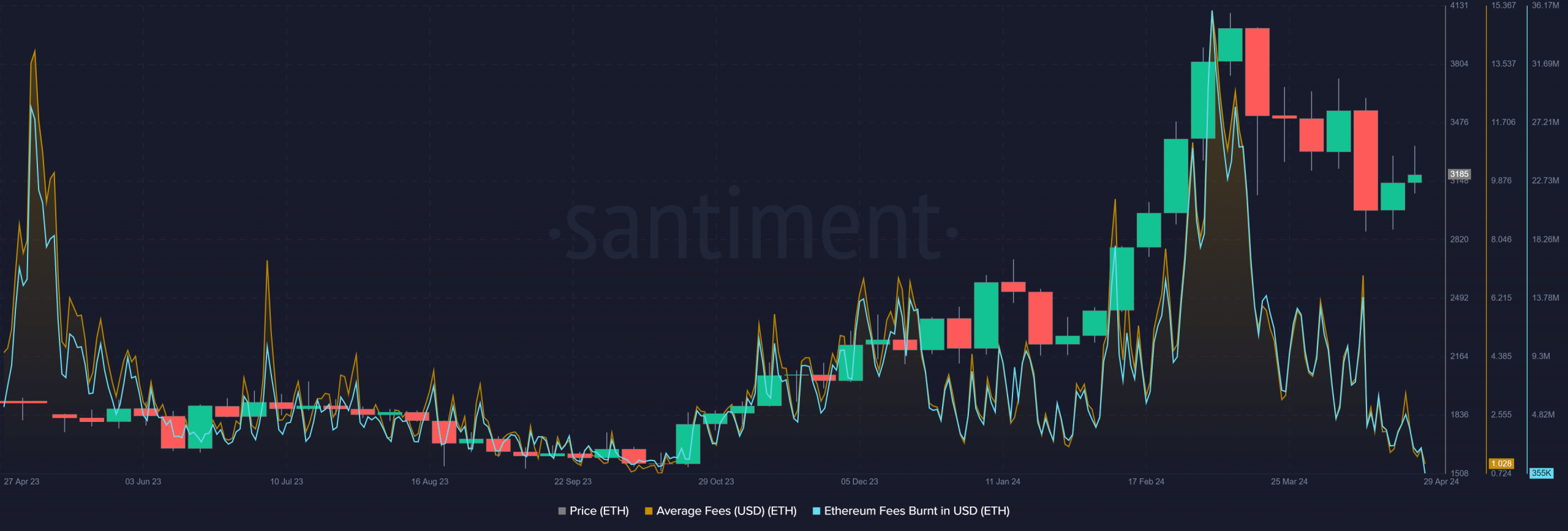

Recent Santiment data indicated a decline in Ethereum fees over the past few weeks. As of the 28th of April, average fees on the network had dropped to approximately $1.28, marking the lowest point since October 2023.

Subsequently, at the time of this writing, the average fee had decreased even further to around $1.02.

Source: Santiment

Concurrently, there has been a reduction in the amount of ETH fees burned.

At the time of this writing, the chart analysis revealed that the burnt fee has declined to its lowest level in months, hovering around $355,000.

Comparatively, just in March, the average fee exceeded $15, with burnt fees totaling over $35 million.

Furthermore, AMBCrypto’s examination of the fee trend on Crypto Fees revealed a noticeable decline in Ethereum fees over recent weeks.

As of press time, the overall network fee stood at approximately $3.3 million.

Comparing this figure to previous weeks, it was evident that fees have halved.

This corroborated the findings from Santiment’s data, which suggested that such fee fluctuations typically correlate with market cycles, rising during price peaks and falling during market downturns.

Furthermore, the decline is often attributed to a decrease in network transactions.

Are L2s taking the Ethereum transactions and fees?

The most recent Ethereum upgrade facilitated a reduction in fees on Layer 2 solutions (L2s), leading to an increase in transaction volume.

Examination of user numbers on L2s revealed growth over the past few months, surpassing 4 million users at present.

However, a detailed analysis of Grow the Pie indicated that the number of active addresses across major L2s is below 2 million.

AMBCrypto’s analysis also showed a decline in transaction count, which was around 6.3 million.

