- ENS whale reclaimed ETH worth 44.14 million on 31 July.

- Most traders did not seem too keen about trading ENS at press time.

Amid last month’s decline in .eth domain registrations on Ethereum Name Service [ENS], crypto user darkmarket.eth reclaimed 39,712 Ether [ETH] worth $74.17 million on 31 July, blockchain sleuth Lookonchain found.

After 2.7 years of dormancy, darkmarket.eth reclaimed 39,712 $ETH ($74.17M) locked in the ENS auction just now.

And transferred 63,734 $ETH($119M) out to a new wallet.https://t.co/OtXYRpcOhn

— Lookonchain (@lookonchain) July 31, 2023

The whale, after that, transferred over $119 million in ETH to a new wallet.

The owner of the darkmarket.eth domain reclaimed their ETH two years after ENS founder and lead developer Nick Johnson reminded them that the funds were locked up in ENS deposits from the first two years of the service.

Realistic or not, here’s ENS’s market cap in BTC’s terms

Investors chorused “no,” to .eth name registrations in July

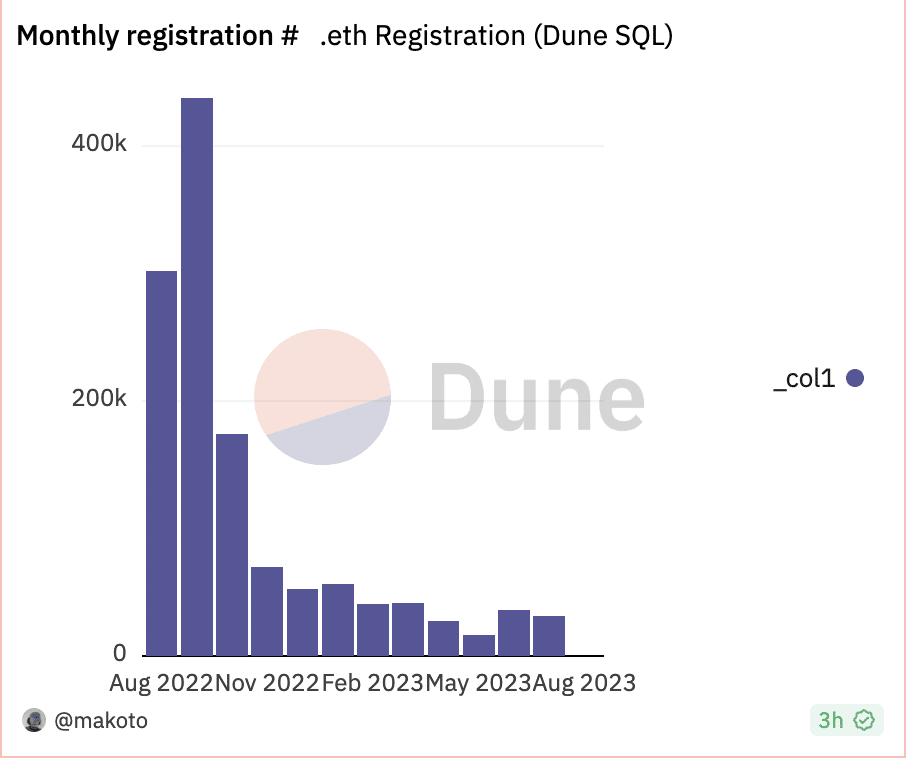

The whale’s decision to reclaim its long-held ENS tokens came at a time when the platform recorded a monthly decline in name registrations. According to a Dune Analytics dashboard, ENS name registrations totaled 31,029 in July. This represented a 14% fall from the 35,963 recorded in .eth registrations in June.

On a year-to-date, monthly ENS name registrations have plummeted by 45%. Since its monthly all-time high of 437,365 name registrations in September 2021, this has trended downward.

Source: Dune Analytics

Further, data from Dune Analytics showed that the count of new addresses created on the ENS network experienced a decline in July. The protocol saw a mere 25,115 new addresses created within the 31-day period. This was an 18% decrease from June’s count of 30,722 addresses.

Source: Dune Analytics

After closing June at a high of 30,099 names, primary ENS name registrations dropped by 19% by July ending. A primary ENS name is a unique, human-readable name used to identify and locate a specific Ethereum address.

Source: Dune Analytics

Regarding monthly revenue made by the protocol from new name registrations and renewals, there has been a steady decline since January. According to Dune Analytics, monthly revenue from new registrations fell by 52% between January and July.

Likewise, the monthly revenue made from name renewals plummeted by 2% within the same period.

Is your portfolio green? Check out the ENS Profit Calculator

Look elsewhere for gains

Sharing a statistically significant positive correlation with leading coin Bitcoin [BTC], ENS has also traded within a tight range in the past few weeks. At press time, the alt exchanged hands at $9.50, per data from CoinMarketCap.

With many unsure of the altcoin’s next direction, an assessment of its price movements on the daily chart revealed that day traders have stayed their hands from aggressive token accumulation. At press time, key momentum indicators lay flat.

The Money Flow Index (MFI) rested below its center line at 35.14, suggesting that selling momentum exceeded accumulation. While the Relative Strength Index (RSI) was above the center line at 51.77, it moved sideways, signaling a rather unenthusiastic trading activity.

Source: ENS/USDT on TradingView