Furthermore, an assessment of fees on L2 platforms revealed a significant decrease over the last 30 days, with total fees amounting to less than $1 million.

This suggests that despite the growing number of users, the decrease in active users and fees indicated a reduction in transactions.

The overall decline may pave the way for an increase once the price of Ethereum starts to rise.

ETH sees a weak start to the week

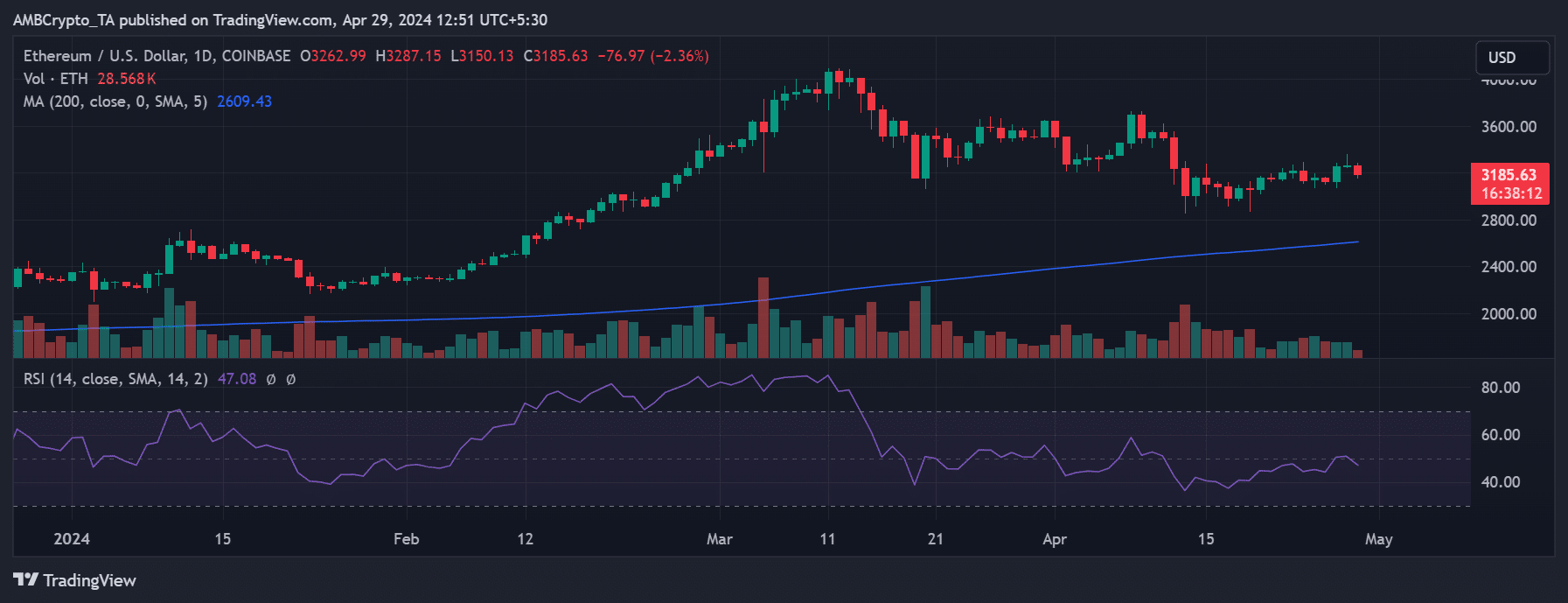

AMBCrypto’s analysis of Ethereum’s price chart indicated that it has largely remained within the $3,000 price range in recent days.

While it briefly touched the $4,000 mark in March, it has since retreated from that level. Also, there was a period in April when it dipped below the $3,000 threshold.

Notably, the end of the previous week saw a significant uptick, with a 3.93% increase pushing its price to around $3,253.

Source: TradingView

Although it maintained a positive trend on the 28th of April, the increase was less pronounced, hovering around 1% and trading at approximately $3,262.

Read Ethereum’s [ETH] Price Prediction 2024-25

However, as of the current writing, it has experienced a decline of over 2%, trading at around $3,180.

Given the observed trend in fees, there are indications that traders anticipate a forthcoming price increase for Ethereum.